As global markets react positively to the recent U.S.-China tariff suspension, Asian markets have shown resilience, with Chinese stocks rallying and Japanese indices experiencing modest gains. In this environment of cautious optimism, dividend stocks in Asia may offer investors a stable income stream and potential for growth as they navigate the evolving trade landscape.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| en-japan (TSE:4849) | 4.38% | ★★★★★★ |

| Daicel (TSE:4202) | 5.01% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.95% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.73% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.34% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.09% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.06% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.03% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.23% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.47% | ★★★★★★ |

Click here to see the full list of 1238 stocks from our Top Asian Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Aichi Electric (NSE:6623)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Aichi Electric Co., Ltd. and its subsidiaries manufacture and sell electric power products both in Japan and internationally, with a market cap of ¥44.72 billion.

Operations: Aichi Electric Co., Ltd.'s revenue primarily comes from its Rotating Machine segment at ¥57.46 billion, followed by Power Equipment at ¥37.76 billion, and Printed Board at ¥25.18 billion.

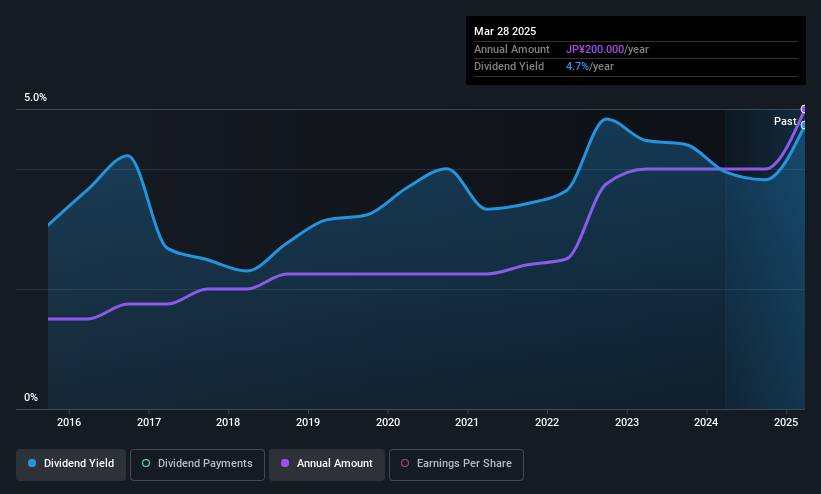

Dividend Yield: 4.6%

Aichi Electric offers a compelling profile for dividend investors, with a stable and reliable dividend history over the past decade. Its 4.62% yield places it in the top quartile of Japanese dividend payers, supported by a low payout ratio of 30.9%, indicating sustainability from earnings. Despite its high cash payout ratio of 79.3%, dividends remain covered by cash flows, while its price-to-earnings ratio of 6.7x suggests good value compared to the broader market.

- Click to explore a detailed breakdown of our findings in Aichi Electric's dividend report.

- The valuation report we've compiled suggests that Aichi Electric's current price could be inflated.

Pico Far East Holdings (SEHK:752)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Pico Far East Holdings Limited is an investment holding company involved in exhibition, event, and brand activation; visual branding activation; museum and themed environment; meeting architecture activation; and related businesses, with a market cap of HK$2.69 billion.

Operations: Pico Far East Holdings Limited generates its revenue primarily from exhibition, event, and brand activation (HK$5.71 billion), followed by museum and themed entertainment (HK$461.61 million), visual branding activation (HK$344.19 million), and meeting architecture activation (HK$176.64 million).

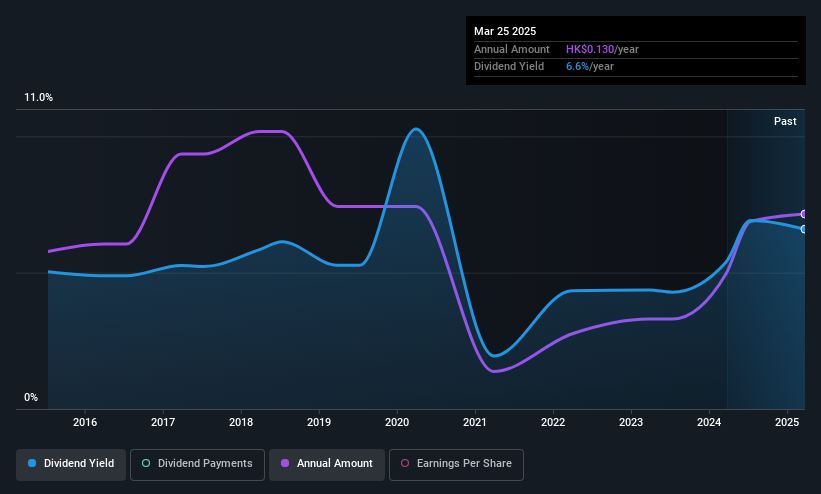

Dividend Yield: 6%

Pico Far East Holdings declared a final dividend of HK$0.075 and a special dividend of HK$0.035 per share, both payable on May 21, 2025. Despite an unreliable and volatile dividend history over the past decade, its current payout ratio of 45.1% indicates dividends are well covered by earnings, while a cash payout ratio of 17.7% ensures coverage by cash flows. However, its yield is below Hong Kong's top quartile for dividend payers at 6.05%.

- Get an in-depth perspective on Pico Far East Holdings' performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Pico Far East Holdings' share price might be too pessimistic.

DMW (TSE:6365)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DMW Corporation manufactures and sells fluid machinery both in Japan and internationally, with a market cap of ¥18.35 billion.

Operations: DMW Corporation's revenue segments include the manufacture and sale of fluid machinery in Japan and international markets.

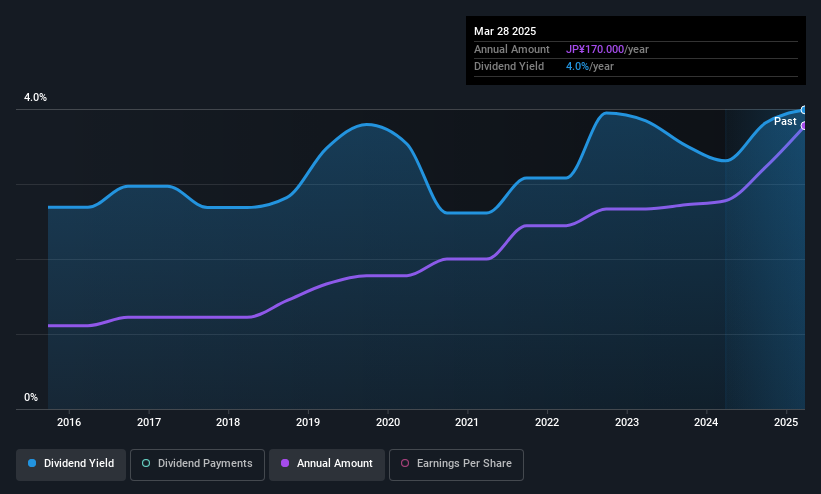

Dividend Yield: 3.8%

DMW Corporation's dividend payments have been stable and reliable over the past decade, with consistent growth and minimal volatility. Although its 3.84% yield is slightly below Japan's top quartile, dividends are well covered by earnings (29.5% payout ratio) and cash flows (47.5% cash payout ratio). Trading at 54.8% below estimated fair value, DMW offers potential value for investors seeking stability in dividend income, supported by last year's earnings growth of 38.6%.

- Take a closer look at DMW's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of DMW shares in the market.

Make It Happen

- Reveal the 1238 hidden gems among our Top Asian Dividend Stocks screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:752

Pico Far East Holdings

An investment holding company, engages in the exhibition, event, and brand activation; visual branding activation; museum and themed environment; meeting architecture activation; and related businesses.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives