STG Co., Ltd. (TSE:5858) Stock Rockets 26% But Many Are Still Ignoring The Company

STG Co., Ltd. (TSE:5858) shares have had a really impressive month, gaining 26% after a shaky period beforehand. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

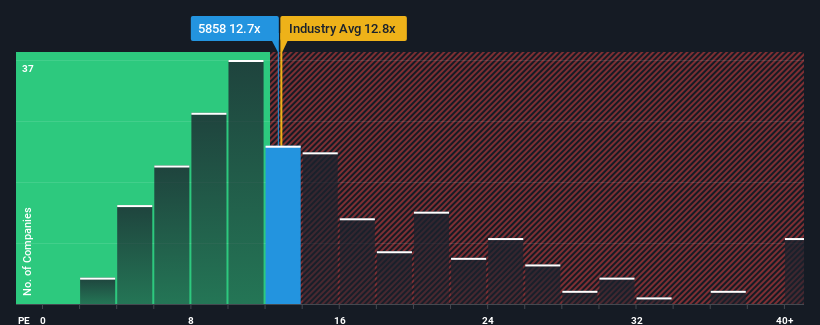

In spite of the firm bounce in price, it's still not a stretch to say that STG's price-to-earnings (or "P/E") ratio of 12.7x right now seems quite "middle-of-the-road" compared to the market in Japan, where the median P/E ratio is around 14x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Earnings have risen at a steady rate over the last year for STG, which is generally not a bad outcome. One possibility is that the P/E is moderate because investors think this good earnings growth might only be parallel to the broader market in the near future. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

View our latest analysis for STG

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like STG's is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 3.1% last year. The latest three year period has also seen an excellent 116% overall rise in EPS, aided somewhat by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 9.7% shows it's noticeably more attractive on an annualised basis.

With this information, we find it interesting that STG is trading at a fairly similar P/E to the market. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Final Word

STG's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of STG revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look better than current market expectations. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

There are also other vital risk factors to consider and we've discovered 4 warning signs for STG (2 don't sit too well with us!) that you should be aware of before investing here.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade STG, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5858

STG

Manufactures and sells magnesium and aluminum die casting products in Japan and internationally.

Solid track record with mediocre balance sheet.

Market Insights

Community Narratives