Assessing Daikin (TSE:6367) Valuation After Recent Share Movements and Mixed Performance

Reviewed by Simply Wall St

If you have been tracking Daikin IndustriesLtd (TSE:6367), you might be wondering what’s driving investor interest lately. There hasn't been a specific event dominating headlines, but sometimes the absence of news is itself the story. Daikin’s shares have shifted enough over the past month to warrant a closer look, especially for those weighing fresh positions or thinking about where fundamentals point next.

Despite no single catalyst making waves, Daikin’s stock has shown a bit of everything this year. After a strong three-month climb of 13%, shares have recently slipped almost 7% over the past month. In a broader view, the one-year performance is still positive at 12%, even though the three-year return is in the red and the five-year gain is flat. This mix of momentum and setbacks, alongside steady revenue and net income growth, sets up a complex landscape for valuation.

With shares retreating this month but holding up over the year, are investors facing a true bargain, or is the market already pricing in all the future growth potential?

Price-to-Earnings of 19.2x: Is it justified?

Daikin IndustriesLtd is currently valued at a price-to-earnings (P/E) ratio of 19.2 times earnings, which is lower than the peer average of 33.5x but higher than the broader JP Building industry average of 16.1x. This reflects a mixed valuation picture, being relatively cheap compared to direct peers but still on the expensive side versus the wider industry group.

The P/E ratio measures how much investors are willing to pay for each yen of a company's earnings. For manufacturers like Daikin, it can offer insight into how the market views its future growth, profitability, and overall risk profile compared to others.

This premium over the industry average suggests that the market is pricing in some degree of quality or expected growth. However, the discount to the peer group implies that upside may be limited by sector or company-specific factors. Investors should weigh whether Daikin's recent revenue and profit growth justifies paying a higher price for its shares than the broader industry, but less than some close competitors.

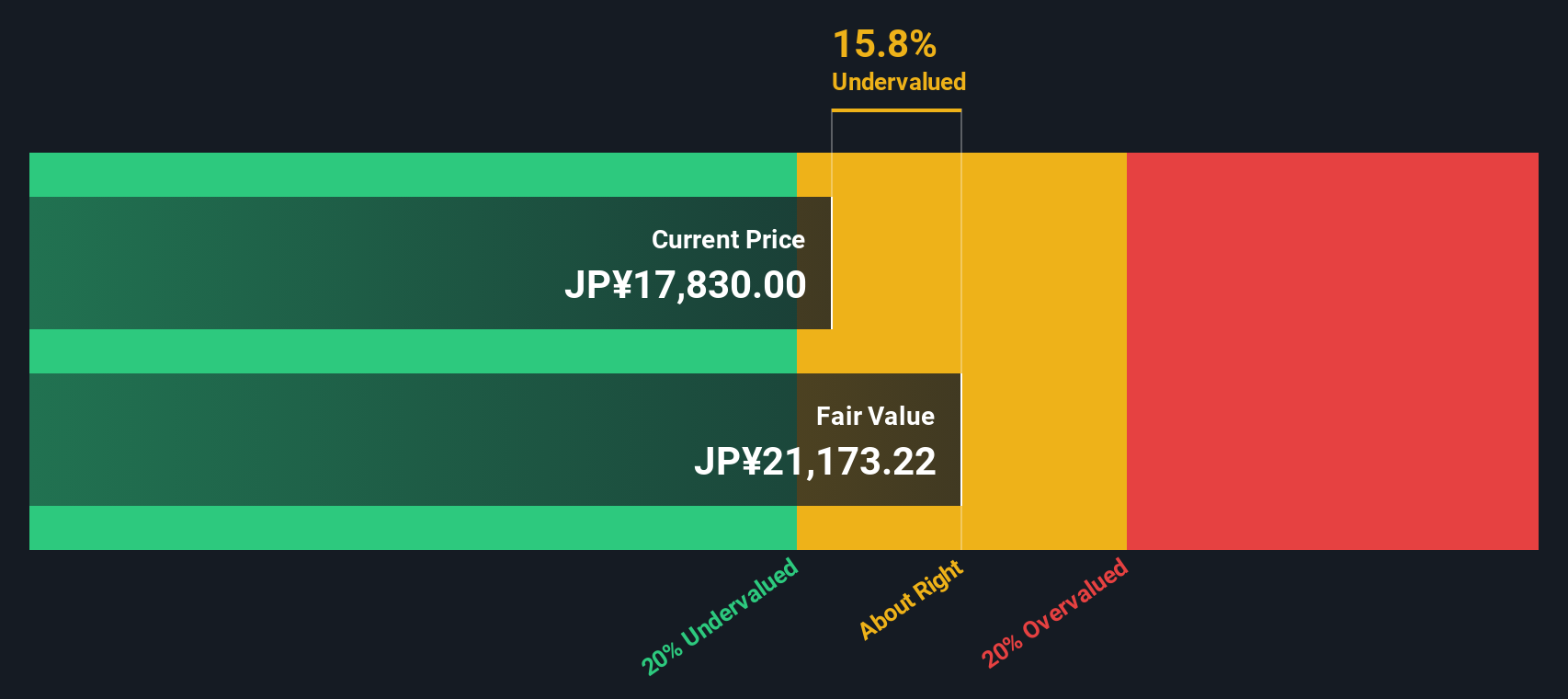

Result: Fair Value of ¥21,629.95 (UNDERVALUED)

See our latest analysis for Daikin IndustriesLtd.However, ongoing weak three-year returns and a recent share price drop could spark renewed caution among investors who are considering Daikin’s outlook.

Find out about the key risks to this Daikin IndustriesLtd narrative.Another View: What Does Our DCF Model Say?

Looking beyond market comparisons, our DCF model offers a different perspective. This method also views Daikin IndustriesLtd as undervalued and reinforces the initial impression. However, does that agreement really settle the question?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Daikin IndustriesLtd Narrative

If you see things differently or want to dive into the numbers yourself, it’s quick and simple to craft your own take on Daikin IndustriesLtd, and share your view in just minutes. Do it your way

A great starting point for your Daikin IndustriesLtd research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Investment Angles?

Smart investors never stop at one idea. Give yourself an edge by tapping into tools that help you spot exciting trends, high-potential sectors, and undervalued opportunities others might miss.

- Uncover hidden value by targeting promising businesses priced below their true worth with undervalued stocks based on cash flows.

- Fuel your portfolio’s growth with cutting-edge companies blazing a trail in healthcare innovation using healthcare AI stocks.

- Boost your income with stocks offering attractive yields by searching dividend stocks with yields > 3% for reliable dividend payers above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:6367

Daikin IndustriesLtd

Manufactures, distributes, and sells air-conditioning and refrigeration equipment, and chemical products in Japan, the Americas, China, Asia, Europe, Europe, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives