Takuma (TSE:6013): Assessing Valuation Following Completion of Major Share Buyback Program

Reviewed by Kshitija Bhandaru

Takuma (TSE:6013) has wrapped up its previously announced buyback program, purchasing a total of 3.4 million shares, or about 4% of its outstanding stock, since March. This capital allocation move can shift both investor sentiment and share dynamics.

See our latest analysis for Takuma.

Takuma’s buyback wraps up at a time when its shares have already enjoyed strong upside, with a year-to-date share price return of nearly 35%. Recent weeks brought some profit-taking; shares slipped about 2% in the last week and 4.5% over the past month. Still, total shareholder return over the past year stands at an impressive 41%, signaling sustained confidence and building long-term momentum despite short-term market noise.

If strategic moves like this buyback pique your interest, it’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With Takuma trading at about a 14% discount to analyst targets and showing solid earnings growth, the key question is whether this momentum leaves room for further upside or if future growth is already reflected in the price.

Price-to-Earnings of 17.6x: Is it justified?

Takuma currently trades at a price-to-earnings (P/E) ratio of 17.6x, which positions it at a premium compared to its immediate industry peers and the wider Japanese machinery sector. With a closing price of ¥2,217, the market appears to have priced in considerable optimism about its future performance.

The P/E ratio measures how much investors are willing to pay for each yen of the company’s earnings. In capital goods and machinery, it provides insight into whether the market expects robust future profit growth, steady performance, or possible stagnation. A higher P/E can indicate expectations of superior growth or be a sign of an overvalued stock if earnings do not keep pace.

Right now, Takuma’s P/E stands notably above the Japanese machinery industry average (13x) and also exceeds the estimated fair P/E ratio (13.3x). This signals that investors are valuing the company at a premium, a difference that could narrow if future growth does not materialize as hoped. The market might be pricing in future earnings acceleration or assigning a quality premium. However, compared to both its peers and fair value estimates, the current valuation looks stretched.

Explore the SWS fair ratio for Takuma

Result: Price-to-Earnings of 17.6x (OVERVALUED)

However, slower earnings growth or broader market volatility could challenge Takuma’s premium valuation and reduce the recent positive momentum.

Find out about the key risks to this Takuma narrative.

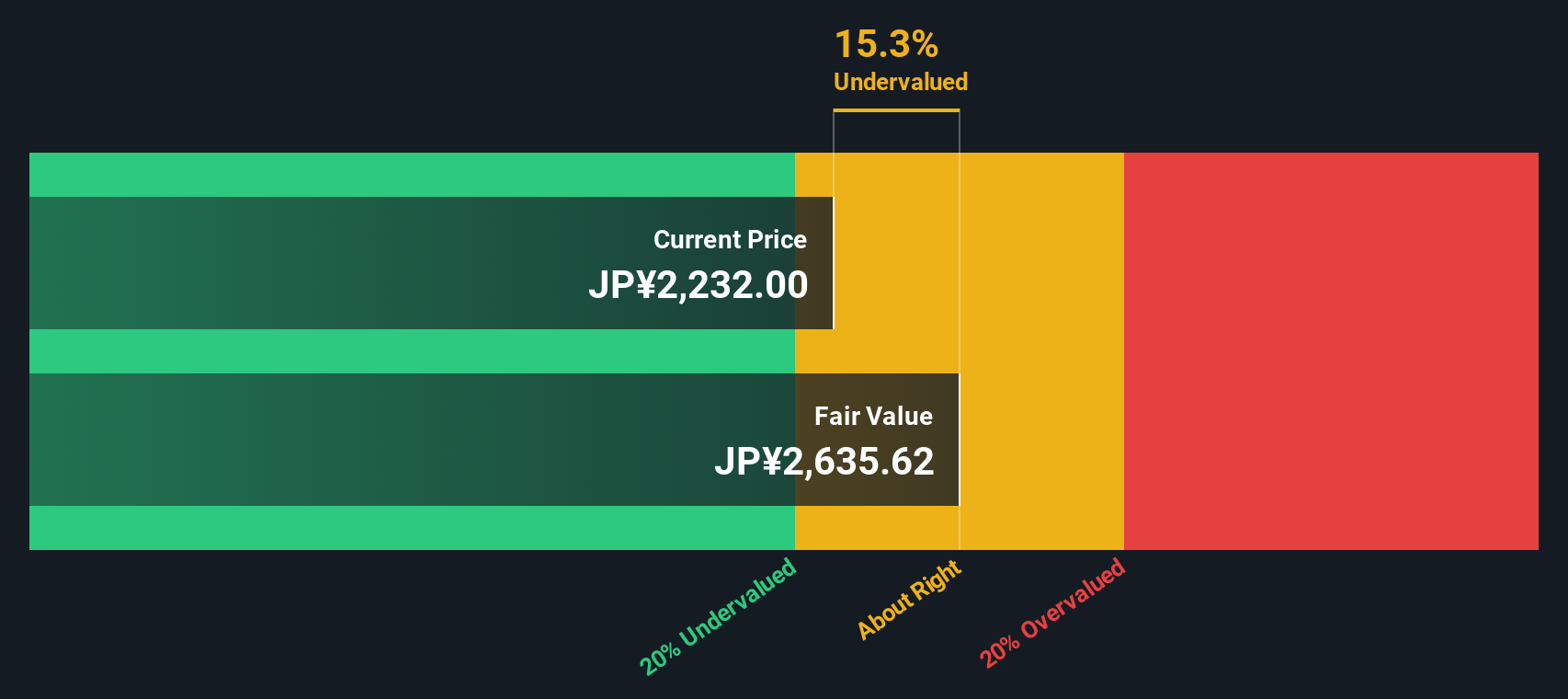

Another View: Discounted Cash Flow Undervalues Takuma

While the market may appear optimistic based on earnings ratios, our DCF model offers a different verdict. According to this cash flow-based approach, Takuma's shares trade at nearly a 17% discount to their estimated fair value. Does this suggest the market is missing upside or just being cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Takuma for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Takuma Narrative

If you’re inclined to do your own digging or believe the story might unfold differently, you can shape your perspective in just a few minutes with Do it your way.

A great starting point for your Takuma research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your opportunities to just one company when vibrant sectors and emerging trends could add real value to your portfolio. Smart investing starts by stepping beyond the obvious.

- Tap into untapped potential with these 3578 penny stocks with strong financials and find lesser-known companies showing solid financials and strong growth prospects.

- Take advantage of surging technologies by searching for tomorrow’s leaders among these 25 AI penny stocks who are pioneering innovations in artificial intelligence.

- Maximize your returns by seeking out these 893 undervalued stocks based on cash flows that trade below their fair value, highlighting hidden opportunities for long-term gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Takuma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6013

Takuma

Engages in the design, construction, and superintendence of various boilers, plant machineries, pollution prevention and environmental equipment plants, heating and cooling equipment, and feed water/drainage sanitation equipment and facilities in Japan.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives