Does Rising Automation and Sustainability Shift the Competitive Landscape for Komatsu (TSE:6301)?

Reviewed by Sasha Jovanovic

- Recent developments highlight strong opportunities in the global machinery market, driven by rising automation demand, infrastructure growth, and evolving technologies, with Komatsu, Caterpillar, and John Deere at the forefront of innovation in response to industry needs.

- The market outlook is being shaped by rapid integration of IoT, AI, and sustainability-focused solutions, accelerating competition in eco-friendly industrial machinery and positioning leaders like Komatsu to respond to evolving customer requirements.

- In light of this emphasis on automation and sustainability, we will examine how these trends may impact Komatsu's investment outlook going forward.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Komatsu Investment Narrative Recap

To be a shareholder in Komatsu today, you need to believe in the ongoing transformation of the global machinery sector, where automation and sustainability are rapidly gaining importance. While the recent news of rising automation and eco-friendly innovations affirms the industry’s trajectory, it does not significantly change the most immediate catalyst for Komatsu: accelerating demand for low-emission equipment in mining and construction. Near-term risks remain tied to potential declines in core segment sales and regional weaknesses, especially in Japan and Indonesia.

Among Komatsu’s recent announcements, the collaboration with Cummins Inc. and Wabtec to develop hybrid powertrains for heavy mining equipment stands out. This aligns closely with the growing focus on automation and sustainability and could reinforce the company’s position as demand increases for compliant, future-ready machinery solutions. Ultimately, the ability to successfully commercialize and scale such innovations will be key to realizing near-term growth benefits for shareholders.

On the other hand, investors should not overlook the risk that if demand in key markets like Japan and Indonesia fails to recover...

Read the full narrative on Komatsu (it's free!)

Komatsu's outlook forecasts ¥4,297.5 billion in revenue and ¥444.3 billion in earnings by 2028. This is based on an assumed 2.0% annual revenue growth and an increase of ¥23.6 billion in earnings from the current ¥420.7 billion.

Uncover how Komatsu's forecasts yield a ¥5075 fair value, a 6% downside to its current price.

Exploring Other Perspectives

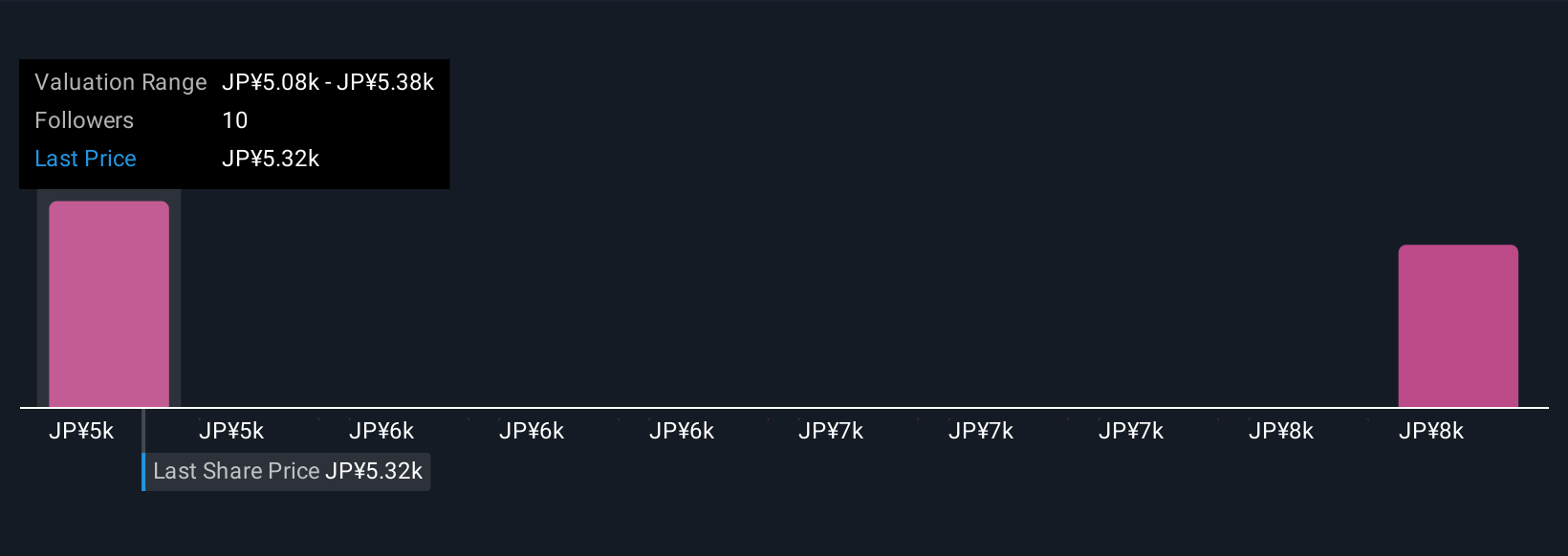

Simply Wall St Community members see Komatsu’s fair value ranging widely from ¥5,075 to ¥8,087 across two analyses. Opinions differ, especially as demand outlooks for Japan and Indonesia weigh on near-term earnings and capital allocation priorities, explore these views to see how your perspective compares.

Explore 2 other fair value estimates on Komatsu - why the stock might be worth as much as 50% more than the current price!

Build Your Own Komatsu Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Komatsu research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Komatsu research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Komatsu's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 39 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Komatsu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6301

Komatsu

Manufactures and sells construction, mining, and utility equipment in Japan, the Americas, Europe, China, rest of Asia, Oceania, the Middle East, Africa, and CIS countries.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives