- Japan

- /

- Hospitality

- /

- TSE:6412

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate a period of mixed performance, with the Nasdaq reaching record highs and expectations rising for a Federal Reserve rate cut, investors are closely watching economic indicators and central bank actions. Amidst this backdrop, dividend stocks can offer a measure of stability and income potential, making them appealing options for those looking to weather market fluctuations while potentially benefiting from regular payouts.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.05% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.58% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.03% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.35% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.96% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.66% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.88% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.67% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.42% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.12% | ★★★★★★ |

Click here to see the full list of 1851 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

LH Shopping Centers Leasehold Real Estate Investment Trust (SET:LHSC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LH Shopping Centers Leasehold Real Estate Investment Trust, with a market cap of THB5.47 billion, is a real estate investment trust managed by Land and Houses Fund Management Company Limited.

Operations: The revenue segment for LH Shopping Centers Leasehold Real Estate Investment Trust primarily consists of rental income from immovable properties, amounting to THB1.39 billion.

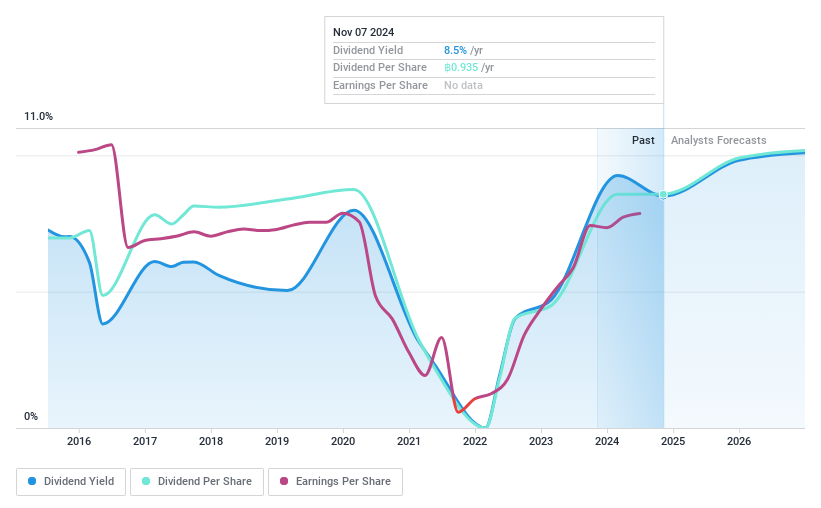

Dividend Yield: 8.3%

LH Shopping Centers Leasehold Real Estate Investment Trust offers a high dividend yield of 8.27%, ranking in the top 25% in its market, with dividends covered by both earnings and cash flows at payout ratios of 77.8% and 68.8%, respectively. However, its dividend history is less stable, showing volatility over nine years. Despite this, recent financial performance shows strong growth with net income rising significantly year-over-year to THB 283.25 million for Q3 2024.

- Take a closer look at LH Shopping Centers Leasehold Real Estate Investment Trust's potential here in our dividend report.

- Upon reviewing our latest valuation report, LH Shopping Centers Leasehold Real Estate Investment Trust's share price might be too pessimistic.

DMW (TSE:6365)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DMW Corporation manufactures and sells fluid machinery both in Japan and internationally, with a market cap of ¥15.48 billion.

Operations: DMW Corporation's revenue segments include the manufacture and sale of fluid machinery in Japan and internationally.

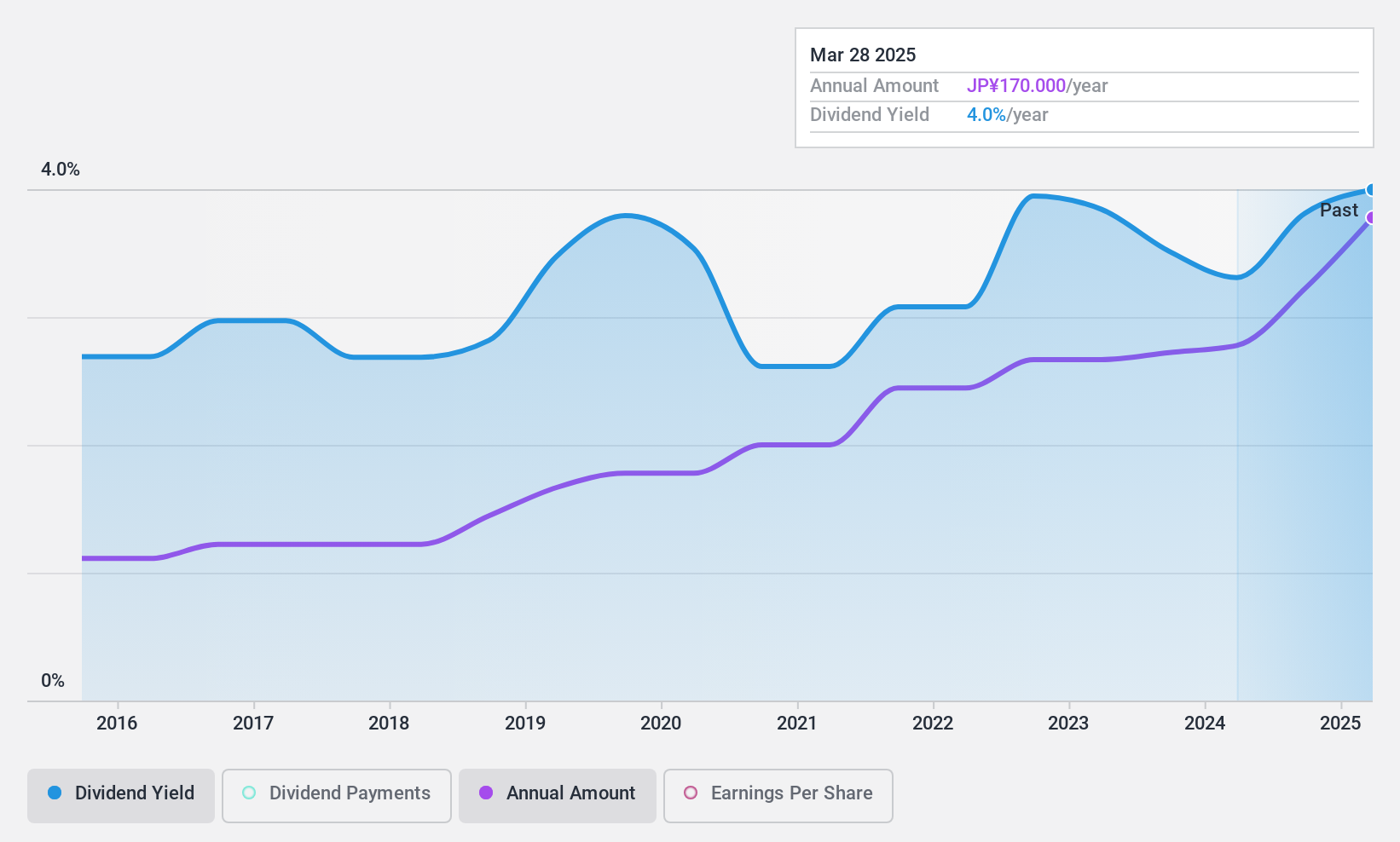

Dividend Yield: 3.6%

DMW's dividend payments are well-supported by both earnings and cash flows, with payout ratios of 38.3% and 55.6%, respectively, indicating sustainability. The dividend yield of 3.61% is slightly below the top quartile in the Japanese market but remains reliable and stable over the past decade, showing growth without volatility. Trading at a discount to its estimated fair value suggests potential attractiveness for investors seeking steady income streams in a stable market environment.

- Dive into the specifics of DMW here with our thorough dividend report.

- Our expertly prepared valuation report DMW implies its share price may be lower than expected.

Heiwa (TSE:6412)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Heiwa Corporation develops, manufactures, and sells pachinko and pachislot machines in Japan with a market cap of ¥209.19 billion.

Operations: Heiwa Corporation's revenue is primarily derived from its Pachislot and Pachinko Machine Business, which generates ¥43.30 billion, complemented by its Golf Business contributing ¥98.16 million.

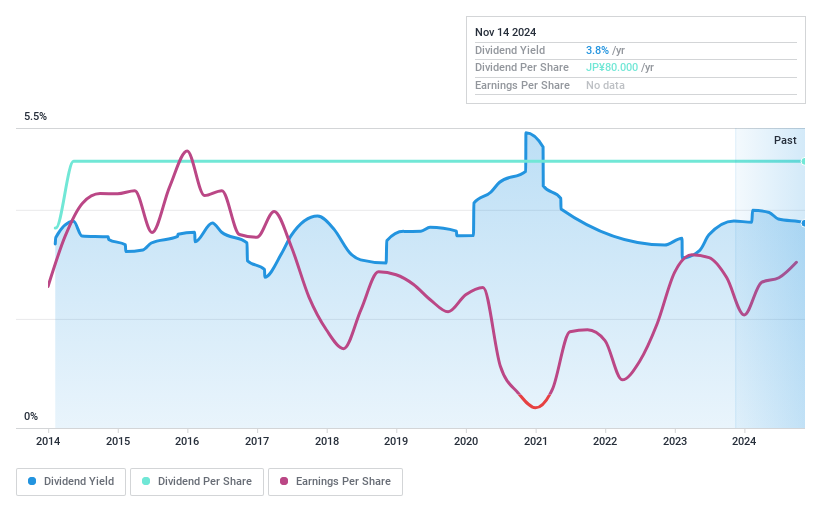

Dividend Yield: 3.7%

Heiwa's dividends have been stable and reliable over the past decade, with consistent growth. Despite a low payout ratio of 40.3%, indicating earnings coverage, the high cash payout ratio of 138.6% suggests dividends are not well-supported by free cash flows, raising sustainability concerns. The dividend yield of 3.74% is slightly below top-tier levels in Japan but remains competitive given its lower price-to-earnings ratio of 10.8x compared to the market average.

- Click here to discover the nuances of Heiwa with our detailed analytical dividend report.

- According our valuation report, there's an indication that Heiwa's share price might be on the expensive side.

Seize The Opportunity

- Click here to access our complete index of 1851 Top Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heiwa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6412

Heiwa

Develops, manufactures, and sells pachinko and pachislot machines in Japan.

Reasonable growth potential with adequate balance sheet and pays a dividend.