As global markets experience mixed performance amid light trading and economic data releases, investors are increasingly seeking stable returns in the face of uncertainty. With inflation showing signs of moderation and consumer spending holding steady, dividend stocks offer a compelling option for those looking to generate income while navigating volatile market conditions. A good dividend stock typically combines a reliable payout history with strong fundamentals, making it an attractive choice for income-focused investors. In light of recent market trends, such as the outperformance of value stocks over growth shares, selecting robust dividend-paying companies can provide both stability and potential growth.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.11% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.91% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 7.03% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.55% | ★★★★★★ |

| Innotech (TSE:9880) | 4.49% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.44% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.08% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.32% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.15% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.73% | ★★★★★★ |

Click here to see the full list of 2055 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

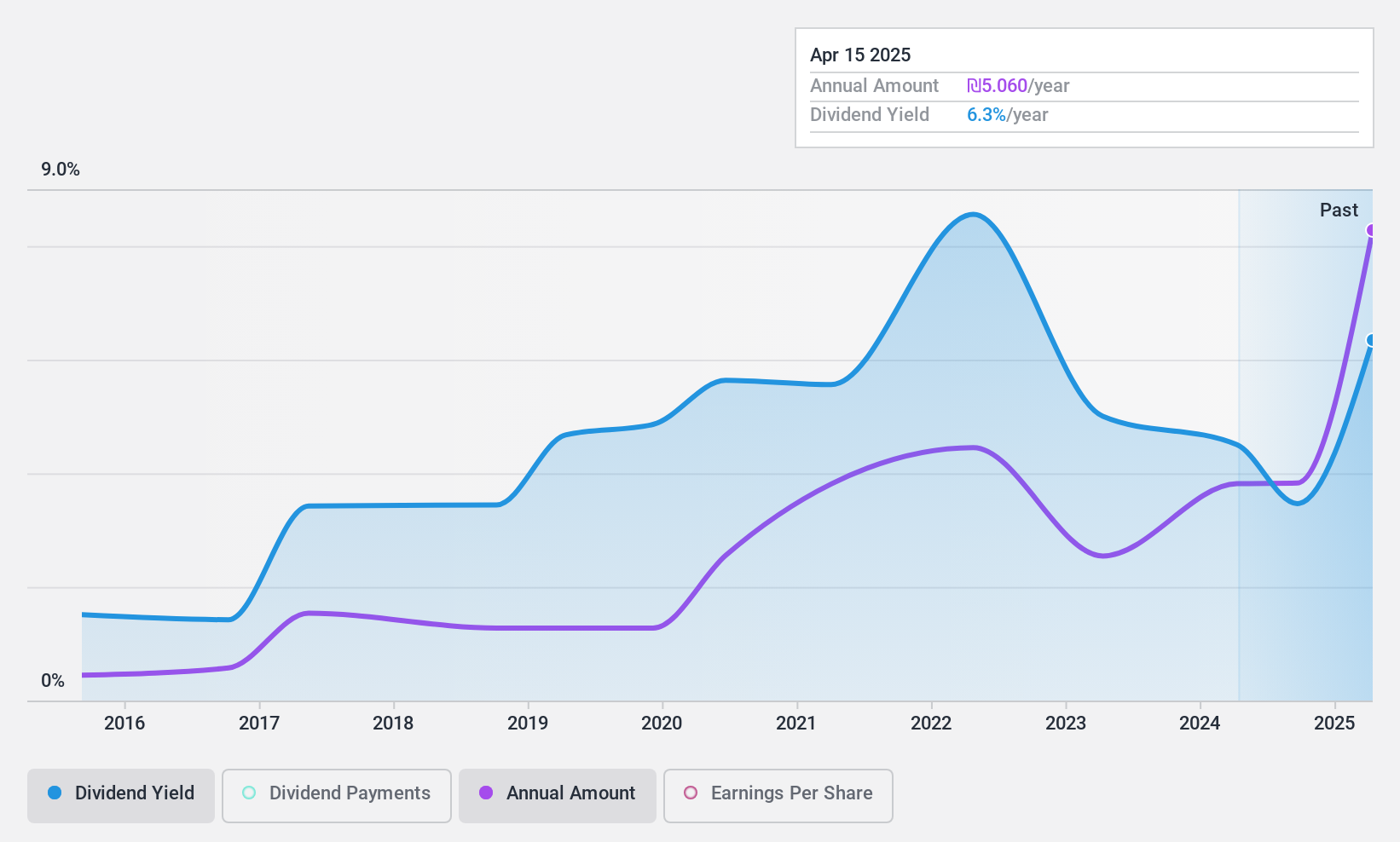

Dubai Refreshment (P.J.S.C.) (DFM:DRC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dubai Refreshment (P.J.S.C.) engages in bottling and selling Pepsi Cola International products in Dubai, Sharjah, and the other Northern Emirates of the United Arab Emirates with a market cap of AED1.89 billion.

Operations: The company's revenue from wholesale groceries amounts to AED807.98 million.

Dividend Yield: 3.8%

Dubai Refreshment (P.J.S.C.) offers a dividend yield of 3.81%, which is below the top 25% of dividend payers in the AE market. While dividends have grown over the past decade, they have been unreliable and volatile. The payout ratio stands at a sustainable 53.2%, and cash flows cover dividends with a reasonable cash payout ratio of 71.3%. However, recent earnings reports show a significant drop in net income from AED 260.59 million to AED 40.03 million year-over-year for Q2, raising concerns about future dividend stability amidst illiquid shares and declining profit margins.

- Unlock comprehensive insights into our analysis of Dubai Refreshment (P.J.S.C.) stock in this dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Dubai Refreshment (P.J.S.C.) shares in the market.

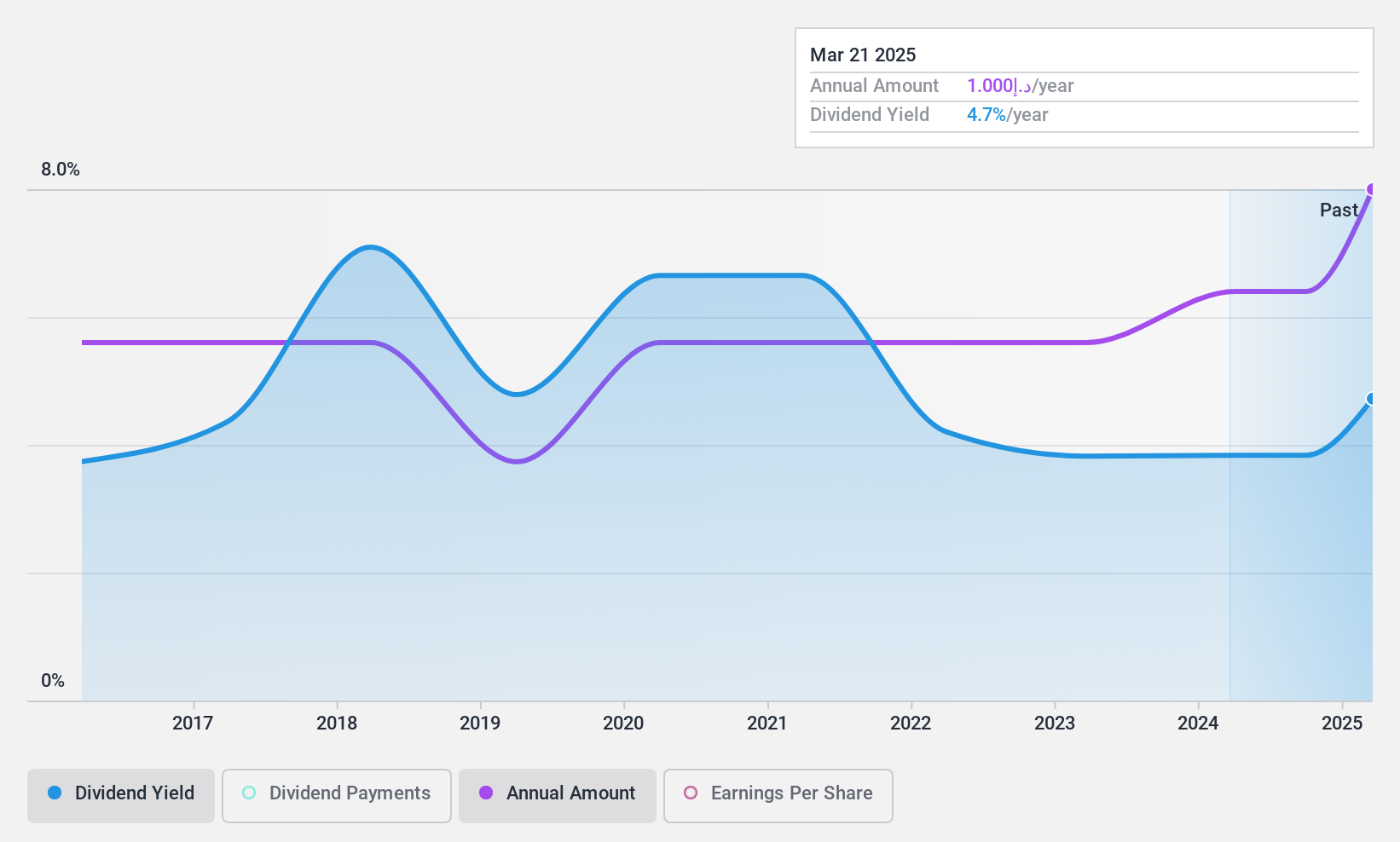

Palram Industries (1990) (TASE:PLRM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Palram Industries (1990) Ltd, with a market cap of ₪1.55 billion, manufactures and sells thermoplastic sheets, panel systems, and finished products both in Israel and internationally.

Operations: Palram Industries (1990) Ltd generates revenue from the sale of thermoplastic sheets, panel systems, and finished products in both domestic and international markets.

Dividend Yield: 3.5%

Palram Industries reported a strong Q2 2024 with sales of ILS 494.37 million and net income of ILS 65.81 million, up from ILS 446.82 million and ILS 41.34 million respectively, year-over-year. Despite a modest dividend yield of 3.51%, dividends are well-covered by earnings (payout ratio: 26.8%) and cash flows (cash payout ratio: 37.4%). However, the company's dividend history has been unreliable over the past decade, showing volatility despite recent growth in payments and profits.

- Click here to discover the nuances of Palram Industries (1990) with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Palram Industries (1990) is priced lower than what may be justified by its financials.

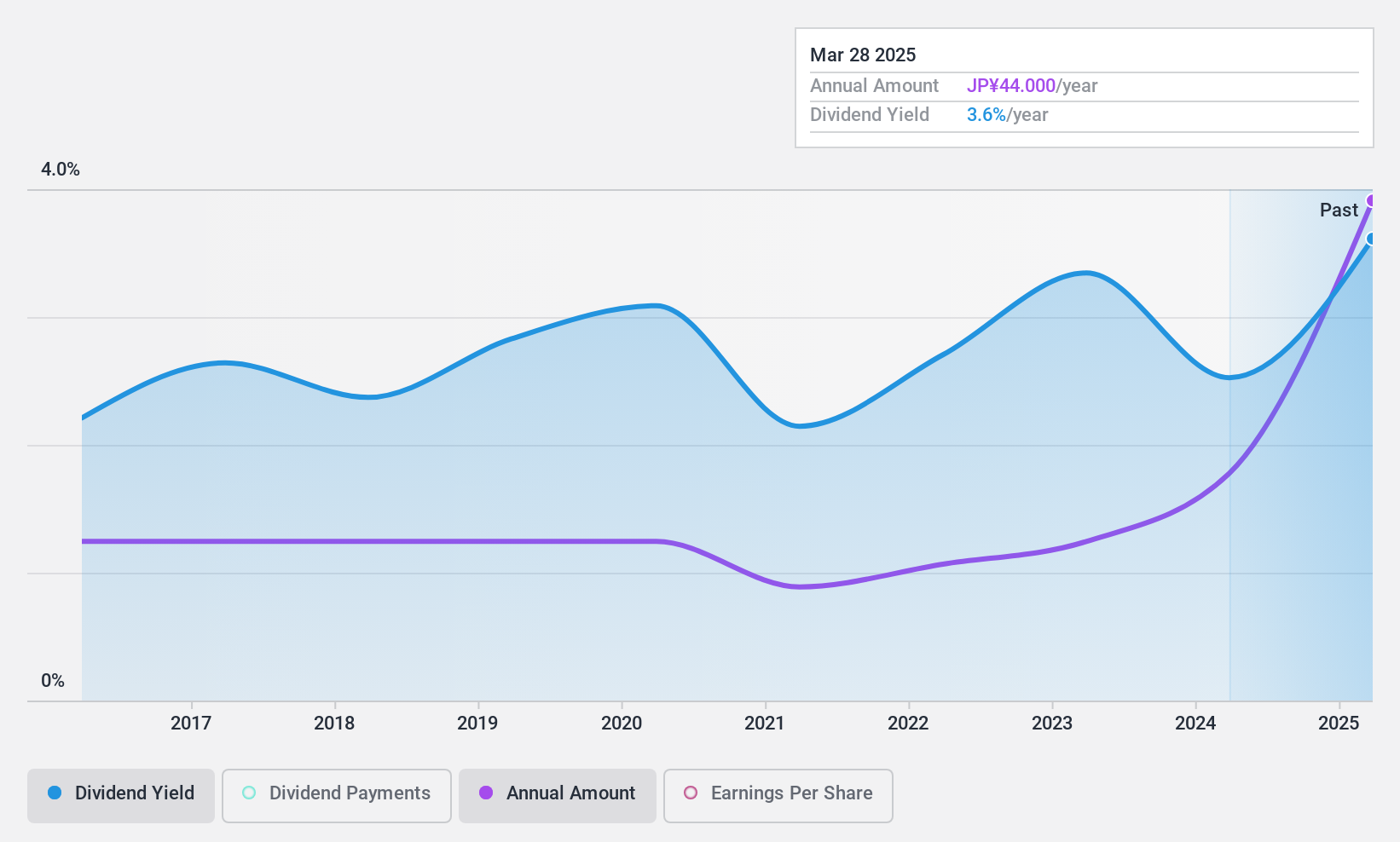

Koike Sanso KogyoLtd (TSE:6137)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koike Sanso Kogyo Co., Ltd. develops, manufactures, and sells gases, welding and cutting machines, and related products for industries processing steel plates, aluminum, and stainless steel with a market cap of ¥23.74 billion.

Operations: Koike Sanso Kogyo Co., Ltd. generates revenue from three primary segments: Machinery (¥22.73 billion), High-Pressure Gas (¥20.18 billion), and Welding Equipment (¥8.29 billion).

Dividend Yield: 3.4%

Koike Sanso Kogyo Ltd. has seen earnings grow by 54% over the past year, with dividend payments well covered by both earnings (payout ratio: 26%) and cash flows (cash payout ratio: 27.1%). Despite a modest dividend yield of 3.41%, which is below the top tier in Japan, dividends have increased over the past decade but remain unstable and volatile. The stock trades at a significant discount to its estimated fair value, though it has been highly volatile recently.

- Get an in-depth perspective on Koike Sanso KogyoLtd's performance by reading our dividend report here.

- Our valuation report here indicates Koike Sanso KogyoLtd may be undervalued.

Turning Ideas Into Actions

- Gain an insight into the universe of 2055 Top Dividend Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:PLRM

Palram Industries (1990)

Manufactures and sells thermoplastic sheets, and panel systems, and finished products in Israel and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives