- Japan

- /

- Construction

- /

- TSE:5076

A Look at INFRONEER Holdings (TSE:5076) Valuation After Upgraded Outlook and Increased Dividend

Reviewed by Kshitija Bhandaru

INFRONEER Holdings (TSE:5076) is drawing attention after increasing its full-year earnings outlook and announcing a higher annual dividend. These moves are fueled by improved performance from consolidating Sumitomo Mitsui Construction and other recent changes.

See our latest analysis for INFRONEER Holdings.

Investors have taken note of INFRONEER Holdings’ upbeat guidance, revised dividend plans, and streamlining moves such as the announced subsidiary merger. The 30-day share price return of 15.6% and a robust 90-day jump of 40.7% suggest momentum is building. Over the past year, the company has delivered a total shareholder return of nearly 57%, pointing to ongoing optimism around its growth story.

If recent gains caught your attention, now is a good time to widen your view and discover fast growing stocks with high insider ownership

Is INFRONEER Holdings still trading at an appealing value, or have its recent gains and upgraded outlook already been accounted for in the current share price? This leaves investors to wonder if future growth is now fully priced in.Price-to-Earnings of 12.1x: Is it justified?

INFRONEER Holdings is trading at a price-to-earnings (P/E) ratio of 12.1x, which is below both its industry peers and the wider market averages. The last close was ¥1,752, pointing to a valuation that appears attractive compared to similar companies.

The price-to-earnings ratio measures how much investors are willing to pay per yen of earnings and is a widely used gauge of value, especially for established, profitable firms in the construction sector. For INFRONEER Holdings, this lower P/E implies the market currently underappreciates the company's profit potential or is cautious about its growth prospects.

Compared to the Japanese construction industry average P/E of 12.4x and a peer group average of 15.1x, INFRONEER stands out for its favorable pricing. Its P/E is also well below the estimated fair price-to-earnings ratio of 14.7x. This suggests there could be room for the market to re-rate upwards if positive momentum is sustained.

Explore the SWS fair ratio for INFRONEER Holdings

Result: Price-to-Earnings of 12.1x (UNDERVALUED)

However, investors should note that any slowdown in revenue growth or margin pressure could challenge the recent optimism that has been driving INFRONEER Holdings’ strong share price momentum.

Find out about the key risks to this INFRONEER Holdings narrative.

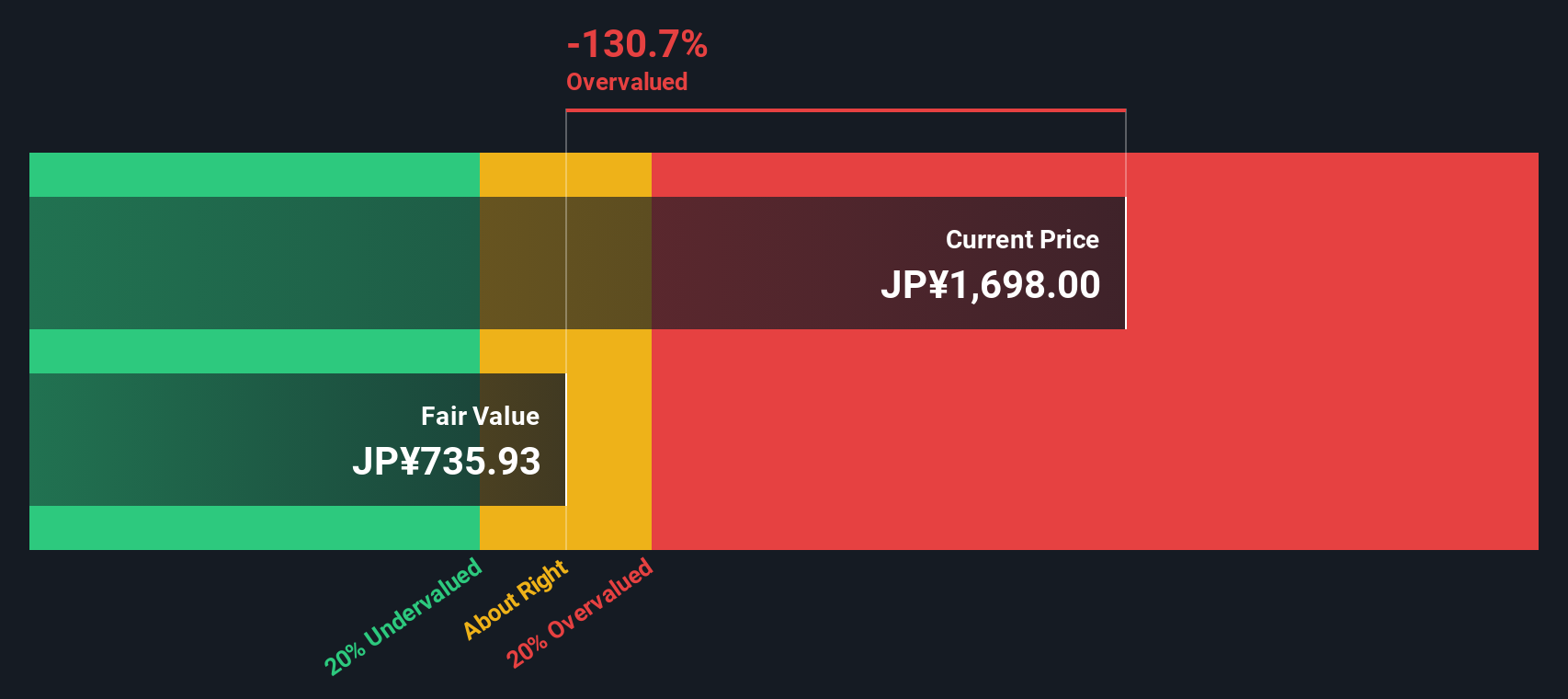

Another View: Discounted Cash Flow Tells a Different Story

While the market multiples suggest INFRONEER Holdings could be undervalued, our DCF model presents a more cautious perspective. According to this method, the shares are trading well above what we estimate as fair value. Could the market be too optimistic about the company’s future prospects?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out INFRONEER Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own INFRONEER Holdings Narrative

If you have a different take or want to dig into the numbers yourself, you can quickly build your own perspective from the ground up in just a few minutes, and Do it your way.

A great starting point for your INFRONEER Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Want to stay ahead and spot fresh opportunities? Use the Simply Wall Street Screener for smart ways to enhance your portfolio before trends hit the mainstream.

- Boost your income by tapping into stocks offering reliable yields. Check out these 19 dividend stocks with yields > 3% for top picks with dividends exceeding 3%.

- Get an edge in the tech race by targeting companies at the forefront of artificial intelligence. Uncover promising names with these 26 AI penny stocks.

- Secure potential bargains and capitalize on mispriced opportunities using these 890 undervalued stocks based on cash flows, which highlights stocks the market may be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5076

Fair value with acceptable track record.

Market Insights

Community Narratives