- Japan

- /

- Semiconductors

- /

- TSE:6890

Top Dividend Stocks On The Japanese Exchange

Reviewed by Simply Wall St

Japan's stock markets have recently experienced significant gains, with the Nikkei 225 Index rising 5.6% and the broader TOPIX Index up 3.7%, driven by optimism surrounding China's stimulus measures and dovish commentary from the Bank of Japan. This favorable backdrop highlights the importance of dividend stocks, which can provide a reliable income stream in times of market volatility and economic uncertainty. A good dividend stock typically offers consistent payouts, strong financial health, and a sustainable business model—traits that are especially valuable in today's dynamic market environment.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.17% | ★★★★★★ |

| Globeride (TSE:7990) | 4.33% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.88% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.10% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.85% | ★★★★★★ |

| Innotech (TSE:9880) | 4.99% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.34% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.60% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.46% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.55% | ★★★★★★ |

Click here to see the full list of 457 stocks from our Top Japanese Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Sakai Heavy Industries (TSE:6358)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sakai Heavy Industries, Ltd. manufactures and sells construction equipment and industrial machinery both in Japan and internationally, with a market cap of ¥21.90 billion.

Operations: Sakai Heavy Industries, Ltd. generates revenue from several key regions, including ¥1.96 billion from China, ¥23.01 billion from Japan, ¥6.33 billion from Indonesia, and ¥9.62 billion from the United States.

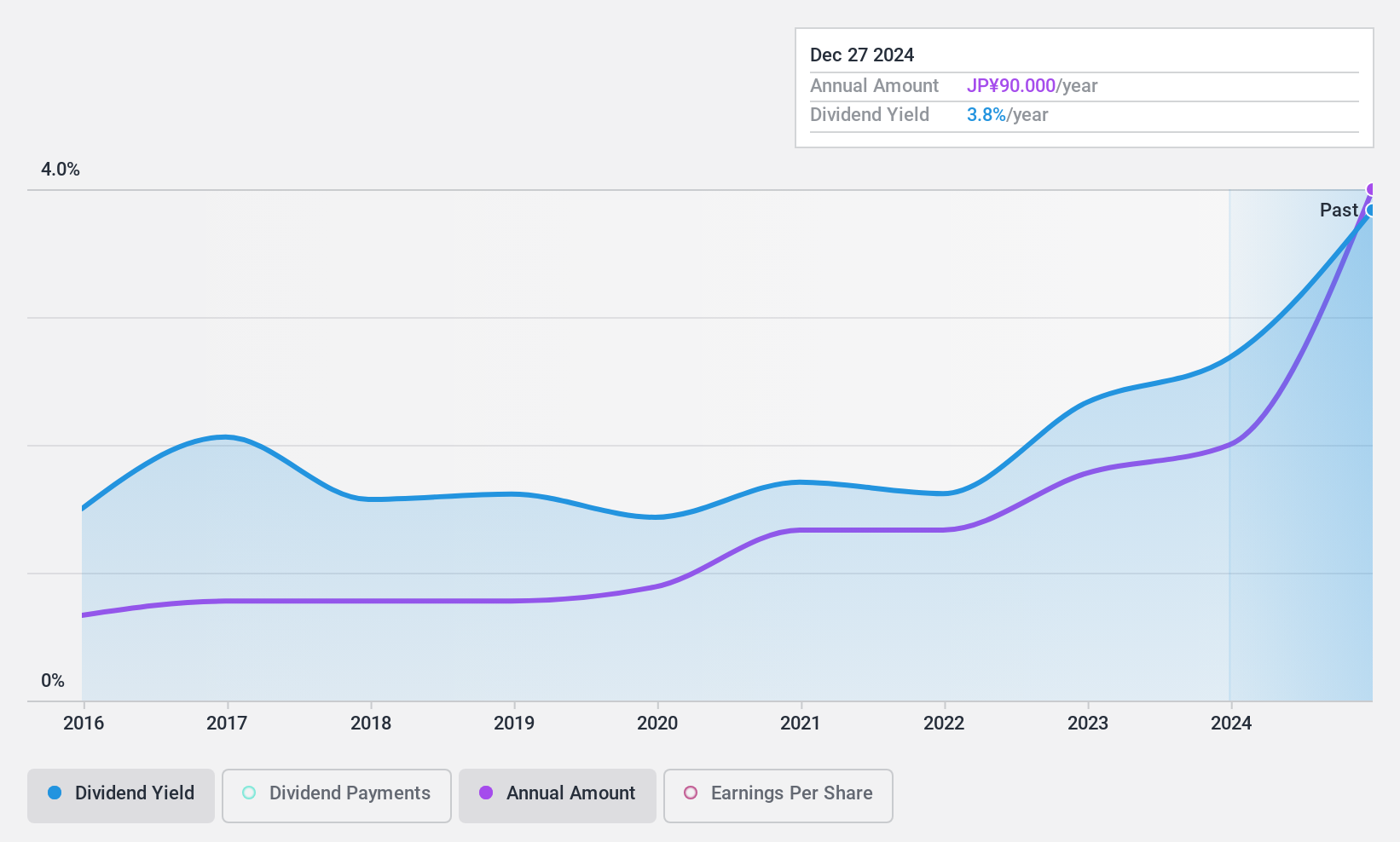

Dividend Yield: 4.2%

Sakai Heavy Industries offers a dividend yield of 4.19%, placing it in the top 25% of Japanese dividend payers. Despite its attractive yield, the company's dividends have been volatile over the past decade, showing instability and unreliability. However, with a payout ratio of 45.6% and a cash payout ratio of 43.1%, dividends are well-covered by earnings and cash flows. Recent ex-dividend was ¥85 on July 9, indicating continued shareholder returns despite past volatility.

- Unlock comprehensive insights into our analysis of Sakai Heavy Industries stock in this dividend report.

- Our valuation report unveils the possibility Sakai Heavy Industries' shares may be trading at a discount.

Ferrotec Holdings (TSE:6890)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ferrotec Holdings Corporation operates in semiconductor equipment-related and electronic device businesses both in Japan and internationally, with a market cap of ¥116.09 billion.

Operations: Ferrotec Holdings Corporation generates revenue from its Semiconductor Equipment Related Business, which accounts for ¥140.12 billion, and its Electronic Device Business, contributing ¥60.99 billion.

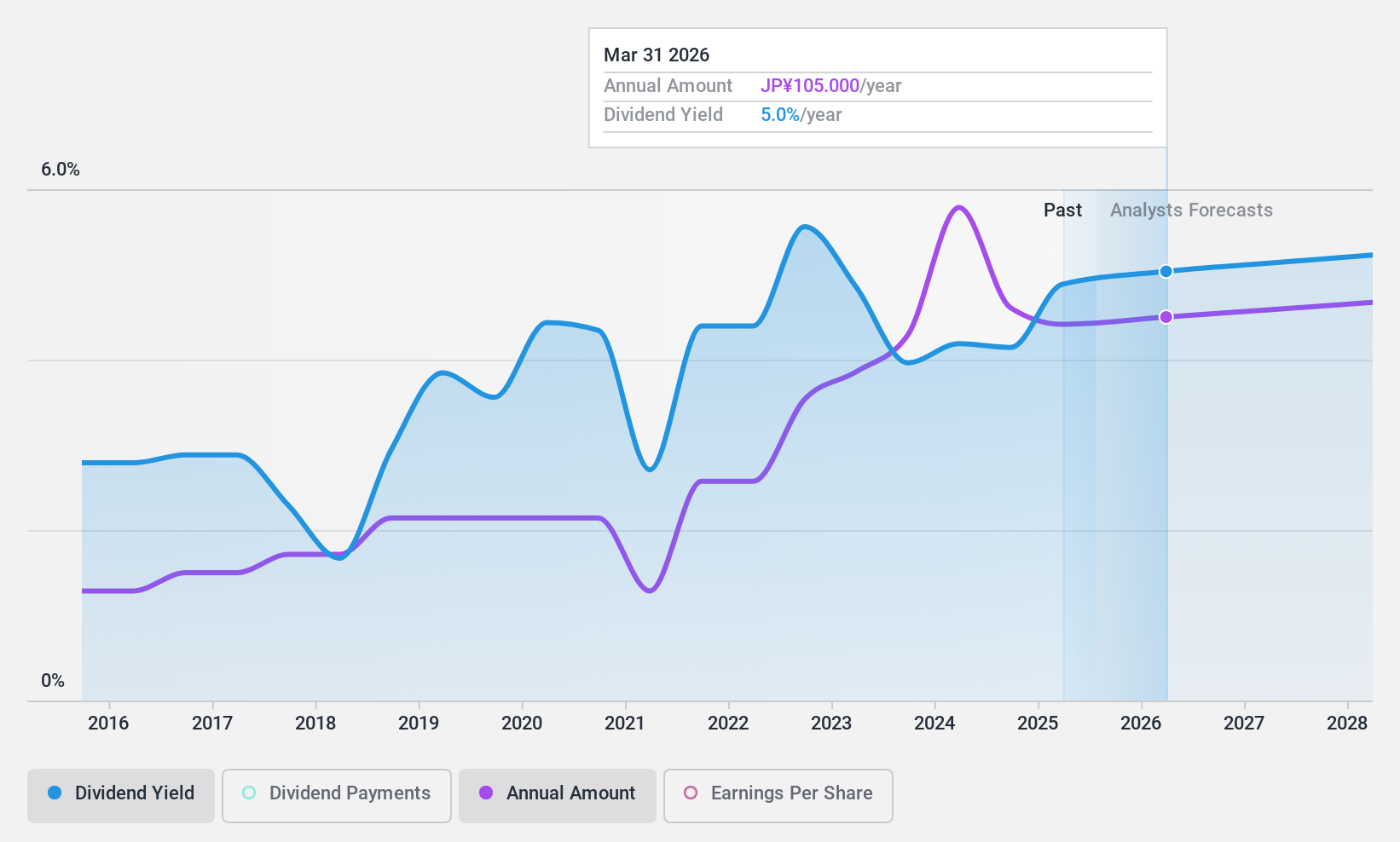

Dividend Yield: 4.1%

Ferrotec Holdings provides a dividend yield of 4.05%, ranking it among the top 25% of Japanese dividend payers. The company's dividends have been volatile over the past decade, with inconsistent payments and no free cash flow coverage, despite a low payout ratio of 30%. While trading at a good value with a P/E ratio of 7.4x below the market average, recent profit margins have declined to 6.8% from last year's 12.2%.

- Click here and access our complete dividend analysis report to understand the dynamics of Ferrotec Holdings.

- According our valuation report, there's an indication that Ferrotec Holdings' share price might be on the cheaper side.

IDEA ConsultantsInc (TSE:9768)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: IDEA Consultants, Inc. offers integrated consultancy services for social infrastructure development and environmental conservation projects both in Japan and internationally, with a market cap of ¥17.71 billion.

Operations: IDEA Consultants, Inc. generates revenue through consultancy services focused on social infrastructure development and environmental conservation projects in both domestic and international markets.

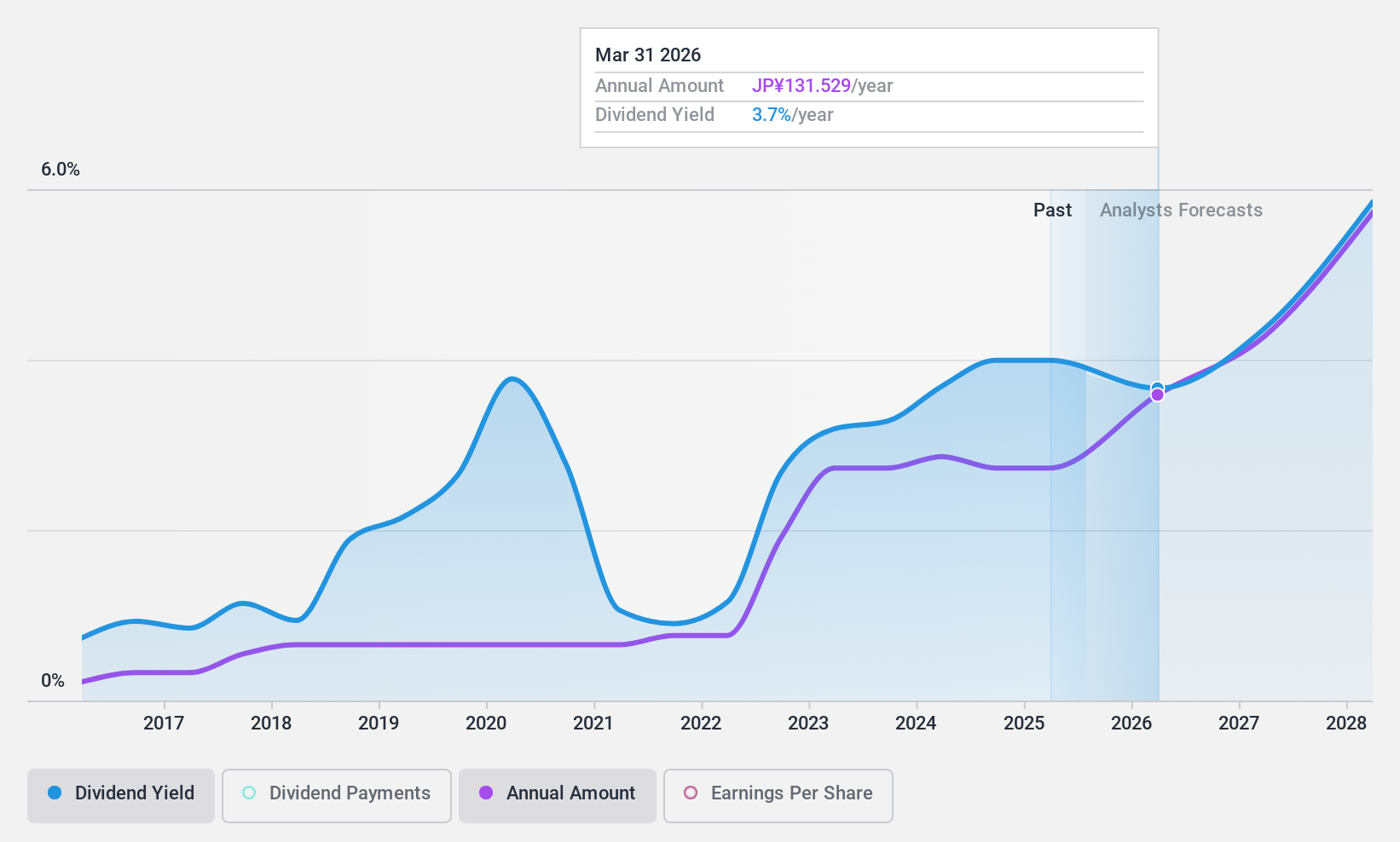

Dividend Yield: 3.6%

IDEA Consultants Inc. offers a stable dividend yield of 3.63%, slightly below the top 25% in Japan's market. The company's dividends have been consistently reliable and growing over the past decade, with a low payout ratio of 17.8%, ensuring sustainability through earnings and cash flows. Trading at 10.5% below its estimated fair value, IDEA Consultants presents good value while maintaining well-covered dividends with a cash payout ratio of 33.6%.

- Delve into the full analysis dividend report here for a deeper understanding of IDEA ConsultantsInc.

- Our expertly prepared valuation report IDEA ConsultantsInc implies its share price may be lower than expected.

Key Takeaways

- Investigate our full lineup of 457 Top Japanese Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6890

Ferrotec Holdings

Engages in semiconductor equipment-related, electronic device, and other businesses in Japan and internationally.

Excellent balance sheet average dividend payer.