In December 2024, global markets are navigating a complex landscape marked by cautious Federal Reserve commentary and political uncertainties, with small-cap indices like the S&P 600 experiencing notable declines amid broader market volatility. As investors digest these developments, the search for undiscovered gems in the stock market becomes increasingly relevant, requiring a keen eye for companies with robust fundamentals and potential resilience in challenging economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Vilkyskiu pienine | 35.79% | 17.20% | 49.04% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Intellego Technologies | 12.32% | 73.44% | 78.22% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.44% | 27.31% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Lavipharm | 39.21% | 9.47% | -15.70% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Faes Farma (BME:FAE)

Simply Wall St Value Rating: ★★★★★☆

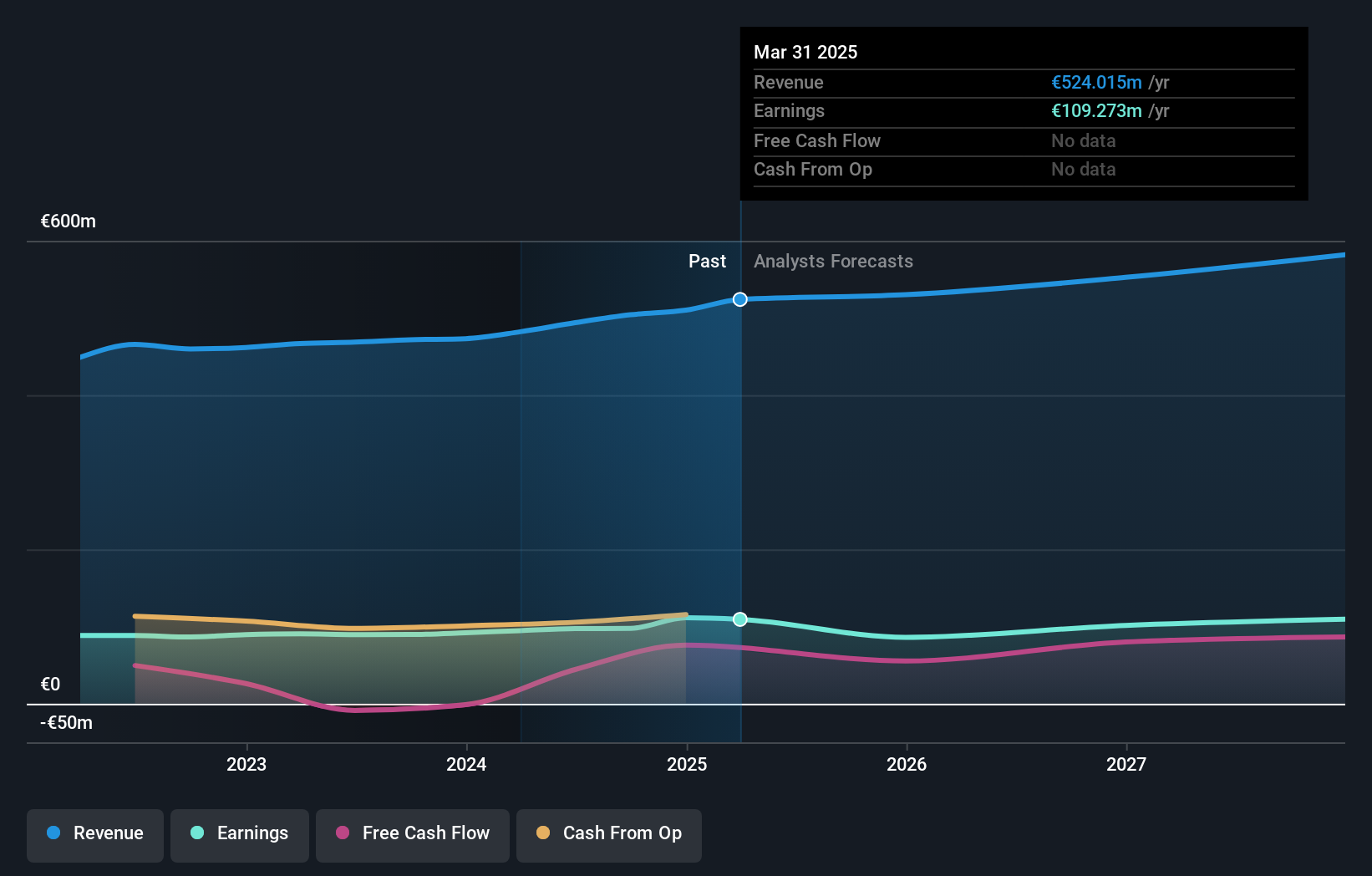

Overview: Faes Farma, S.A. is a global company engaged in the research, development, production, and marketing of pharmaceutical and healthcare products as well as raw materials, with a market capitalization of approximately €1.07 billion.

Operations: Faes Farma generates revenue primarily from its Pharmaceutical Products segment, amounting to €448.08 million, followed by the Nutrition and Animal Health segment with €52.36 million.

Faes Farma, a nimble player in the pharmaceutical industry, posted revenue of €392.92 million for the first nine months of 2024, up from €361.97 million last year. Net income also rose to €79.84 million from €74.16 million previously, highlighting its solid financial footing despite earnings growth (8.8%) lagging behind the industry's 9.5%. The firm trades at a compelling value, 31% below estimated fair value and boasts high-quality earnings with interest payments well-covered by EBIT at an impressive 211x coverage ratio. However, its debt-to-equity ratio has climbed to 6.9% over five years, suggesting some caution is warranted moving forward.

- Click here to discover the nuances of Faes Farma with our detailed analytical health report.

Assess Faes Farma's past performance with our detailed historical performance reports.

Union Tool (TSE:6278)

Simply Wall St Value Rating: ★★★★★★

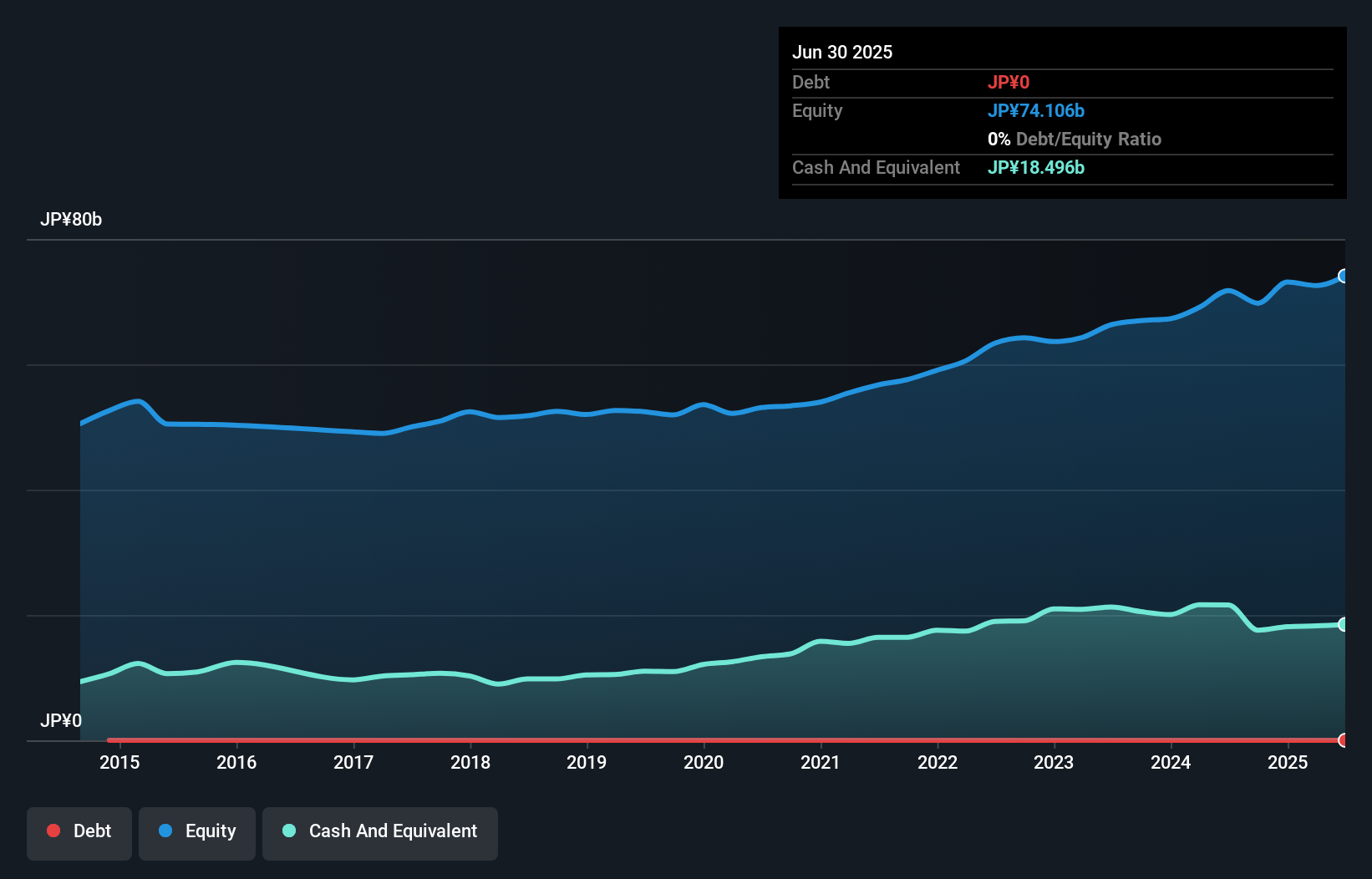

Overview: Union Tool Co. specializes in the production and sale of cutting tools, linear motion products, and metal machining equipment both in Japan and internationally, with a market capitalization of ¥85.86 billion.

Operations: Union Tool Co.'s revenue primarily comes from Japan and Asia, contributing ¥20.95 billion and ¥15.54 billion respectively, with smaller revenues from Europe and North America.

Union Tool, a nimble player in the machinery sector, has showcased impressive earnings growth of 36% over the past year, outpacing the industry average of 0.8%. The company is trading at a significant discount, approximately 38% below its estimated fair value. With no debt on its books for five years and high-quality earnings reported consistently, Union Tool seems well-positioned financially. The firm forecasts net sales of ¥30.1 billion and an operating profit of ¥6.2 billion for fiscal year-end 2024, signaling robust potential despite recent share price volatility over three months.

- Click to explore a detailed breakdown of our findings in Union Tool's health report.

Explore historical data to track Union Tool's performance over time in our Past section.

ScinoPharm Taiwan (TWSE:1789)

Simply Wall St Value Rating: ★★★★★★

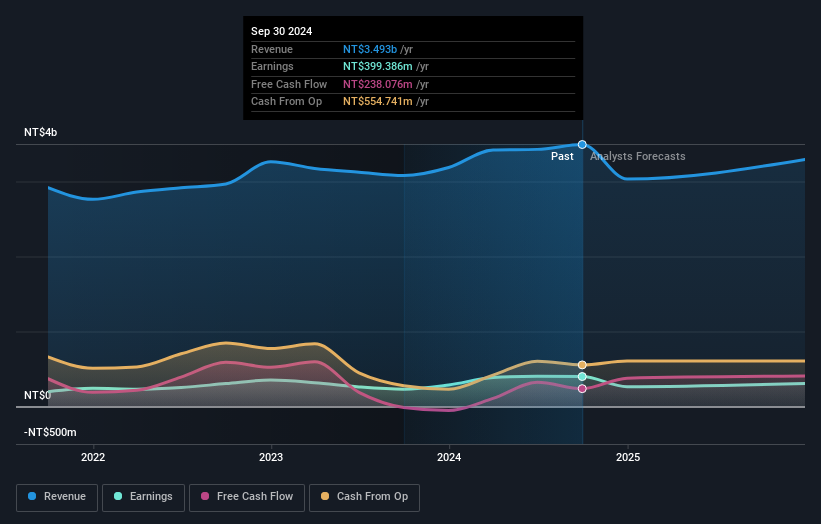

Overview: ScinoPharm Taiwan, Ltd. is engaged in the research, development, production, and sale of active pharmaceutical ingredients (API) to pharmaceutical companies across Taiwan and globally, with a market capitalization of NT$17.67 billion.

Operations: ScinoPharm Taiwan generates revenue primarily from its main operations in Taiwan, contributing NT$3.25 billion, while its subsidiary Changshu Shenlong adds NT$650.89 million to the total revenue stream.

ScinoPharm Taiwan, a dynamic player in the pharmaceutical sector, recently reported third-quarter sales of TWD 724.22 million, up from TWD 659.59 million last year. Despite this increase in sales, net income slightly decreased to TWD 27.1 million from TWD 30.72 million previously, indicating some pressure on margins as basic earnings per share dipped to TWD 0.03 from TWD 0.04 a year ago. Over the past year, however, earnings have surged by an impressive 72%, outpacing industry growth of around 12%. The company is trading at a notable discount of about 16% below its fair value estimate and maintains a robust financial position with more cash than total debt and reduced debt-to-equity ratio from previous years' figures of around 2% to just under half a percent now.

Turning Ideas Into Actions

- Reveal the 4633 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:FAE

Faes Farma

Researches, develops, produces, and markets pharmaceutical products, healthcare products, and raw materials worldwide.

Excellent balance sheet and good value.