TOTO (TSE:5332): Exploring Valuation as Shares Show Mixed Momentum

Reviewed by Kshitija Bhandaru

See our latest analysis for TOTO.

Over the past year, TOTO’s share price has seen some modest ups and downs, with momentum showing signs of fading as demand in the capital goods sector evolves. The company’s 1-year total shareholder return stands just below flat, highlighting a mixed picture for long-term holders even as recent price action remains subdued.

If you’re weighing what else is moving in the industrials space, now may be a good time to broaden your research and explore fast growing stocks with high insider ownership

With TOTO shares trading just below analyst targets and recent returns lagging, investors face a key question: is the market overlooking hidden value, or have expectations for future growth already been fully priced in?

Price-to-Earnings of 65.8x: Is it justified?

TOTO trades at a price-to-earnings (P/E) ratio of 65.8x, placing it well above both its industry and peer group averages. At the last close price of ¥3,905, this suggests the market is assigning a steep premium to TOTO shares.

The price-to-earnings ratio measures how much investors are willing to pay for each yen of current earnings. For TOTO, a high P/E often indicates expectations of robust future profit growth or unique business advantages. However, it can also be a warning if earnings do not scale as fast as anticipated.

Compared to the Japanese Building industry average of 15.1x and a peer average of 33.6x, TOTO’s valuation is significantly higher. The stock also trades noticeably above its estimated "fair" P/E of 26.5x, showing a gap between market optimism and fundamentals that may narrow over time.

Explore the SWS fair ratio for TOTO

Result: Price-to-Earnings of 65.8x (OVERVALUED)

However, slowing annual revenue growth and a one-year negative total return both raise concerns that TOTO's premium valuation may not be sustainable.

Find out about the key risks to this TOTO narrative.

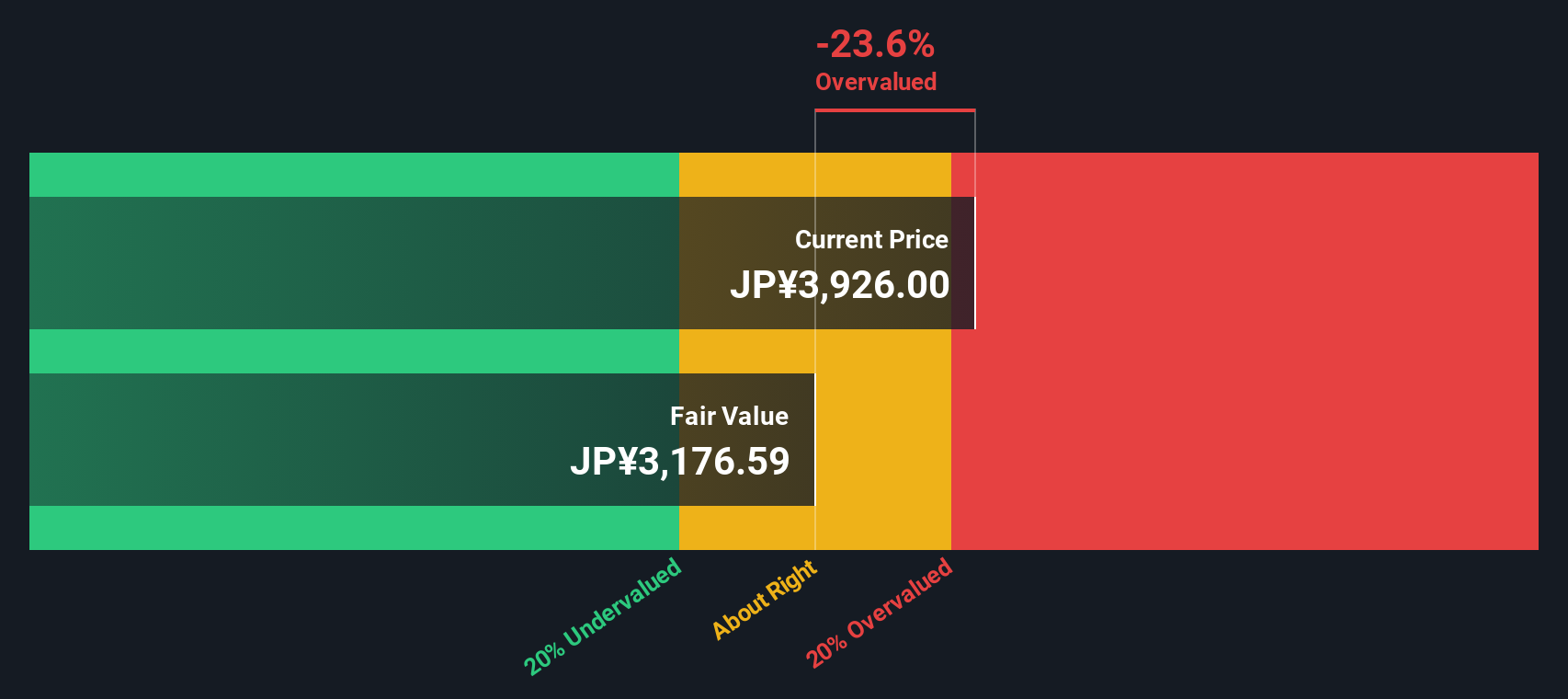

Another View: Discounted Cash Flow Tells a Different Story

Looking at TOTO through the lens of our DCF model reveals a very different valuation signal. Based on the SWS DCF model, TOTO currently trades above its estimated fair value, suggesting the shares may be overvalued. This stands in contrast to market optimism seen in the P/E ratio.

Look into how the SWS DCF model arrives at its fair value.

This raises an important question for investors: does the market know something the models don’t, or is there more downside risk ahead?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TOTO for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TOTO Narrative

If you have a different perspective or want to dive deeper, you can analyse the figures yourself and craft your own insights quickly and easily. Do it your way.

A great starting point for your TOTO research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop at just one stock. Uncover unique opportunities now with these handpicked lists that could give your portfolio an exciting edge.

- Tap into potential future leaders by evaluating these 906 undervalued stocks based on cash flows. These have been selected for their strong financials and attractive valuations.

- Boost your passive income by reviewing these 19 dividend stocks with yields > 3%. These offer consistent yields over 3 percent, making them ideal for income-focused strategies.

- Catalyze your returns with these 24 AI penny stocks, which are powering advances in artificial intelligence and redefining the tech landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TOTO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5332

TOTO

Manufactures and sells bathroom and kitchen plumbing fixtures worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives