Shareholders in Shima Seiki Mfg.Ltd (TSE:6222) have lost 56%, as stock drops 14% this past week

If you love investing in stocks you're bound to buy some losers. Long term Shima Seiki Mfg.,Ltd. (TSE:6222) shareholders know that all too well, since the share price is down considerably over three years. So they might be feeling emotional about the 57% share price collapse, in that time. The more recent news is of little comfort, with the share price down 39% in a year. Furthermore, it's down 22% in about a quarter. That's not much fun for holders.

With the stock having lost 14% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Given that Shima Seiki Mfg.Ltd didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, Shima Seiki Mfg.Ltd saw its revenue grow by 1.2% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. This uninspiring revenue growth has no doubt helped send the share price lower; it dropped 16% during the period. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term). Keep in mind it isn't unusual for good businesses to have a tough time or a couple of uninspiring years.

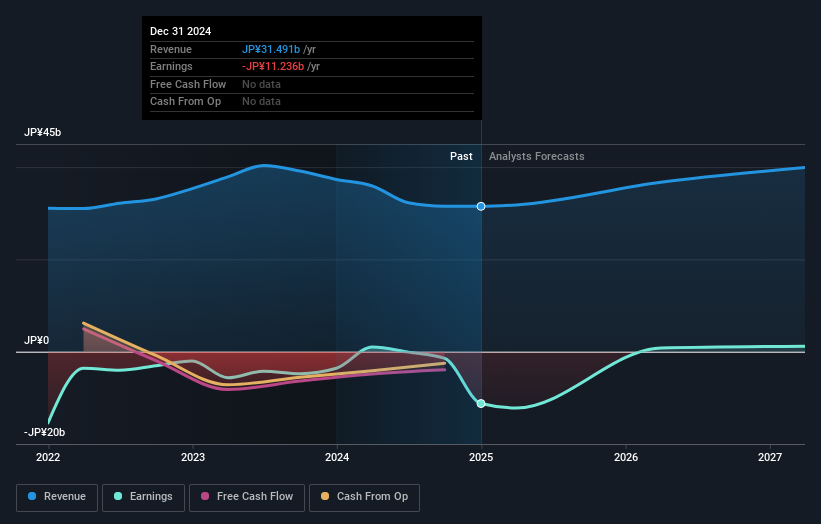

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Shima Seiki Mfg.Ltd's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market lost about 3.9% in the twelve months, Shima Seiki Mfg.Ltd shareholders did even worse, losing 38% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You could get a better understanding of Shima Seiki Mfg.Ltd's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

But note: Shima Seiki Mfg.Ltd may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6222

Shima Seiki Mfg.Ltd

Engages in the development, manufacture, sale, marketing, and service of computerized flat knitting, automatic fabric cutting, glove and sock knitting machines, and design systems in Japan, Europe, the Middle East, Asia, and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives