As global markets navigate a mixed landscape with the Nasdaq hitting record highs amidst broader index declines, investors are closely watching central banks' monetary policies, including anticipated rate cuts from the Federal Reserve. In this environment of economic uncertainty and fluctuating yields, dividend stocks can offer a measure of stability and income potential by providing regular payouts to shareholders.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.25% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.81% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.11% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.24% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.44% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.87% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.83% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.59% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.86% | ★★★★★★ |

Click here to see the full list of 1973 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

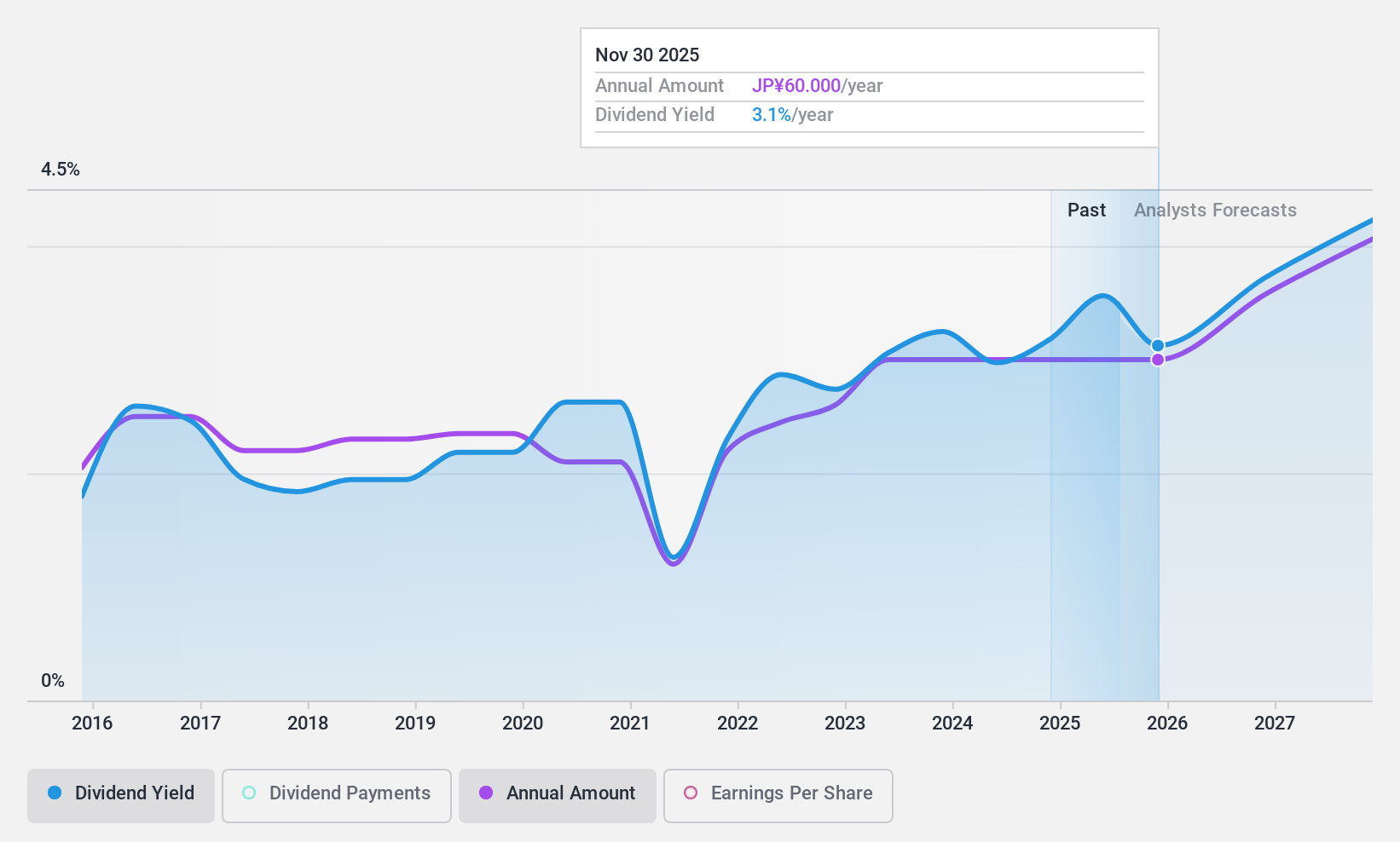

OSG (TSE:6136)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: OSG Corporation, along with its subsidiaries, manufactures and sells cutting tools across Japan, the Americas, Europe, Africa, and Asia with a market cap of ¥151.13 billion.

Operations: OSG Corporation generates revenue from various regions, with ¥37.76 billion from Asia, ¥74.51 billion from Japan, ¥35.96 billion from the Americas, and ¥36.62 billion from Europe/Africa.

Dividend Yield: 3.4%

OSG Corporation's dividend payments are well-covered by earnings, with a payout ratio of 39.6%, and cash flows, with a cash payout ratio of 29.8%. Despite this coverage, the company's dividend yield is lower than the top quartile in Japan. The dividends have been volatile over the past decade, although they have increased during this period. Recent buybacks totaling ¥21.99 billion could support shareholder returns despite lowered profit forecasts for fiscal year-end November 2024.

- Take a closer look at OSG's potential here in our dividend report.

- According our valuation report, there's an indication that OSG's share price might be on the cheaper side.

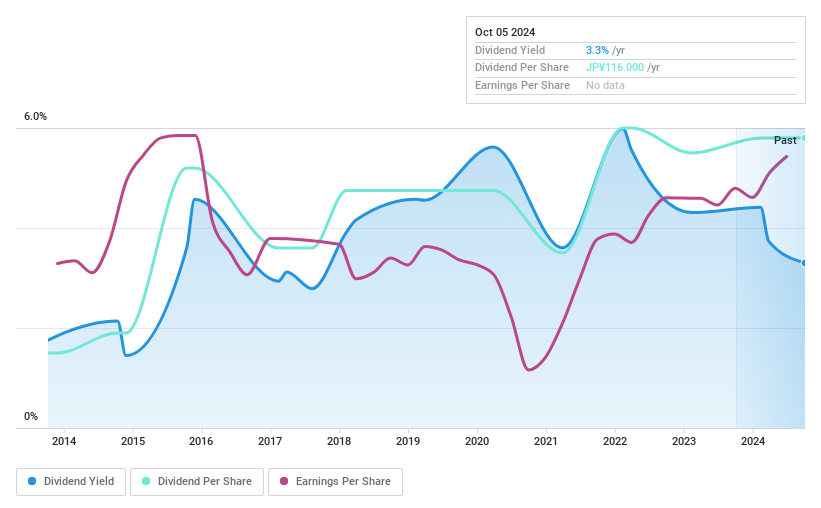

Chiyoda IntegreLtd (TSE:6915)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chiyoda Integre Co., Ltd. manufactures and sells structural and functional parts for various products both in Japan and internationally, with a market cap of ¥36.36 billion.

Operations: Chiyoda Integre Ltd. generates revenue through the manufacturing and sale of structural and functional components for a variety of products across domestic and international markets.

Dividend Yield: 3.3%

Chiyoda Integre Ltd.'s dividends are well-covered by earnings and cash flows, with payout ratios of 43.4% and 46.2%, respectively. Despite this coverage, the dividend yield is below the top quartile in Japan, and payouts have been volatile over the past decade. The company has initiated a share repurchase program worth ¥400 million to enhance shareholder returns, complementing previous buybacks totaling ¥1.58 billion completed in October 2024 under its medium-term management plan.

- Click here to discover the nuances of Chiyoda IntegreLtd with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Chiyoda IntegreLtd's current price could be inflated.

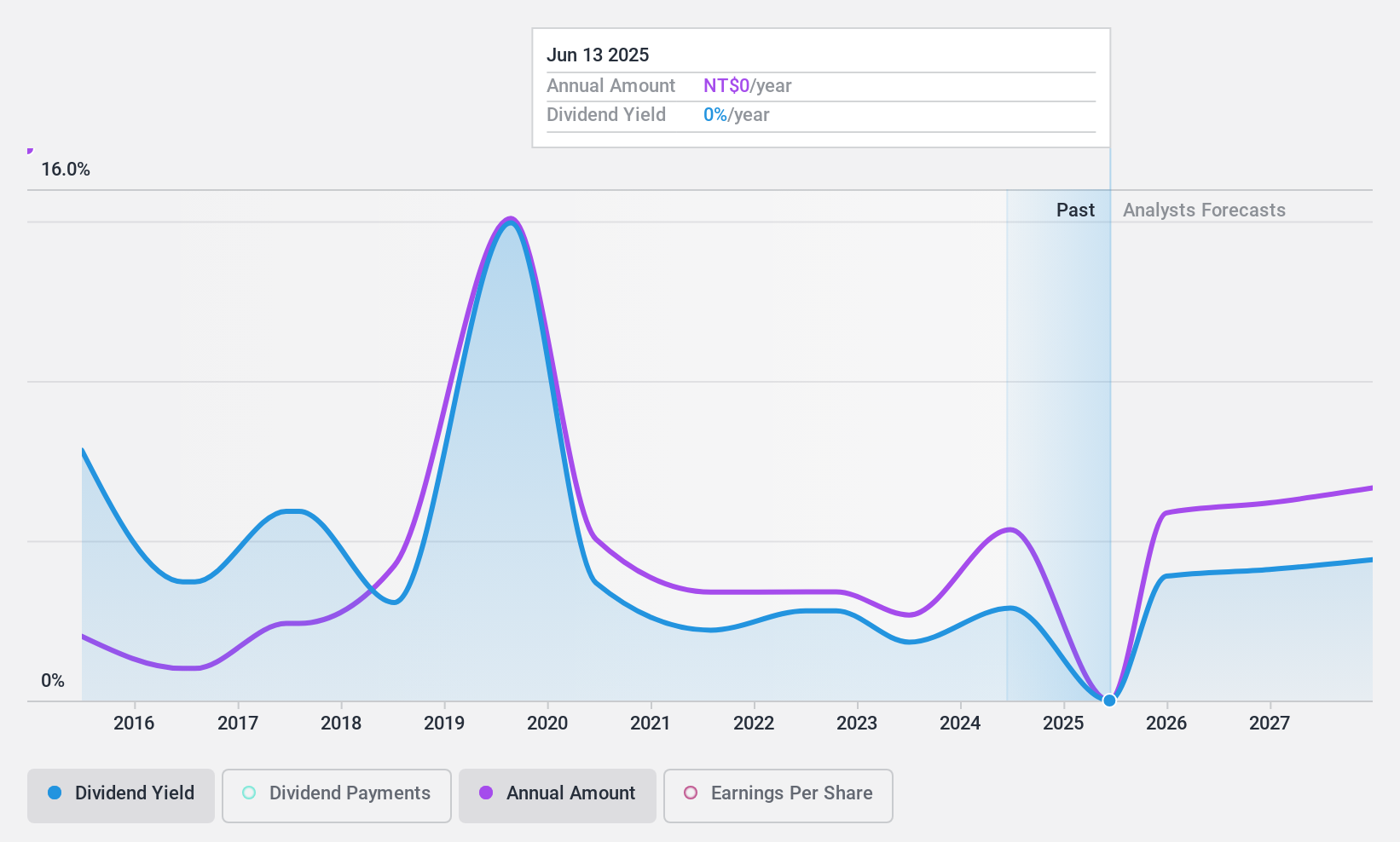

Yageo (TWSE:2327)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yageo Corporation manufactures and sells passive components across China, Europe, the United States, and other parts of Asia, with a market cap of NT$270.39 billion.

Operations: Yageo Corporation's revenue from its Electronic Components & Parts segment amounts to NT$119.02 billion.

Dividend Yield: 3.2%

Yageo's dividend payments are well-covered by earnings and cash flows, with payout ratios of 41% and 37.2%, respectively, despite a history of volatility over the past decade. The dividend yield is lower than the top quartile in Taiwan's market. Recent financials show strong sales growth, with consolidated sales reaching TWD 112.15 billion year-to-date, up 13.7% year-on-year, indicating potential for future stability in dividends amidst ongoing earnings growth.

- Delve into the full analysis dividend report here for a deeper understanding of Yageo.

- Our valuation report unveils the possibility Yageo's shares may be trading at a discount.

Summing It All Up

- Click here to access our complete index of 1973 Top Dividend Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6136

OSG

Manufactures and sells cutting tools in Japan, the Americas, Europe, Africa, and Asia.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives