As global markets react positively to the recent U.S.-China tariff pause, Asian markets have also seen a lift in sentiment, with indices like China's CSI 300 and Japan's Nikkei 225 registering gains. In this context of easing trade tensions and modest economic growth, dividend stocks in Asia present an attractive opportunity for investors seeking stable returns through income generation.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| en-japan (TSE:4849) | 4.38% | ★★★★★★ |

| Daicel (TSE:4202) | 5.01% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.95% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.73% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.34% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.09% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.06% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.03% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.23% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.47% | ★★★★★★ |

Click here to see the full list of 1238 stocks from our Top Asian Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Shanghai Shuixing Home Textile (SHSE:603365)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shanghai Shuixing Home Textile Co., Ltd. is engaged in the research, development, design, production, and sale of household textiles in China with a market cap of CN¥4.54 billion.

Operations: Shanghai Shuixing Home Textile Co., Ltd.'s revenue from textile manufacturing amounts to CN¥4.20 billion.

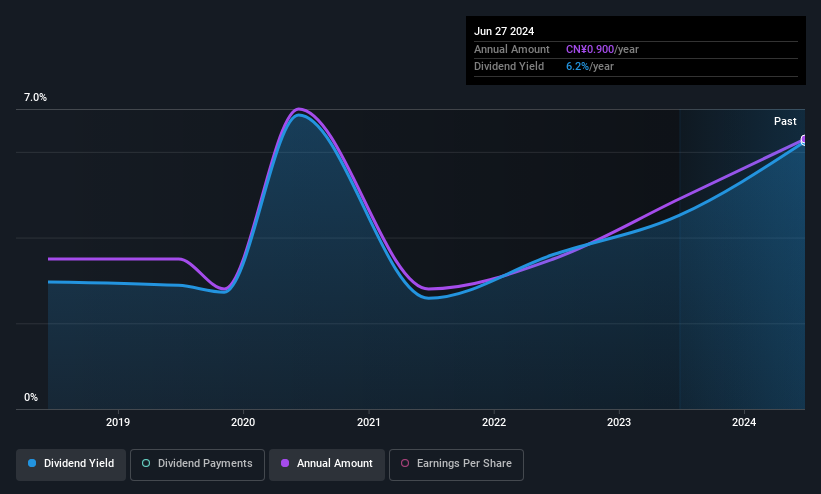

Dividend Yield: 5.2%

Shanghai Shuixing Home Textile's dividend payments have been volatile over the past seven years, with a history of unreliability. Despite this, the company's dividends are covered by earnings and cash flows, with payout ratios of 65.2% and 82.5%, respectively. Trading at a significant discount to its estimated fair value, it offers a dividend yield in the top quartile of China's market at 5.2%. Recent Q1 earnings showed stable revenue growth but slight declines in net income.

- Click here and access our complete dividend analysis report to understand the dynamics of Shanghai Shuixing Home Textile.

- The analysis detailed in our Shanghai Shuixing Home Textile valuation report hints at an deflated share price compared to its estimated value.

TYK (TSE:5363)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TYK Corporation is involved in the manufacture and sale of functional refractories and ceramics on a global scale, with a market cap of ¥23.86 billion.

Operations: TYK Corporation generates revenue through its global operations in the manufacture and sale of functional refractories and ceramics.

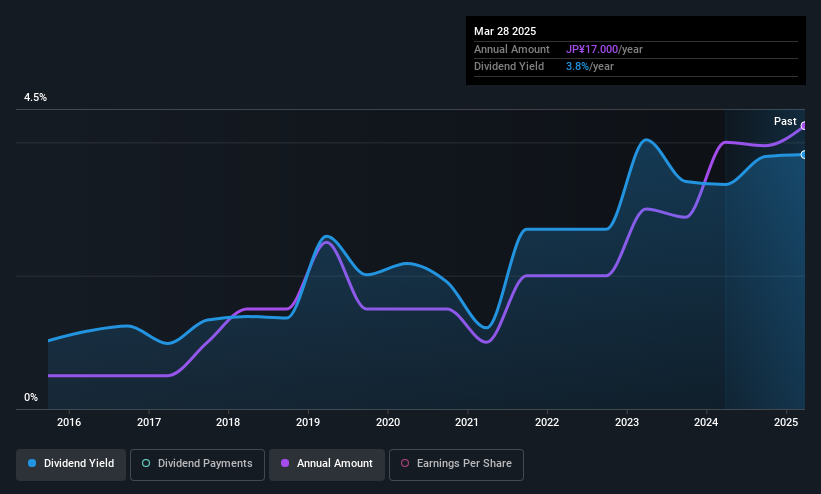

Dividend Yield: 3.2%

TYK Corporation's dividend payments have been volatile over the past decade, with periods of significant declines. However, dividends are well-covered by earnings and cash flows, with low payout ratios of 13% and 23.4%, respectively. The company's recent earnings growth of 20.7% supports its ability to maintain payouts despite a lower yield compared to Japan's top quartile dividend payers. Trading at a substantial discount to estimated fair value may indicate an attractive entry point for investors seeking value.

- Dive into the specifics of TYK here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that TYK is trading behind its estimated value.

Takuma (TSE:6013)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Takuma Co., Ltd. specializes in designing, constructing, and overseeing boilers, plant machinery, pollution prevention and environmental equipment plants, as well as heating, cooling, and sanitation systems in Japan with a market cap of ¥155.18 billion.

Operations: Takuma Co., Ltd.'s revenue segments include the design, construction, and management of boilers, plant machinery, environmental equipment plants for pollution control, as well as heating, cooling, and sanitation systems in Japan.

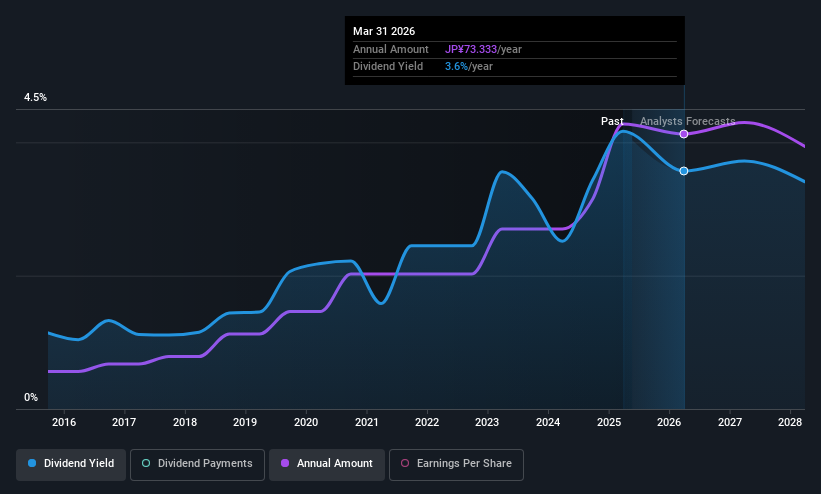

Dividend Yield: 3.7%

Takuma Co., Ltd. has demonstrated a consistent dividend growth trajectory, with recent increases to ¥39.00 per share for the fiscal year ended March 31, 2025, and projected further hikes for the upcoming fiscal year. Although dividends are well-covered by earnings due to a low payout ratio of 37.3%, they are not supported by free cash flows, indicating potential sustainability concerns. The company also executed a share buyback program worth ¥2.21 billion, enhancing shareholder value alongside dividends.

- Get an in-depth perspective on Takuma's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of Takuma shares in the market.

Taking Advantage

- Take a closer look at our Top Asian Dividend Stocks list of 1238 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603365

Shanghai Shuixing Home Textile

Researches, develops, designs, produces, and sells household textiles in China.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives