Amid ongoing trade discussions and monetary policy shifts, Asian markets have been navigating a complex economic landscape. In this environment, dividend stocks can offer investors a measure of stability and income potential, making them an attractive consideration for those seeking to balance risk with reward.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.77% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.65% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Chudenko (TSE:1941) | 3.92% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.09% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.97% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.48% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.91% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.31% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.49% | ★★★★★★ |

Click here to see the full list of 1210 stocks from our Top Asian Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

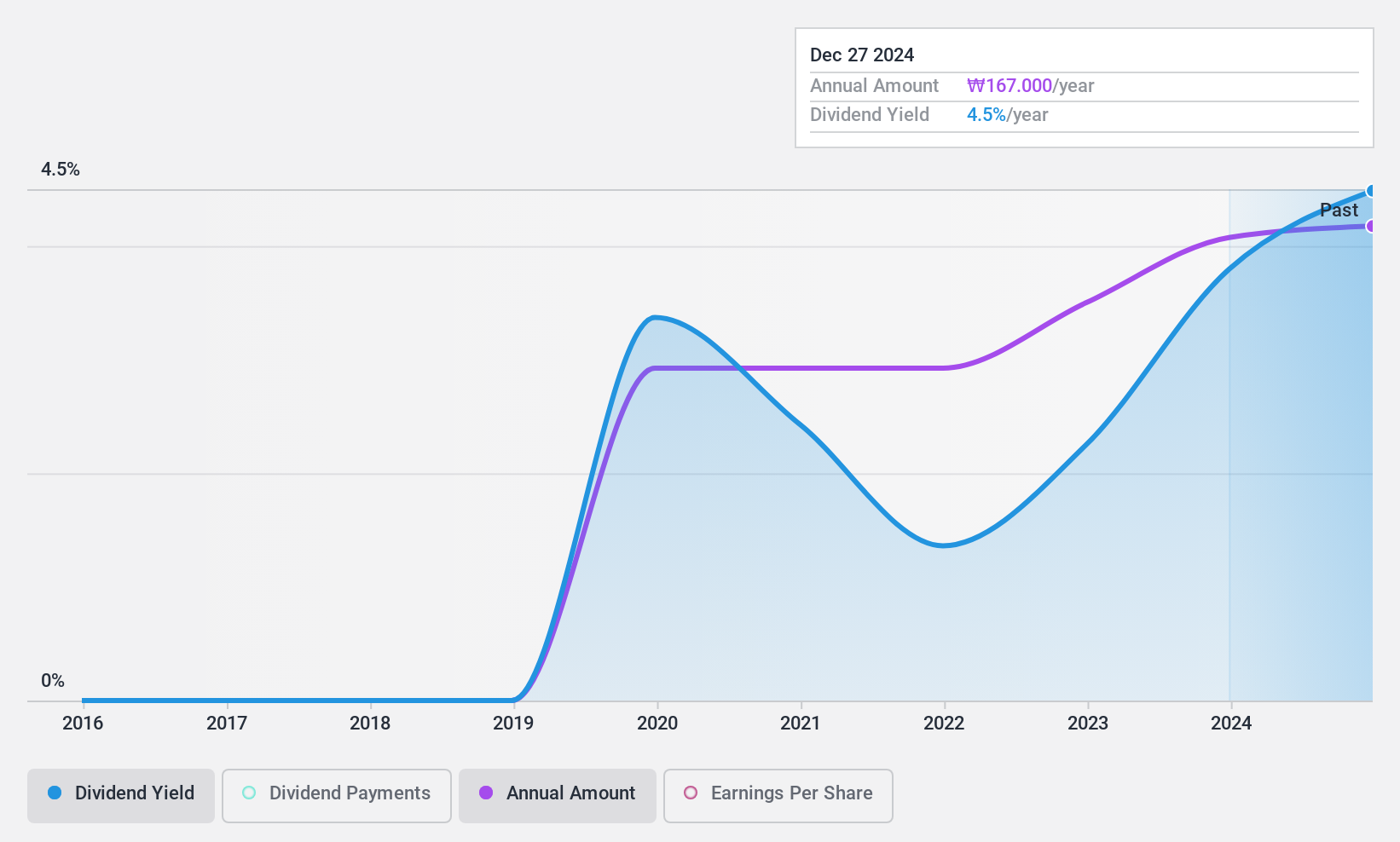

GOLFZON HOLDINGS (KOSDAQ:A121440)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GOLFZON HOLDINGS Co., Ltd., with a market cap of ₩217.59 billion, operates through its subsidiaries in the golf, sports, health, and lifestyle sectors both in South Korea and internationally.

Operations: GOLFZON HOLDINGS Co., Ltd.'s revenue segments include Distribution Business at ₩329.59 billion, Landlord at ₩69.30 billion, and Golf Course Rental at ₩7.47 billion.

Dividend Yield: 4.7%

GOLFZON HOLDINGS, with a cash payout ratio of 53.8%, covers its dividends through cash flows, and a low payout ratio of 23.4% ensures earnings coverage. Although the company has only paid dividends for five years, the payments have been stable and growing. Its dividend yield is in the top 25% of the KR market. A recent share buyback program worth KRW 10 billion aims to stabilize stock price and enhance shareholder value, potentially benefiting dividend investors further.

- Click to explore a detailed breakdown of our findings in GOLFZON HOLDINGS' dividend report.

- The valuation report we've compiled suggests that GOLFZON HOLDINGS' current price could be quite moderate.

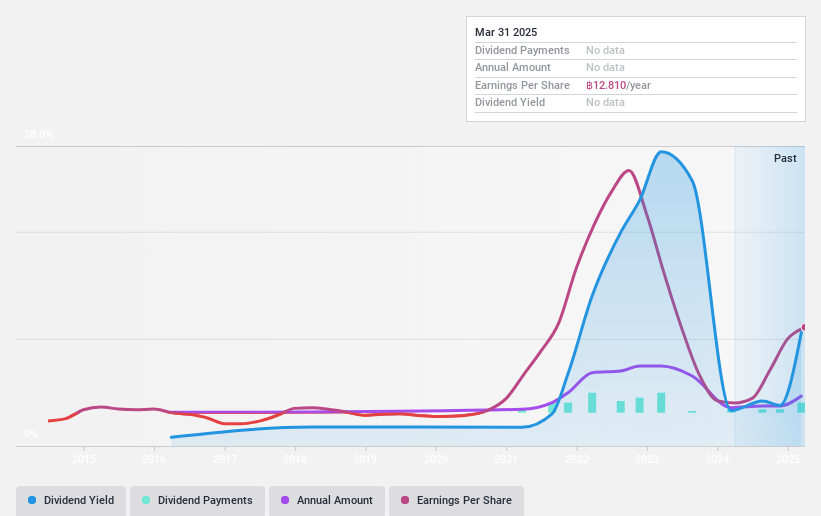

Regional Container Lines (SET:RCL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Regional Container Lines Public Company Limited, with a market cap of THB20.93 billion, operates feeder and vessel services across Thailand, Singapore, Hong Kong, China, Taiwan and internationally.

Operations: Regional Container Lines generates revenue from its feeder and vessel operations across various regions, including Thailand, Singapore, Hong Kong, China, and Taiwan.

Dividend Yield: 9.9%

Regional Container Lines offers a compelling dividend yield of 9.9%, ranking in the top 25% within the Thai market. Despite this, its dividend history is marked by volatility and unreliability over the past decade, with payments not consistently covered by free cash flow. However, a low payout ratio of 19.5% indicates dividends are well-covered by earnings. Recent financial results show significant revenue and net income growth, potentially supporting future dividend stability if sustained.

- Delve into the full analysis dividend report here for a deeper understanding of Regional Container Lines.

- Our valuation report unveils the possibility Regional Container Lines' shares may be trading at a premium.

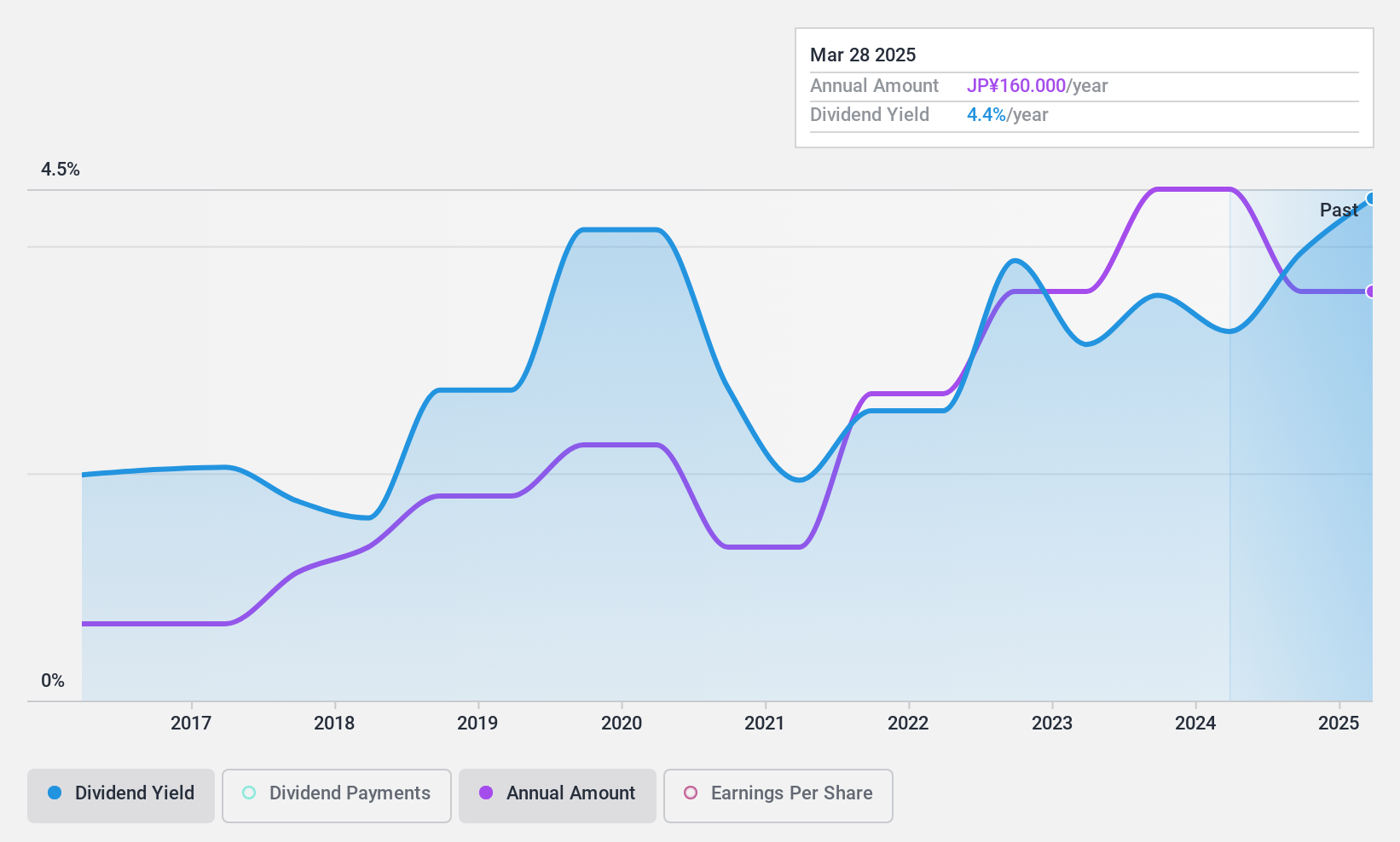

Okamoto Machine Tool Works (TSE:6125)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Okamoto Machine Tool Works, Ltd. specializes in the manufacturing and sale of grinding machines, semiconductor, gear, and casting equipment both domestically in Japan and internationally, with a market cap of ¥26.54 billion.

Operations: Okamoto Machine Tool Works, Ltd. generates revenue primarily from its Machine Tools segment, contributing ¥31.84 billion, and its Semiconductor Related Equipment segment, which adds ¥13.39 billion.

Dividend Yield: 4%

Okamoto Machine Tool Works offers a dividend yield of 3.99%, placing it among the top 25% of Japanese dividend payers, yet its dividends have been volatile and unreliable over the past decade. The payout ratio is low at 38%, suggesting earnings coverage, but dividends are not supported by free cash flow. Additionally, recent shareholder dilution may affect future returns. The stock's price-to-earnings ratio of 9.8x is attractive compared to the broader market at 13.2x.

- Click here and access our complete dividend analysis report to understand the dynamics of Okamoto Machine Tool Works.

- Upon reviewing our latest valuation report, Okamoto Machine Tool Works' share price might be too optimistic.

Key Takeaways

- Gain an insight into the universe of 1210 Top Asian Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Okamoto Machine Tool Works, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6125

Okamoto Machine Tool Works

Manufactures and sells grinding machines, semiconductor, gear, and casting equipment in Japan and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives