As global markets navigate a landscape marked by rising inflation and shifting tariff policies, U.S. stock indexes are climbing toward record highs, with growth stocks leading the charge. In this environment of economic uncertainty and volatile interest rates, dividend stocks can offer a steady income stream and potential for capital appreciation, making them an attractive option for investors seeking stability in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.93% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.95% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.41% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.33% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.01% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.91% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.68% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.42% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.27% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.33% | ★★★★★★ |

Click here to see the full list of 1998 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

DMG Mori (TSE:6141)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DMG Mori Co., Ltd. is a global manufacturer and seller of machine tools, with a market capitalization of approximately ¥365.93 billion.

Operations: DMG Mori Co., Ltd. generates revenue primarily from its Machine Tools segment at ¥636.53 billion and Industrial Service segment at ¥230.58 billion, supplemented by corporate services contributing ¥1.65 million.

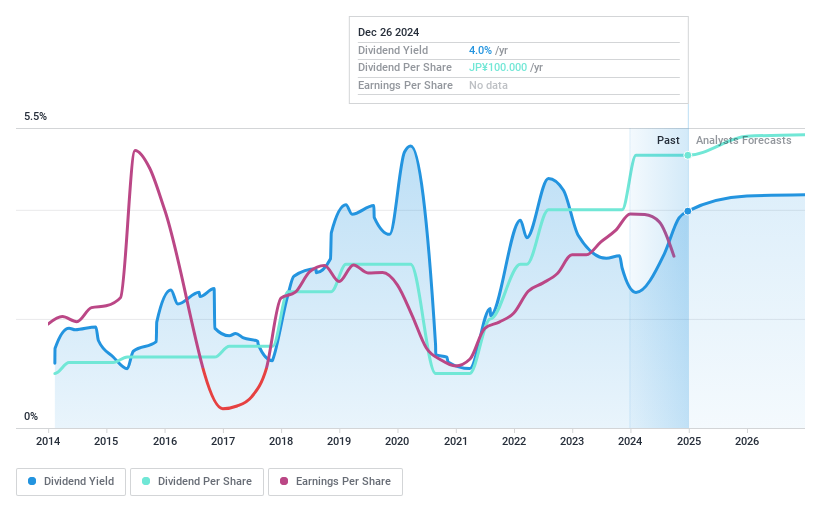

Dividend Yield: 3.9%

DMG Mori's dividend payments, though in the top 25% of JP market payers at 3.86%, face sustainability challenges due to a high cash payout ratio of 1827.1%. Despite increasing dividends over the past decade, their reliability remains questionable with historical volatility and coverage issues by earnings and free cash flows. Recent announcements indicate a stable dividend of JPY 50 per share for early 2025, with an increase to JPY 55 expected by year-end.

- Click here and access our complete dividend analysis report to understand the dynamics of DMG Mori.

- Our valuation report here indicates DMG Mori may be undervalued.

Itoki (TSE:7972)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Itoki Corporation is involved in the manufacturing and sale of office furniture both in Japan and internationally, with a market cap of ¥86.21 billion.

Operations: Itoki Corporation's revenue is primarily derived from its Workplace Business segment, which accounts for ¥102.46 billion, and its Equipment and Public Works-Related Business segment, contributing ¥34.60 billion.

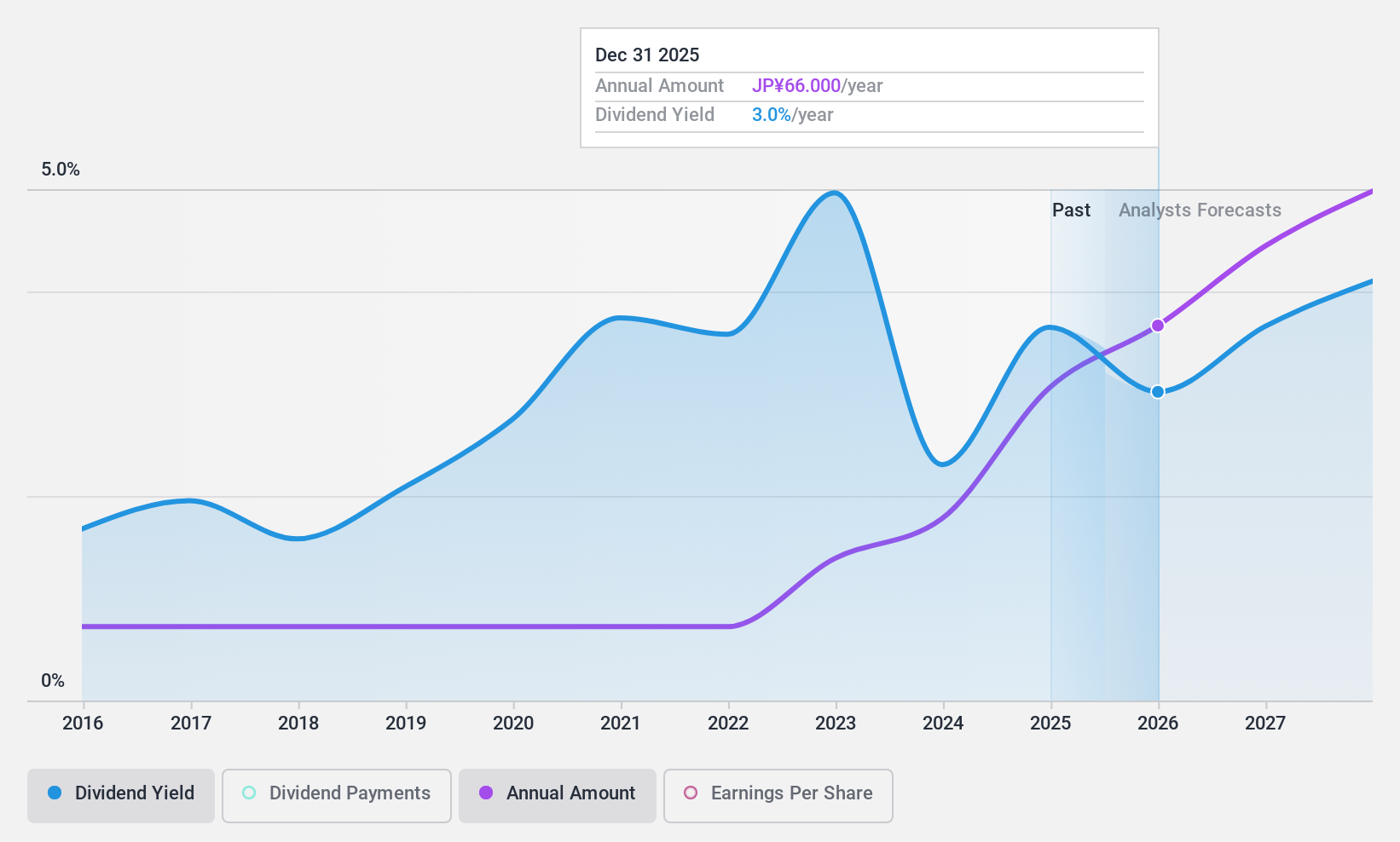

Dividend Yield: 3.1%

Itoki's dividend of 3.14% is not fully covered by free cash flows, raising sustainability concerns despite stable and reliable payments over the past decade. The company announced a dividend increase from JPY 42 to JPY 55 per share for fiscal year 2024, with guidance suggesting further growth to JPY 65 in 2025. While earnings grew by 21.6% last year and are expected to rise annually by 11.44%, high non-cash earnings could affect quality perceptions.

- Unlock comprehensive insights into our analysis of Itoki stock in this dividend report.

- Our valuation report unveils the possibility Itoki's shares may be trading at a discount.

Oponeo.pl (WSE:OPN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oponeo.pl S.A. operates as an online retailer of tires and wheels for motor vehicles in Poland and internationally, with a market capitalization of PLN1.03 billion.

Operations: Oponeo.pl S.A.'s revenue segments include PLN91.02 million from the Tools Segment, PLN1.69 billion from Car Accessories, and PLN271.55 million from Bicycles and Bicycle Accessories.

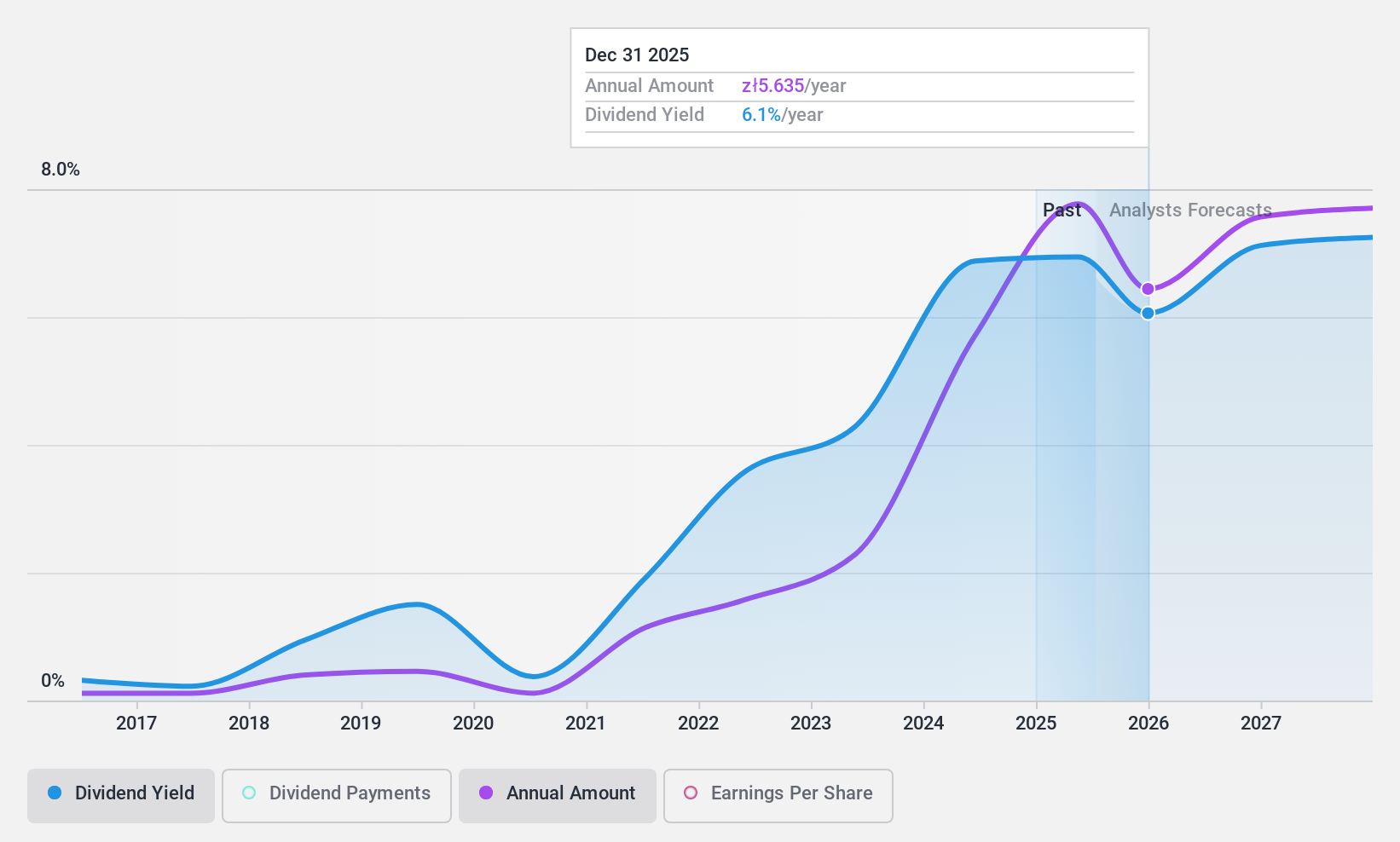

Dividend Yield: 5.4%

Oponeo.pl's dividend payments have increased over the past decade, although they have been volatile with annual drops exceeding 20%. Currently trading at good value relative to peers, its dividends are covered by earnings and cash flows with payout ratios of 60.6% and 51.4%, respectively. However, its dividend yield of 5.43% is lower than the top quartile in Poland (7.83%). Despite recent earnings growth of 166.1%, high debt levels pose financial risks.

- Click to explore a detailed breakdown of our findings in Oponeo.pl's dividend report.

- Our expertly prepared valuation report Oponeo.pl implies its share price may be lower than expected.

Summing It All Up

- Get an in-depth perspective on all 1998 Top Dividend Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6141

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives