JRCLtd (TSE:6224) Profit Margin Decline Challenges Bullish Growth Narrative

Reviewed by Simply Wall St

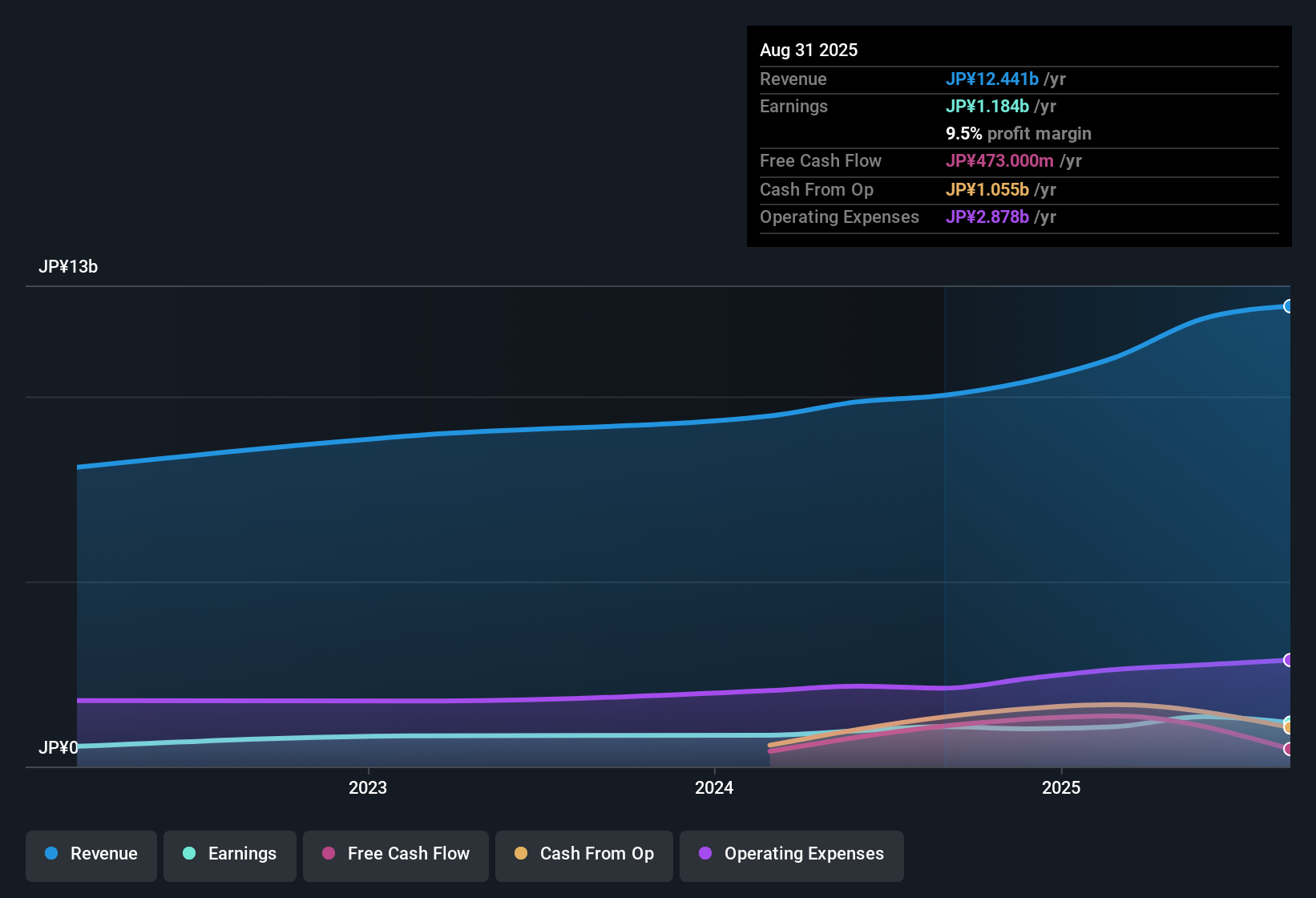

JRC Ltd (TSE:6224) reported a net profit margin of 9.5%, down from 10.7% last year, and the company’s earnings are forecast to grow by 14.49% per year. Over the past five years, profits have risen at a 19.4% annual pace, while future revenue is projected to expand at 12.5% per year, comfortably outpacing the broader Japanese market’s expected 4.4% growth. Although recent profit growth of 10% trails the five-year average and margins have slipped, investors are likely to focus on the strong earnings outlook and the stock’s valuation, which currently sits below estimated fair value.

See our full analysis for JRCLtd.Next up, we’ll see how these results measure up against Simply Wall St’s prevailing market narratives and what the numbers might challenge or confirm about JRC Ltd’s story.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Slippage Hints at Competition

- Net profit margin declined to 9.5%, down from 10.7% in the prior year. This narrows the buffer JRCLtd has enjoyed versus rivals and raises questions about cost pressures or competitive pricing.

- While momentum remains, with annual profits still growing by 10% over twelve months, the prevailing market view focuses on whether this pace can continue as competitive challenges intensify.

- Bulls may highlight five-year annual profit growth of 19.4%. However, recent margin pressure suggests not all gains are filtering through at the same rate.

- It is surprising that shrinking margins come despite continued revenue expansion, placing greater emphasis on cost controls to defend profitability.

Share Price Volatility Adds Uncertainty

- The share price has experienced instability over the past three months, emphasizing that even with strong fundamentals, external shocks or rapid shifts in investor mood can quickly move the stock away from underlying business trends.

- The prevailing market view points out that although forecasted annual earnings growth of 14.49% is robust, above-average price-to-earnings ratios and recent market swings could limit near-term upside.

- Despite growing both revenue and profit, investors are placing JRCLtd on a tighter leash as price movements diverge from fundamentals in the short term.

- Bears argue that without a recovery in margins or more stable trading, valuation risks could begin to outweigh the growth narrative.

DCF Fair Value Signals Room for Upside

- At a current share price of ¥1,342, JRCLtd trades well below its DCF fair value estimate of ¥2,323.65. This suggests a potential discount that could attract long-term investors if growth targets hold.

- Rather than a consensus narrative, the prevailing analysis highlights this valuation gap as a critical contrast. On the one hand, aggressive growth forecasts and a price below intrinsic value encourage optimism; on the other, slowing margin trends and volatile share movement urge caution.

- DCF fair value points to upside, but only if the company can reignite profit margin strength and stabilize trading conditions.

- Investors looking for bargains will watch to see if fundamentals reassert control over sentiment-driven swings.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on JRCLtd's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Recent margin declines, share price volatility, and uncertainty around sustaining high growth suggest JRC Ltd faces potential headwinds in maintaining consistent performance.

If you want to prioritize companies with more reliable earnings and fewer swings, turn to stable growth stocks screener (2094 results) to target steady growers built for resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6224

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives