As global markets navigate a choppy start to 2025, with U.S. equities experiencing declines amid inflation concerns and political uncertainties, investors are increasingly focusing on resilient sectors such as dividend stocks. In this environment of economic unpredictability and fluctuating interest rates, dividend-paying stocks can offer a stable income stream, making them an attractive option for those seeking to balance risk and return in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.52% | ★★★★★★ |

| MISC Berhad (KLSE:MISC) | 5.10% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.15% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.03% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.56% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.08% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 2004 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

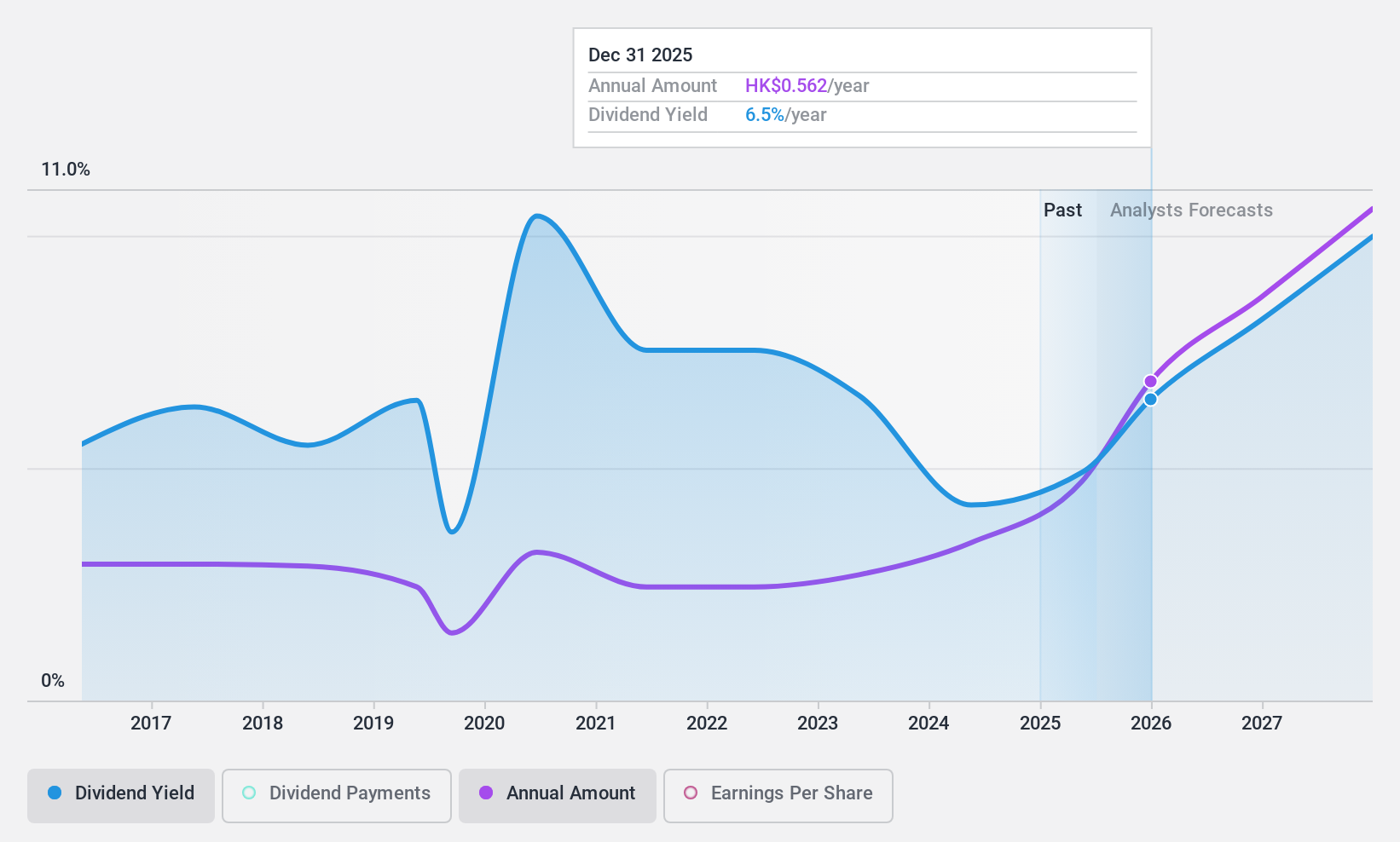

Wasion Holdings (SEHK:3393)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wasion Holdings Limited is an investment holding company that focuses on the research, development, production, and sale of energy metering and energy efficiency management solutions for energy supply industries across various regions including the People's Republic of China, Africa, the United States, Europe, and Asia; it has a market cap of approximately HK$6.92 billion.

Operations: Wasion Holdings Limited generates revenue from three main segments: Advanced Distribution Operations (CN¥2.51 billion), Power Advanced Metering Infrastructure (CN¥2.99 billion), and Communication and Fluid Advanced Metering Infrastructure (CN¥2.42 billion).

Dividend Yield: 3.9%

Wasion Holdings, trading at 50.3% below its estimated fair value, offers a dividend yield of 3.94%, which is low compared to top-tier payers in Hong Kong. Despite earnings growth of 61.9% last year and dividends being well-covered by earnings (40% payout ratio) and cash flows (39%), its dividend history has been volatile over the past decade with significant annual drops exceeding 20%. Nonetheless, dividends have increased over this period.

- Click here and access our complete dividend analysis report to understand the dynamics of Wasion Holdings.

- Our expertly prepared valuation report Wasion Holdings implies its share price may be lower than expected.

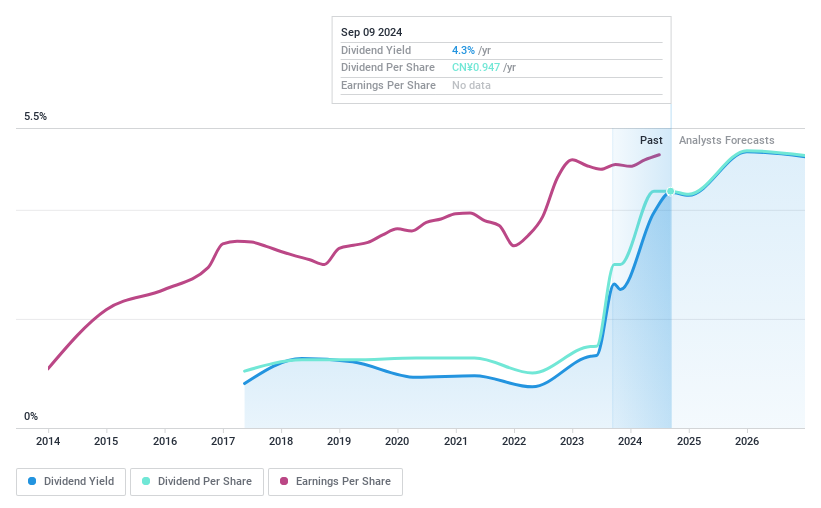

ShenZhen YUTO Packaging Technology (SZSE:002831)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ShenZhen YUTO Packaging Technology Co., Ltd. operates in the packaging industry, providing comprehensive packaging solutions, with a market cap of CN¥24.60 billion.

Operations: ShenZhen YUTO Packaging Technology Co., Ltd. generates revenue primarily from its Paper Packaging segment, totaling CN¥16.27 billion.

Dividend Yield: 3.5%

ShenZhen YUTO Packaging Technology's dividend yield of 3.53% ranks in the top 25% of Chinese dividend payers, supported by a reasonable payout ratio (55.2%) and cash flow coverage (58.6%). However, its eight-year dividend history is marked by volatility, with payments not consistently growing. The company shows good relative value with a price-to-earnings ratio of 15.7x compared to the market's 33.4x and has completed a share buyback worth CNY 101.89 million recently, potentially enhancing shareholder value.

- Get an in-depth perspective on ShenZhen YUTO Packaging Technology's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of ShenZhen YUTO Packaging Technology shares in the market.

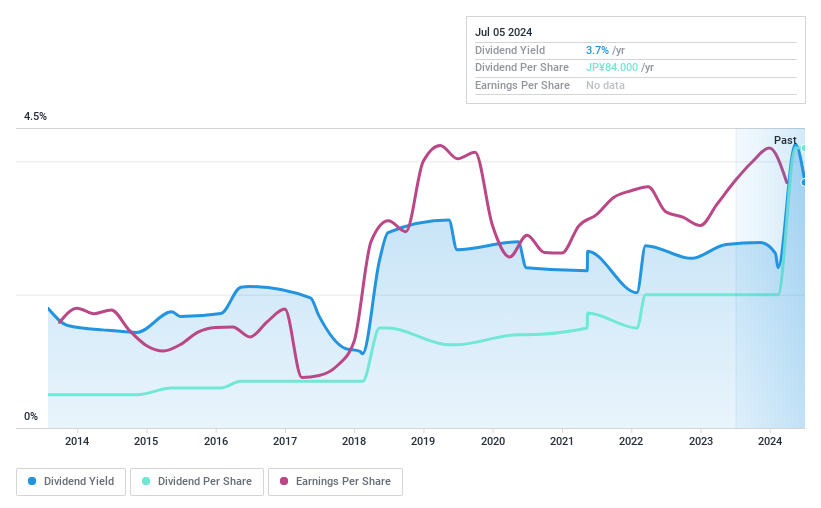

Seibu Electric & Machinery (TSE:6144)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Seibu Electric & Machinery Co., Ltd. is a Japanese company that manufactures and sells mechatronics, with a market cap of ¥30.21 billion.

Operations: Seibu Electric & Machinery Co., Ltd.'s revenue is primarily derived from its Precision Machinery Business at ¥13.76 billion, Conveyance Machinery Business at ¥10.91 billion, and Industrial Machinery Business at ¥6.64 billion.

Dividend Yield: 4.2%

Seibu Electric & Machinery offers a dividend yield of 4.2%, ranking in the top 25% of Japanese dividend payers. Despite a stable and reliable 10-year dividend history, its dividends are not covered by free cash flows, raising sustainability concerns. The payout ratio is reasonable at 56%, indicating coverage by earnings but highlighting potential risks without adequate cash flow support. Non-cash earnings contribute significantly to its reported profits, which may affect future payouts.

- Dive into the specifics of Seibu Electric & Machinery here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Seibu Electric & Machinery is trading beyond its estimated value.

Taking Advantage

- Explore the 2004 names from our Top Dividend Stocks screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002831

ShenZhen YUTO Packaging Technology

ShenZhen YUTO Packaging Technology Co., Ltd.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives