Undiscovered Gems And 2 Other Hidden Small Caps With Strong Potential

Reviewed by Simply Wall St

In the midst of a global market environment marked by fluctuating indices and economic uncertainties, small-cap stocks have faced their share of challenges, as evidenced by the Russell 2000's recent decline. However, within this landscape of volatility lie opportunities for discovery, where lesser-known small-cap companies can offer unique growth potential. Identifying a good stock in such conditions often involves looking for strong fundamentals and innovative business models that align with current market trends and investor sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nihon Parkerizing | 0.31% | 2.12% | 6.94% | ★★★★★★ |

| Intelligent Wave | NA | 7.39% | 15.42% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Shenzhen Zhongheng Huafa | NA | 0.80% | 18.00% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Shenzhen Longtech Smart Control | 3.11% | 18.50% | 15.96% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Akis Gayrimenkul Yatirim Ortakligi (IBSE:AKSGY)

Simply Wall St Value Rating: ★★★★★☆

Overview: Akis Gayrimenkul Yatirim Ortakligi is a Turkey-based real estate investment company with a market capitalization of TRY16.35 billion, focusing on the development and management of commercial and residential properties.

Operations: Akis Gayrimenkul Yatirim A.S generates revenue primarily from its Akasya Project, contributing TRY1.52 billion, and the Akbati Project, adding TRY624.36 million.

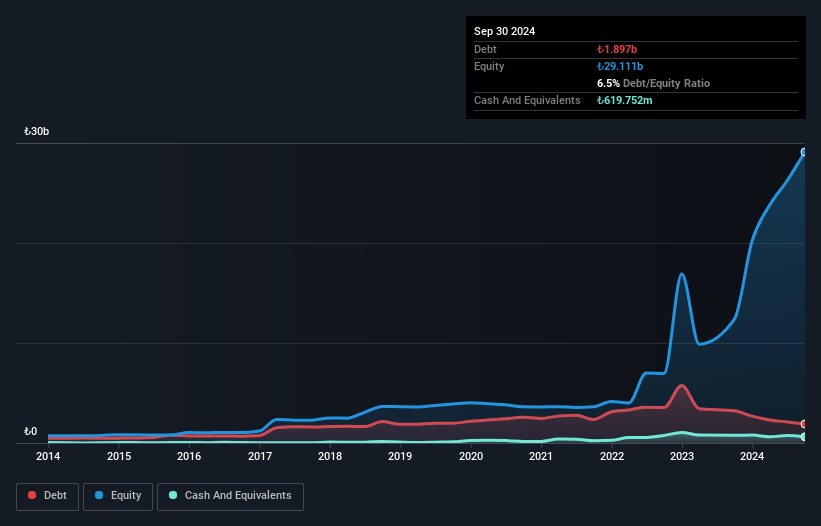

Akis Gayrimenkul Yatirim Ortakligi, a notable player in the real estate sector, presents intriguing dynamics with its current Price-To-Earnings ratio of 5.2x, significantly below the TR market average of 14.7x. Despite a slight negative earnings growth of -0.9% over the past year, it outpaces the REITs industry average of -42%. The company's debt to equity ratio has impressively decreased from 50.9% to 6.5% over five years, highlighting improved financial health. Recent earnings reports show quarterly sales at TRY 734 million and net income at TRY 541 million for Q3, reflecting a decrease compared to last year’s figures but maintaining profitability with high-quality earnings and satisfactory interest coverage.

DongKook Pharmaceutical (KOSDAQ:A086450)

Simply Wall St Value Rating: ★★★★★★

Overview: DongKook Pharmaceutical Co., Ltd. is engaged in the production and sale of pharmaceutical products both in South Korea and internationally, with a market capitalization of approximately ₩792.75 billion.

Operations: DongKook Pharmaceutical generates revenue primarily from its pharmaceutical segment, amounting to approximately ₩775.33 billion. The company has a market capitalization of around ₩792.75 billion.

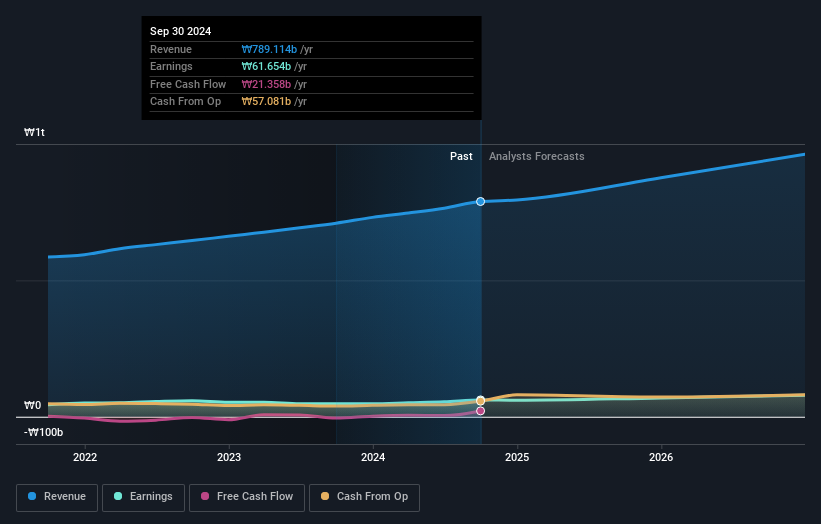

In the pharmaceutical landscape, DongKook Pharmaceutical stands out with its robust financial health and promising growth trajectory. Over the past five years, the company's debt to equity ratio has improved significantly from 15.6% to 10.4%, indicating better financial management. With earnings forecasted to grow by 14% annually, DongKook is poised for steady expansion despite not surpassing the industry's recent growth of nearly 22%. The firm also boasts high-quality earnings and sufficient cash flow to cover interest obligations comfortably, reflecting a strong position in managing its finances effectively without excessive leverage concerns.

Union Tool (TSE:6278)

Simply Wall St Value Rating: ★★★★★★

Overview: Union Tool Co. specializes in producing and selling cutting tools, linear motion products, and metal machining equipment both in Japan and internationally, with a market cap of ¥105.55 billion.

Operations: Union Tool Co. generates revenue through the sale of cutting tools, linear motion products, and metal machining equipment. The company's market capitalization is ¥105.55 billion.

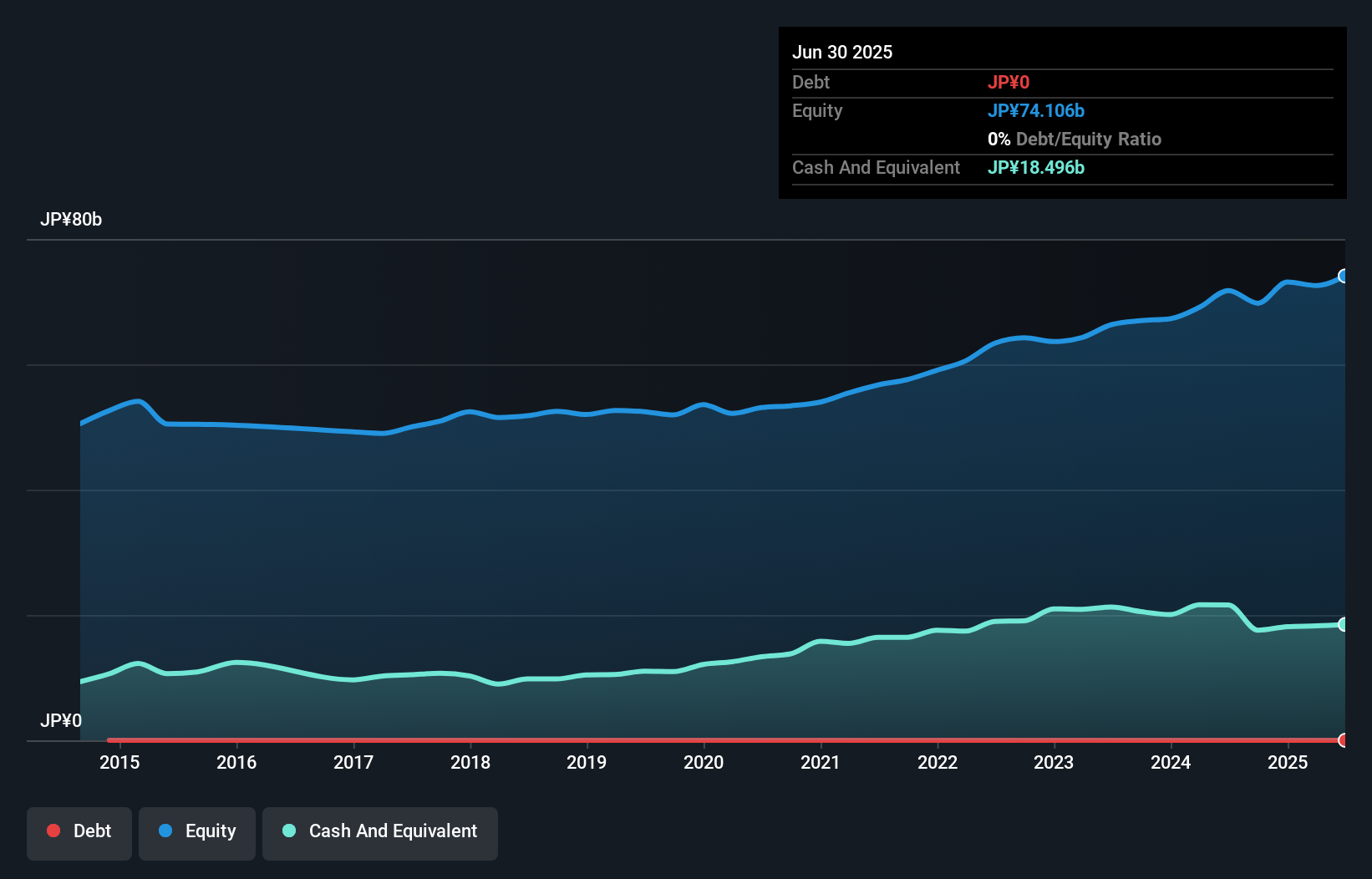

Union Tool, a promising player in the machinery sector, has shown impressive financial health with no debt for five years and high-quality past earnings. Over the past year, its earnings surged by 36.3%, outpacing the industry's modest 0.8% growth rate. The company is trading at 22.2% below its estimated fair value, suggesting potential undervaluation in the market. Recent guidance forecasts net sales of ¥30 billion and an operating profit of ¥6.2 billion for fiscal year-end December 2024, indicating robust performance expectations amidst a volatile share price environment over recent months.

Taking Advantage

- Embark on your investment journey to our 4654 Undiscovered Gems With Strong Fundamentals selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:AKSGY

Akis Gayrimenkul Yatirim Ortakligi

Akis Gayrimenkul Yatirim A.S is based in Turkey.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives