As global markets navigate the challenges of rising U.S. Treasury yields and cautious economic growth, investors are keenly watching for opportunities that can thrive in this environment. Despite these headwinds, growth stocks with high insider ownership often attract attention due to their potential for strong alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Medley (TSE:4480) | 34% | 30.4% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

We're going to check out a few of the best picks from our screener tool.

Suzhou Novosense Microelectronics (SHSE:688052)

Simply Wall St Growth Rating: ★★★★★☆

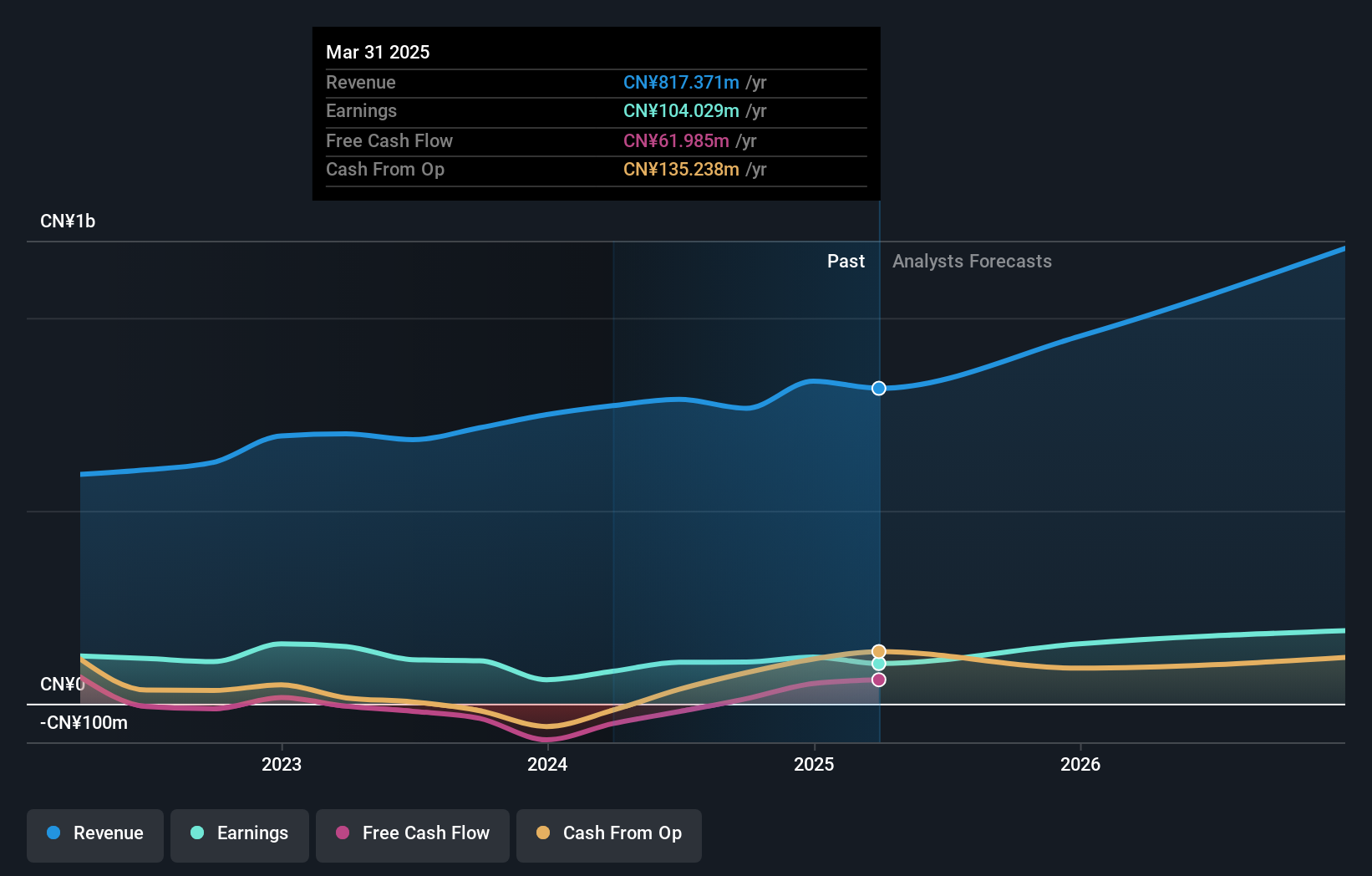

Overview: Suzhou Novosense Microelectronics Co., Ltd. is a company engaged in the design and development of microelectronic products, with a market cap of approximately CN¥18.73 billion.

Operations: Revenue Segments (in millions of CN¥):

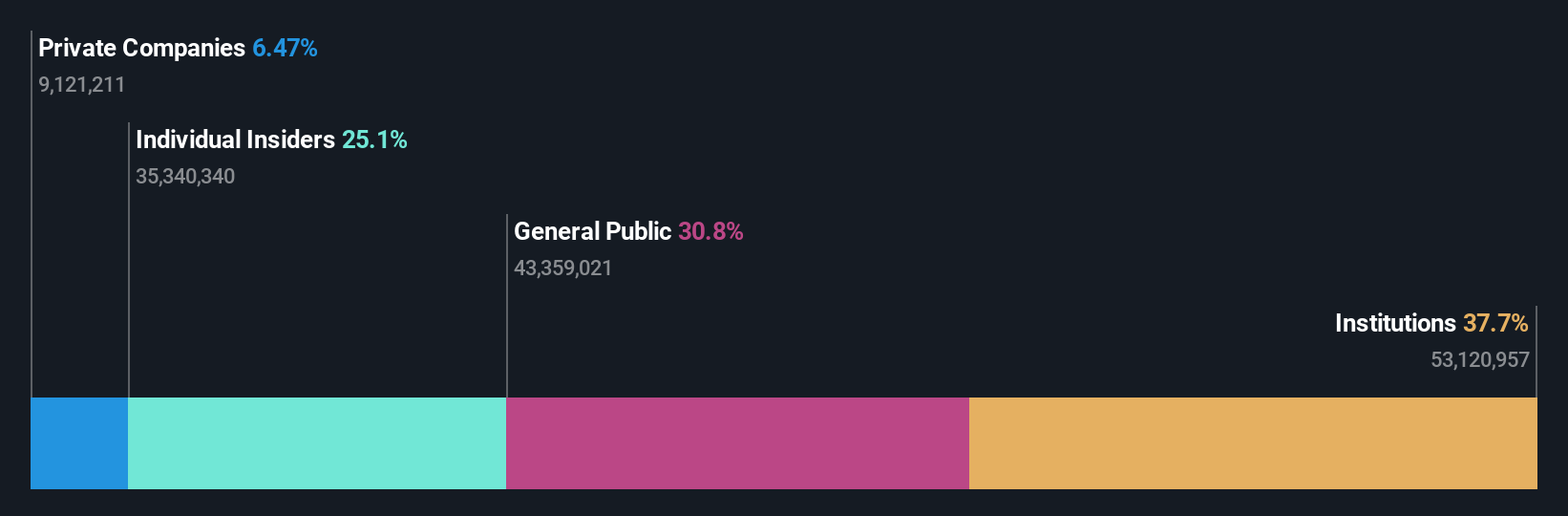

Insider Ownership: 25.1%

Earnings Growth Forecast: 116.8% p.a.

Suzhou Novosense Microelectronics is experiencing significant revenue growth, with forecasts suggesting a 31.2% annual increase, outpacing the broader Chinese market. Despite this, the company reported a net loss of CNY 265.25 million for the first half of 2024, doubling from last year. While earnings are expected to grow rapidly at 116.79% annually and profitability is anticipated within three years, insider trading activity has been minimal recently and share price volatility remains high.

- Dive into the specifics of Suzhou Novosense Microelectronics here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Suzhou Novosense Microelectronics' share price might be too optimistic.

Pansoft (SZSE:300996)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pansoft Company Limited offers enterprise management information solutions and IT integrated services in China, with a market cap of CN¥4.05 billion.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 36.6%

Earnings Growth Forecast: 28.5% p.a.

Pansoft is poised for significant growth, with earnings projected to rise 28.5% annually, surpassing the Chinese market average. Despite a volatile share price recently, its P/E ratio of 39.2x is attractive compared to the industry average of 86.4x. Recent earnings reports show positive momentum; sales reached CNY 293.81 million for the first nine months of 2024, reversing last year's net loss into a CNY 14.93 million profit, reflecting robust revenue expansion and improved profitability metrics.

- Navigate through the intricacies of Pansoft with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Pansoft's shares may be trading at a discount.

Union Tool (TSE:6278)

Simply Wall St Growth Rating: ★★★★☆☆

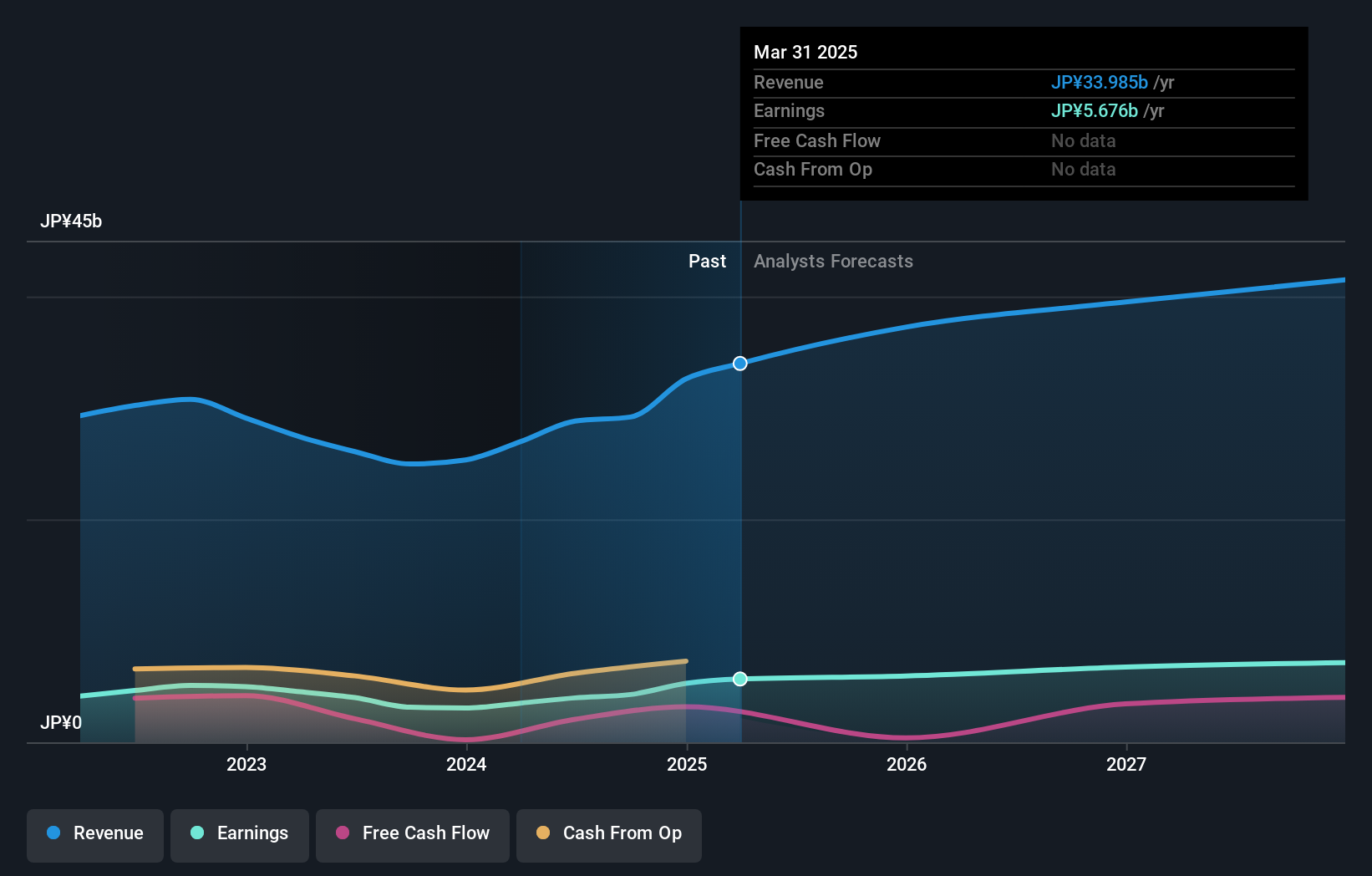

Overview: Union Tool Co. produces and sells cutting tools, linear motion products, and metal machining equipment both in Japan and internationally, with a market cap of ¥115.57 billion.

Operations: Revenue segments for Union Tool Co. are ¥19.84 billion from Japan, ¥15.05 billion from Asia, ¥2.17 billion from Europe, and ¥1.84 billion from North America.

Insider Ownership: 39.2%

Earnings Growth Forecast: 21.5% p.a.

Union Tool's earnings are forecast to grow significantly at 21.5% annually, outpacing the Japanese market average. The company's revenue is also projected to increase by 8.4% per year, though less than the desired high-growth threshold of 20%. While recent share price volatility may concern some investors, it trades at an attractive discount of 13.9% below its estimated fair value. Recent guidance suggests strong financial health with expected net sales of ¥30 billion and operating profit of ¥6.4 billion for fiscal year-end 2024.

- Click here to discover the nuances of Union Tool with our detailed analytical future growth report.

- The analysis detailed in our Union Tool valuation report hints at an inflated share price compared to its estimated value.

Summing It All Up

- Reveal the 1510 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300996

Pansoft

Provides enterprise management information solutions and IT integrated services in China.

Flawless balance sheet with high growth potential.