Investors Appear Satisfied With Harmonic Drive Systems Inc.'s (TSE:6324) Prospects As Shares Rocket 35%

Harmonic Drive Systems Inc. (TSE:6324) shareholders have had their patience rewarded with a 35% share price jump in the last month. Looking further back, the 10% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

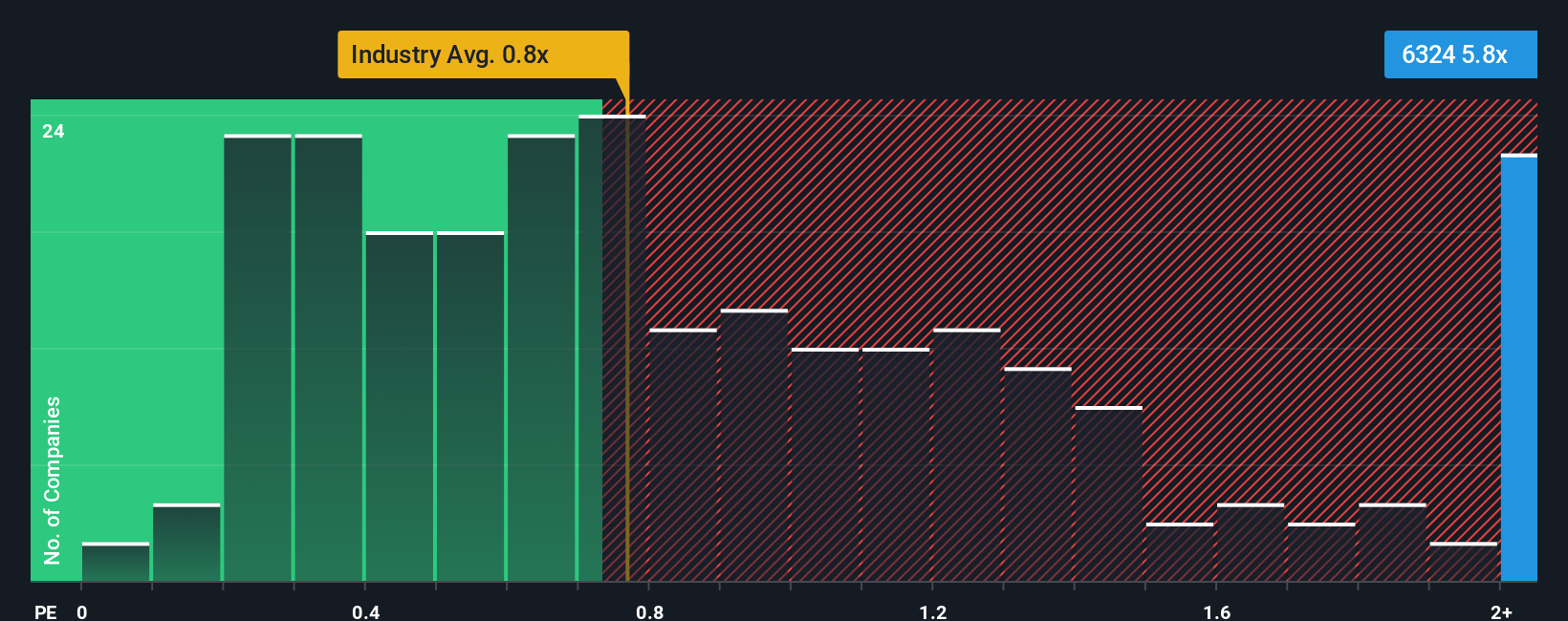

Since its price has surged higher, you could be forgiven for thinking Harmonic Drive Systems is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5.8x, considering almost half the companies in Japan's Machinery industry have P/S ratios below 0.8x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Harmonic Drive Systems

How Harmonic Drive Systems Has Been Performing

There hasn't been much to differentiate Harmonic Drive Systems' and the industry's revenue growth lately. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Harmonic Drive Systems' future stacks up against the industry? In that case, our free report is a great place to start.How Is Harmonic Drive Systems' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Harmonic Drive Systems' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a decent 4.4% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 7.8% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 12% per year as estimated by the twelve analysts watching the company. That's shaping up to be materially higher than the 5.2% per year growth forecast for the broader industry.

In light of this, it's understandable that Harmonic Drive Systems' P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

The strong share price surge has lead to Harmonic Drive Systems' P/S soaring as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Harmonic Drive Systems' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Harmonic Drive Systems (1 doesn't sit too well with us!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Harmonic Drive Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6324

Harmonic Drive Systems

Produces and sells precision control equipment and components worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.