ID Holdings And 2 Other Top Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

In a week marked by cautious commentary from the Federal Reserve and political uncertainty surrounding a potential government shutdown, global markets have experienced notable fluctuations. As investors navigate these turbulent waters, dividend stocks offer a compelling option for those seeking stability and income in uncertain times. A strong dividend stock typically combines reliable yield with solid fundamentals, making it an attractive choice amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.93% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.52% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.24% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.83% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.02% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.72% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1951 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

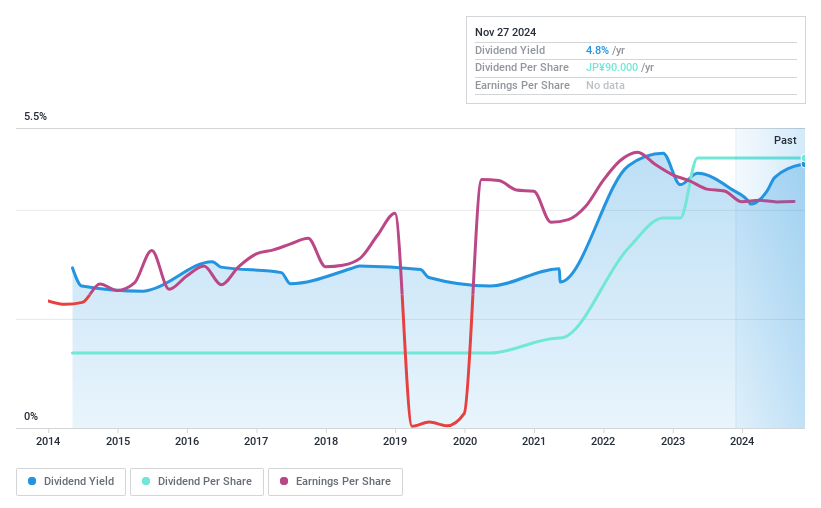

ID Holdings (TSE:4709)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ID Holdings Corporation offers information technology services in Japan and has a market cap of ¥27.12 billion.

Operations: ID Holdings Corporation generates revenue of ¥34.09 billion from its Information Services Business in Japan.

Dividend Yield: 3.1%

ID Holdings has announced a year-end dividend increase to JPY 30 per share, up from JPY 25 last year, reflecting a commitment to shareholder returns despite historically volatile dividends. The company's payout ratio of 42.2% indicates dividends are well-covered by earnings, though cash flow coverage is tighter at an 85% cash payout ratio. Recent guidance revisions show improved financial performance with net income expected at ¥2 billion, supporting its current dividend strategy amidst ongoing business developments.

- Take a closer look at ID Holdings' potential here in our dividend report.

- In light of our recent valuation report, it seems possible that ID Holdings is trading behind its estimated value.

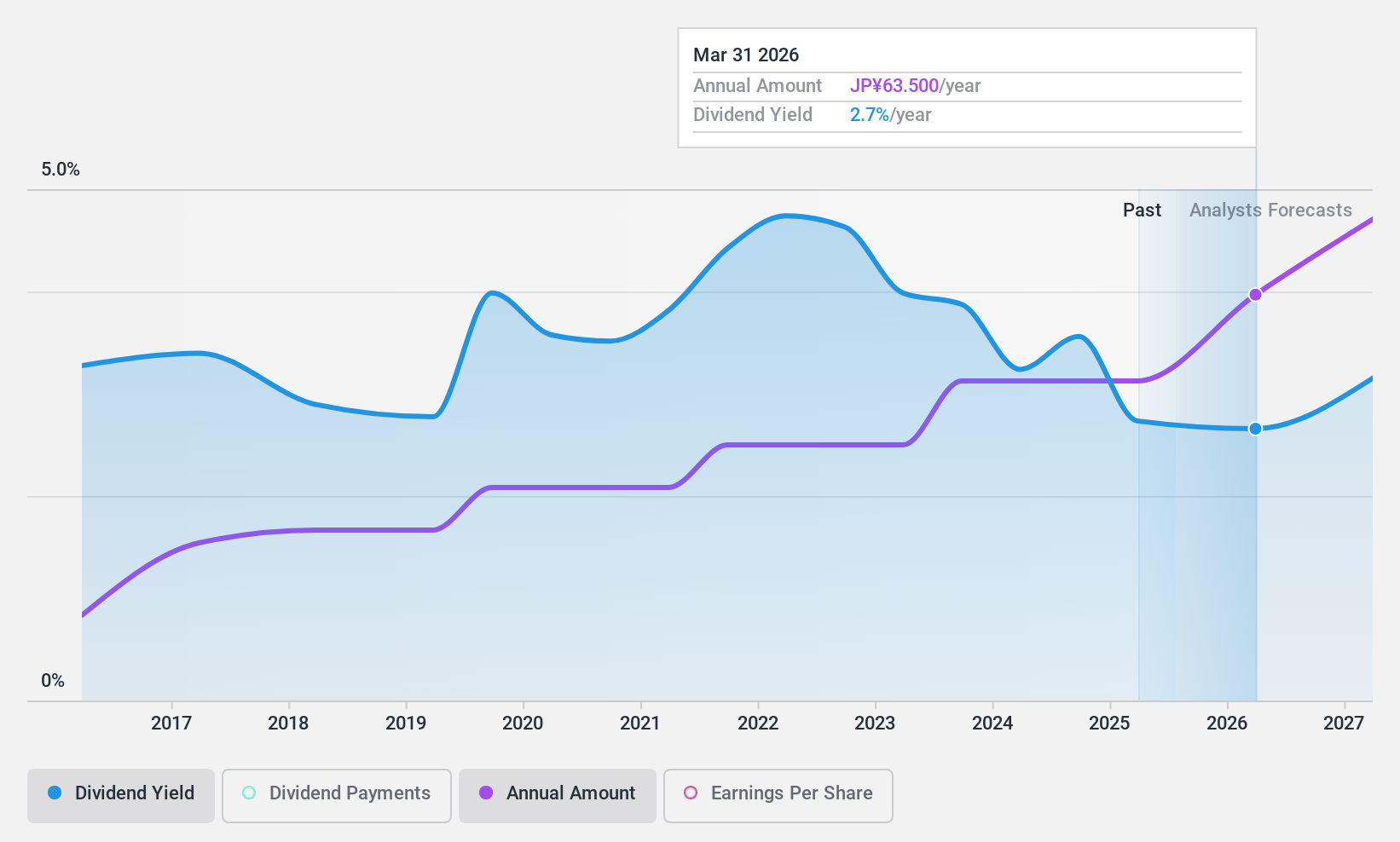

DMG Mori (TSE:6141)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DMG Mori Co., Ltd. is a global manufacturer and seller of machine tools, with a market capitalization of approximately ¥353.77 billion.

Operations: DMG Mori Co., Ltd.'s revenue is primarily derived from its Machine Tools segment, which accounts for ¥650.31 billion, and its Industrial Service segment, contributing ¥236.16 billion.

Dividend Yield: 4%

DMG Mori's dividend yield of 4% ranks in the top 25% of JP market payers, yet it's not well-supported by free cash flow, with a high cash payout ratio of 252.6%. Recent guidance revisions indicate significant reductions in expected profits and earnings per share for 2024. The company's dividends have been volatile over the past decade, with inconsistent growth and stability, despite being covered by earnings due to a low payout ratio of 48.3%.

- Delve into the full analysis dividend report here for a deeper understanding of DMG Mori.

- The valuation report we've compiled suggests that DMG Mori's current price could be quite moderate.

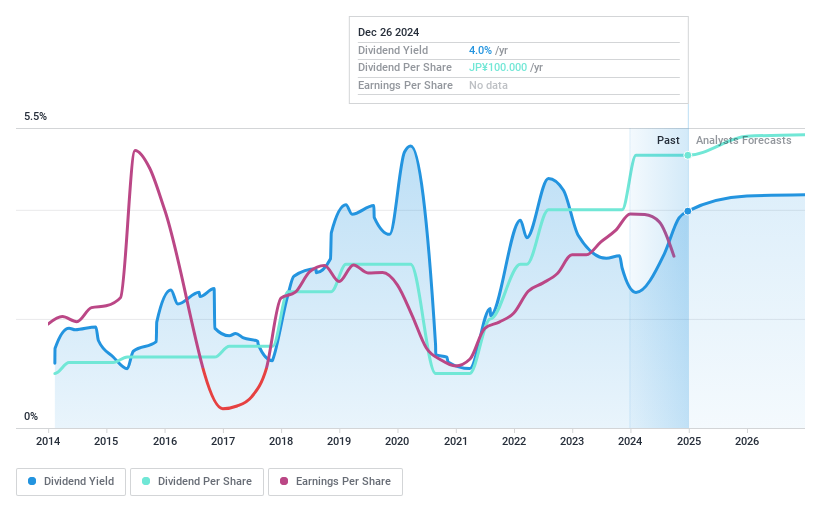

Nichimo (TSE:8091)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nichimo Co., Ltd., with a market cap of ¥16.53 billion, primarily manufactures and sells fish products both in Japan and internationally through its subsidiaries.

Operations: Nichimo Co., Ltd. generates revenue primarily from the manufacturing and sale of fish products, catering to both domestic and international markets through its subsidiaries.

Dividend Yield: 4.5%

Nichimo's dividend yield of 4.54% is among the top 25% in Japan, but it's not supported by free cash flow, indicating potential sustainability issues. Although dividends have grown steadily and remained stable over the past decade with a low payout ratio of 16.1%, debt coverage by operating cash flow is weak, raising financial concerns. The stock trades at a discount to its estimated fair value, suggesting it might be undervalued despite these challenges.

- Click to explore a detailed breakdown of our findings in Nichimo's dividend report.

- According our valuation report, there's an indication that Nichimo's share price might be on the cheaper side.

Summing It All Up

- Delve into our full catalog of 1951 Top Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6141

Excellent balance sheet, good value and pays a dividend.