- Japan

- /

- Electrical

- /

- TSE:5803

Why Investors Shouldn't Be Surprised By Fujikura Ltd.'s (TSE:5803) 32% Share Price Surge

Despite an already strong run, Fujikura Ltd. (TSE:5803) shares have been powering on, with a gain of 32% in the last thirty days. The annual gain comes to 184% following the latest surge, making investors sit up and take notice.

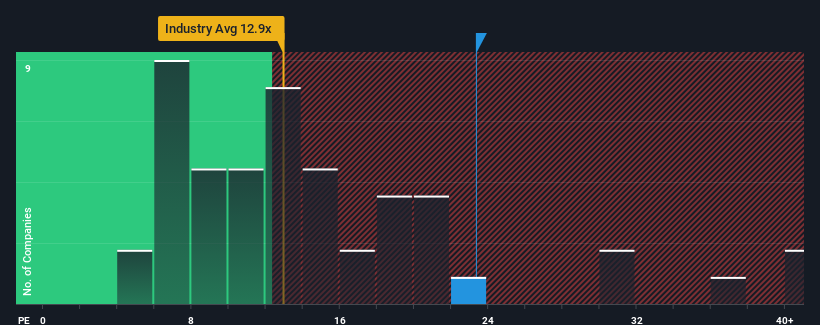

Following the firm bounce in price, given close to half the companies in Japan have price-to-earnings ratios (or "P/E's") below 14x, you may consider Fujikura as a stock to avoid entirely with its 23.3x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Fujikura hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Fujikura

How Is Fujikura's Growth Trending?

In order to justify its P/E ratio, Fujikura would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a frustrating 49% decrease to the company's bottom line. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 21% per year over the next three years. That's shaping up to be materially higher than the 11% per annum growth forecast for the broader market.

In light of this, it's understandable that Fujikura's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Fujikura's P/E

Shares in Fujikura have built up some good momentum lately, which has really inflated its P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Fujikura maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You need to take note of risks, for example - Fujikura has 4 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If these risks are making you reconsider your opinion on Fujikura, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5803

Fujikura

Engages in energy, telecommunications, electronics, automotive, and real estate businesses in Japan, the United States, China, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives