Investors more bullish on Japan Steel Works (TSE:5631) this week as stock advances 3.0%, despite earnings trending downwards over past five years

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. For example, the The Japan Steel Works, Ltd. (TSE:5631) share price has soared 131% in the last half decade. Most would be very happy with that. Also pleasing for shareholders was the 35% gain in the last three months.

Since the stock has added JP¥12b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

View our latest analysis for Japan Steel Works

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Japan Steel Works actually saw its EPS drop 4.5% per year.

By glancing at these numbers, we'd posit that the decline in earnings per share is not representative of how the business has changed over the years. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

We doubt the modest 1.3% dividend yield is attracting many buyers to the stock. In contrast revenue growth of 4.1% per year is probably viewed as evidence that Japan Steel Works is growing, a real positive. In that case, the company may be sacrificing current earnings per share to drive growth.

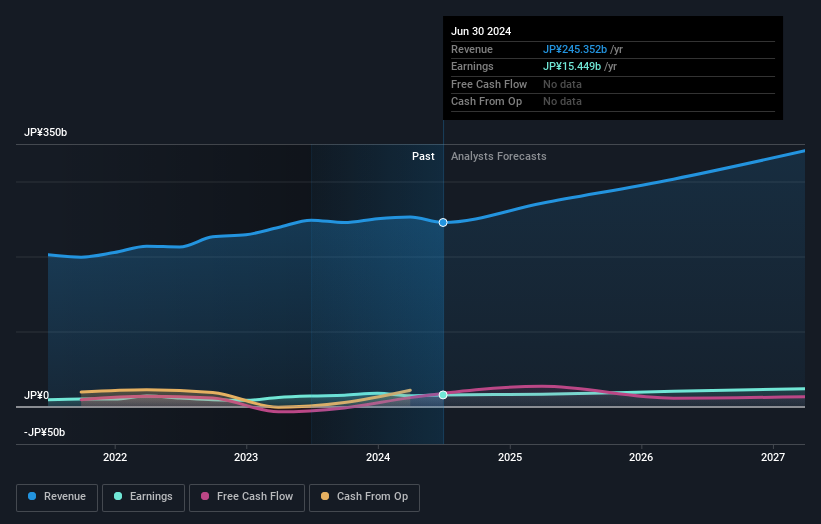

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that Japan Steel Works has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on Japan Steel Works

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Japan Steel Works' TSR for the last 5 years was 155%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that Japan Steel Works shareholders have received a total shareholder return of 127% over one year. And that does include the dividend. That's better than the annualised return of 21% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for Japan Steel Works that you should be aware of.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5631

Japan Steel Works

Engages in the provision of industrial machinery products, and material and engineering business in Japan and internationally.

Excellent balance sheet with moderate growth potential.