Is Ebara (TSE:6361) Using Share Buybacks to Signal Strong Financial Discipline or Limited Expansion Plans?

Reviewed by Sasha Jovanovic

- Between August 14 and September 30, 2025, Ebara Corporation completed the repurchase of 1,747,600 shares, representing 0.38% of outstanding shares, for ¥5,339.47 million, finalizing their previously announced buyback program.

- This move reflects the company’s ongoing commitment to improving capital efficiency and signals management’s confidence in Ebara’s financial health.

- To explore the implications for Ebara's investment case, we'll focus on how share repurchases highlight proactive capital allocation and shareholder priorities.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Ebara's Investment Narrative?

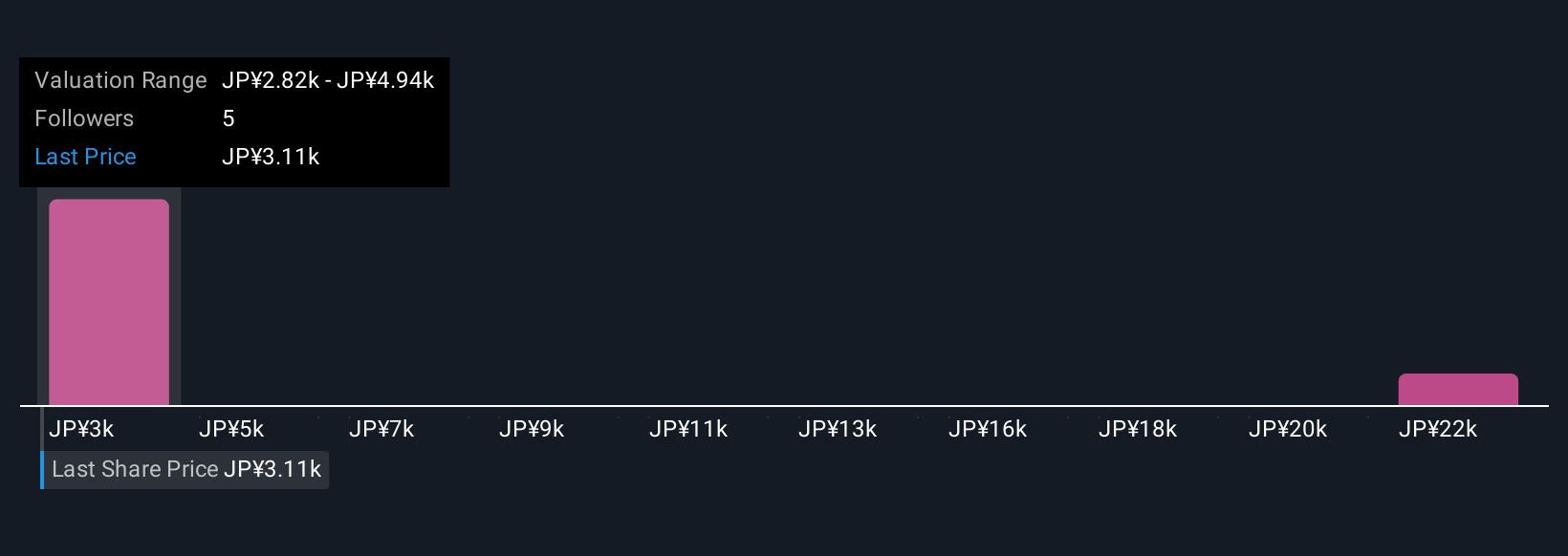

To own Ebara stock, you have to believe in its ability to consistently improve operational efficiency and generate value for shareholders, especially in Japan’s highly competitive machinery sector. The recently completed ¥5.34 billion share buyback fits into a pattern of disciplined capital management and confidence from management, reinforcing Ebara's existing reputation for financial stability. However, this particular buyback, while helpful in supporting near-term sentiment and perhaps contributing to the recent sharp share price moves, does not materially shift the major short-term catalysts or risks for the business. Key eyes remain on the upcoming Q3 2025 results in November, where investors will look for confirmation of margin and earnings growth in the face of only modest revenue expansion. Risks like high earnings multiples and a relatively expensive valuation remain, especially given sector comparables and the company’s slightly lower return on equity forecast.

But the biggest concern may be how resilient margins prove if earnings growth starts to slow.

Exploring Other Perspectives

Explore 3 other fair value estimates on Ebara - why the stock might be worth over 6x more than the current price!

Build Your Own Ebara Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ebara research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ebara research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ebara's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ebara might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6361

Ebara

Manufactures and sells pumps, compressors, turbines, and chillers in Europe, the Middle East, Africa, Asia, Japan, Oceania, North America, and Central and South America.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives