Kitagawa SeikiLtd's (TSE:6327) Sluggish Earnings Might Be Just The Beginning Of Its Problems

Investors were disappointed by Kitagawa Seiki Co.,Ltd.'s (TSE:6327 ) latest earnings release. We did some analysis, and found that there are some reasons to be cautious about the headline numbers.

View our latest analysis for Kitagawa SeikiLtd

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. Kitagawa SeikiLtd expanded the number of shares on issue by 14% over the last year. That means its earnings are split among a greater number of shares. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. Check out Kitagawa SeikiLtd's historical EPS growth by clicking on this link.

How Is Dilution Impacting Kitagawa SeikiLtd's Earnings Per Share (EPS)?

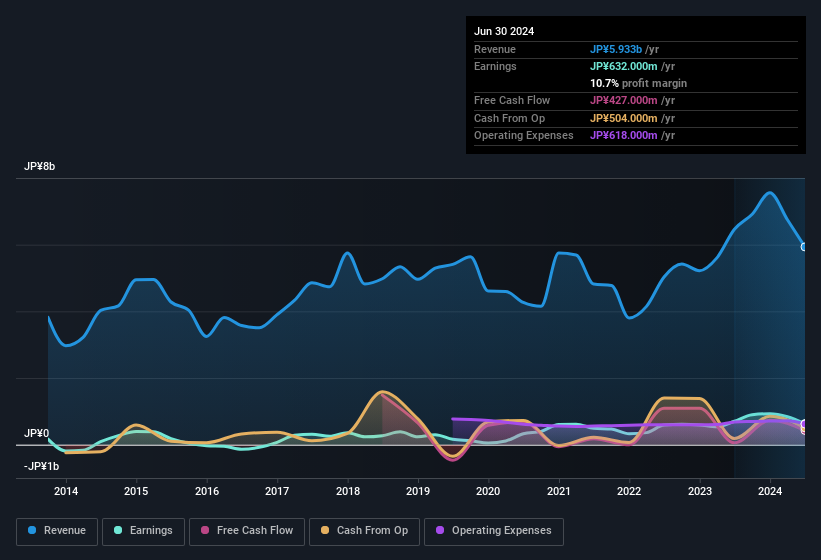

As you can see above, Kitagawa SeikiLtd has been growing its net income over the last few years, with an annualized gain of 28% over three years. Net income was down 10.0% over the last twelve months. But the EPS result was even worse, with the company recording a decline of 14%. So you can see that the dilution has had a bit of an impact on shareholders.

If Kitagawa SeikiLtd's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Kitagawa SeikiLtd's Profit Performance

Kitagawa SeikiLtd issued shares during the year, and that means its EPS performance lags its net income growth. Because of this, we think that it may be that Kitagawa SeikiLtd's statutory profits are better than its underlying earnings power. Nonetheless, it's still worth noting that its earnings per share have grown at 25% over the last three years. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. You'd be interested to know, that we found 3 warning signs for Kitagawa SeikiLtd and you'll want to know about these.

This note has only looked at a single factor that sheds light on the nature of Kitagawa SeikiLtd's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

Valuation is complex, but we're here to simplify it.

Discover if Kitagawa SeikiLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6327

Kitagawa SeikiLtd

Engages in the manufacture and sale of press machines, factory automation equipment, and transfer machines.

Flawless balance sheet and fair value.

Market Insights

Community Narratives