Japan's stock markets have shown mixed performance recently, with the Nikkei 225 Index gaining 0.5% and the broader TOPIX Index down 1.0%. Amid this backdrop, expectations of further interest rate hikes by the Bank of Japan add another layer of complexity for investors. In such a dynamic environment, dividend stocks yielding at least 3% can offer a stable income stream and potentially mitigate some market volatility. Here are three Japanese dividend stocks that might be worth considering for their attractive yields and potential resilience in uncertain times.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.27% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.23% | ★★★★★★ |

| Globeride (TSE:7990) | 4.42% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.87% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.96% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.03% | ★★★★★★ |

| Innotech (TSE:9880) | 4.91% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.57% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.27% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

Click here to see the full list of 455 stocks from our Top Japanese Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Koike Sanso KogyoLtd (TSE:6137)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koike Sanso Kogyo Co., Ltd. develops, manufactures, and sells gases, welding and cutting machines, and related products for industries processing steel plates, aluminum, and stainless steel in Japan and internationally; it has a market cap of ¥24.08 billion.

Operations: Koike Sanso Kogyo Co., Ltd.'s revenue segments are comprised of Machinery (¥22.73 billion), High-Pressure Gas (¥20.18 billion), and Welding Equipment (¥8.29 billion).

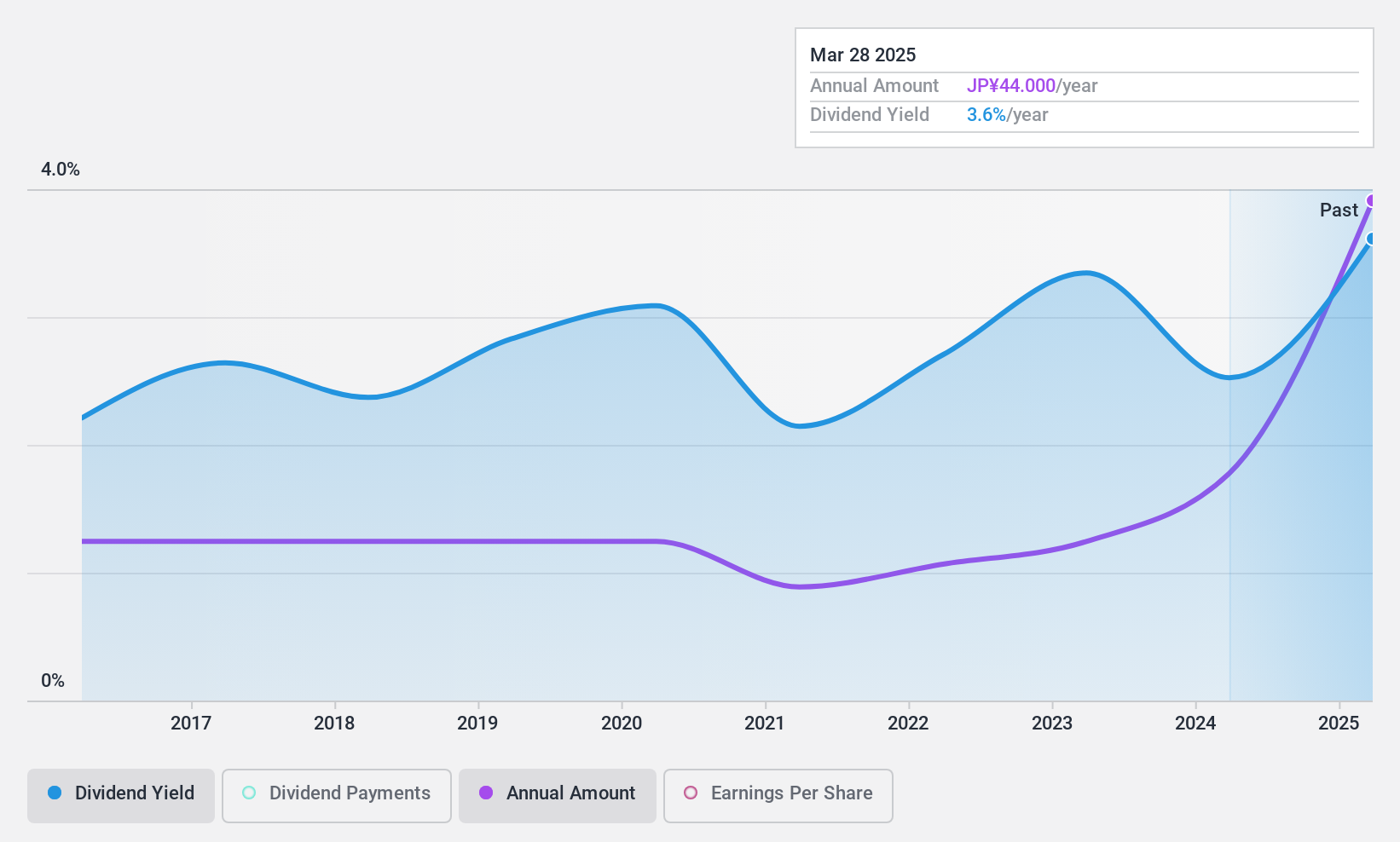

Dividend Yield: 3.5%

Koike Sanso Kogyo Ltd. offers a mixed picture for dividend investors. The company’s dividends are well covered by both earnings (26% payout ratio) and free cash flows (27.1% cash payout ratio), indicating sustainability. However, its dividend yield of 3.5% is below the top quartile in Japan, and the dividend track record has been volatile over the past decade despite recent growth in payments. Additionally, the stock price has shown high volatility recently but trades at 62.1% below estimated fair value, suggesting potential undervaluation.

- Take a closer look at Koike Sanso KogyoLtd's potential here in our dividend report.

- The valuation report we've compiled suggests that Koike Sanso KogyoLtd's current price could be quite moderate.

Nippon Yusen Kabushiki Kaisha (TSE:9101)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Yusen Kabushiki Kaisha provides various logistics services worldwide and has a market cap of ¥2.17 billion.

Operations: Nippon Yusen Kabushiki Kaisha's revenue segments include ¥726.57 million from Logistics, ¥180.48 million from Liner Trade, and ¥170.78 million from Air Cargo Transportation.

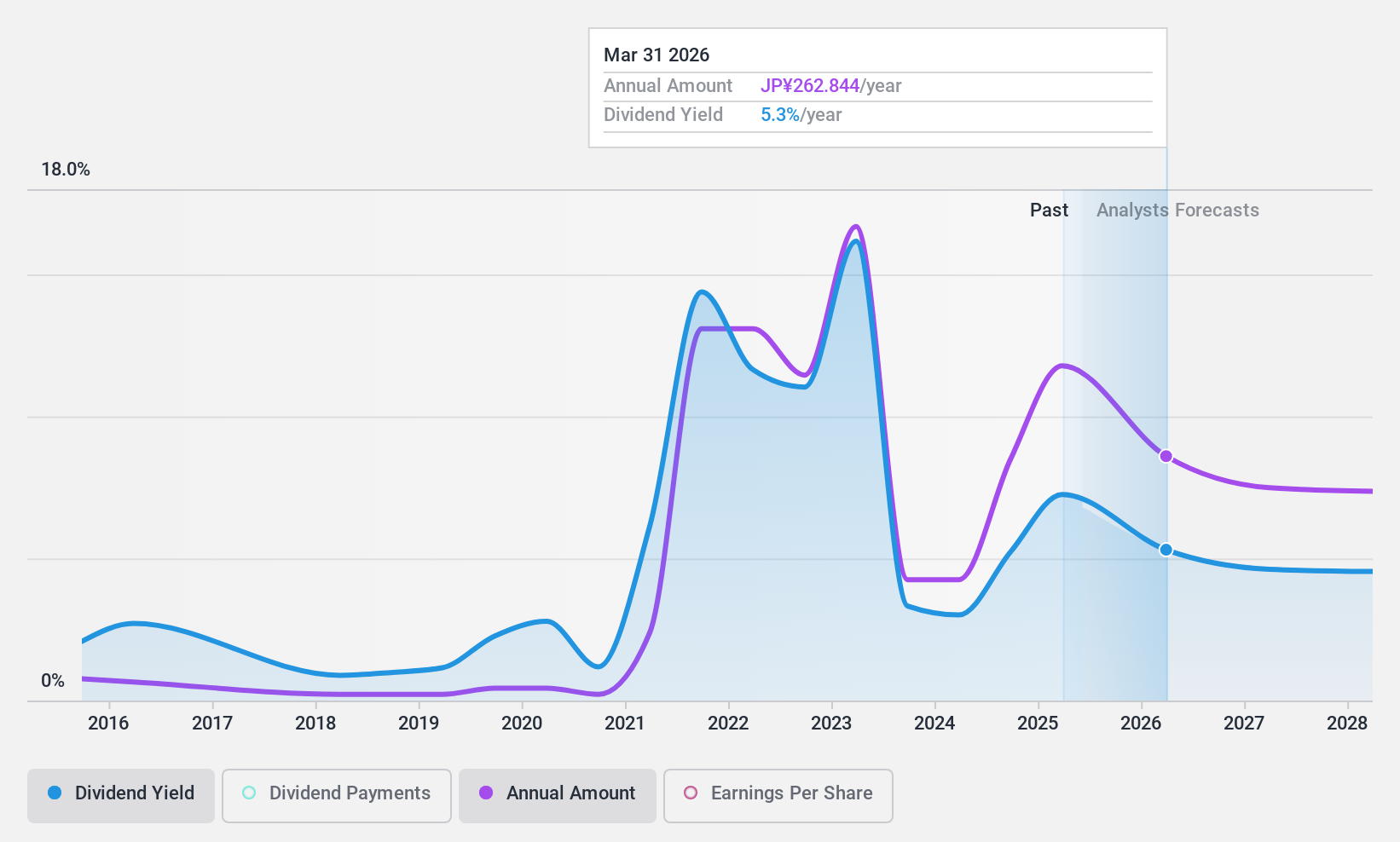

Dividend Yield: 5.4%

Nippon Yusen Kabushiki Kaisha's dividend yield of 5.38% places it in the top 25% of Japanese dividend payers, but its high cash payout ratio (179.1%) raises concerns about sustainability despite a low earnings payout ratio (25.1%). Recent increases in dividend guidance and improved earnings forecasts indicate positive momentum, though past volatility and large one-off items impact financial stability. The company's role in the green ammonia project could enhance future growth prospects.

- Click here and access our complete dividend analysis report to understand the dynamics of Nippon Yusen Kabushiki Kaisha.

- In light of our recent valuation report, it seems possible that Nippon Yusen Kabushiki Kaisha is trading beyond its estimated value.

Computer Engineering & Consulting (TSE:9692)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Computer Engineering & Consulting Ltd. operates in the digital industry and system integration sectors in Japan, with a market cap of ¥59.18 billion.

Operations: Computer Engineering & Consulting Ltd.'s revenue segments include ¥18.91 billion from the Digital Industry Business and ¥35.97 billion from the Service Integration Business.

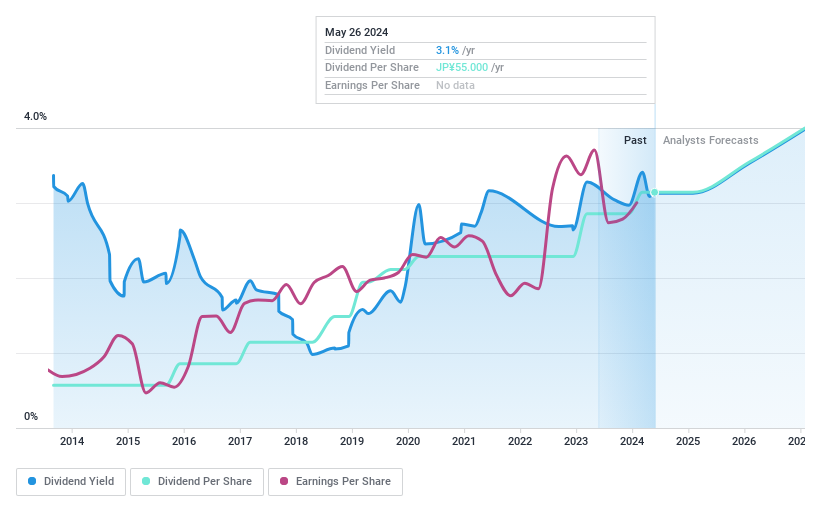

Dividend Yield: 3.1%

Computer Engineering & Consulting's dividend payments are well-covered, with a cash payout ratio of 33.2% and an earnings payout ratio of 42.9%. The company offers a reliable 3.06% yield, though it is lower than the top quartile in Japan. Dividends have been stable and growing over the past decade. Recent share buybacks totaling ¥839.18 million indicate strong financial health, while consistent earnings growth at 7.5% annually supports sustainable dividends.

- Dive into the specifics of Computer Engineering & Consulting here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Computer Engineering & Consulting shares in the market.

Key Takeaways

- Dive into all 455 of the Top Japanese Dividend Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Koike Sanso KogyoLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6137

Koike Sanso KogyoLtd

Develops, manufactures, and sells various types of gases, welding and cutting machines and systems, and related products to industries that process steel plates, aluminum, and stainless steel in Japan and internationally.

Flawless balance sheet, good value and pays a dividend.