- Switzerland

- /

- Capital Markets

- /

- SWX:CFT

Sinofert Holdings And 2 Other Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a mixed landscape with fluctuations in consumer confidence and economic indicators, investors are keenly observing how these dynamics impact their portfolios. Despite the recent volatility, dividend stocks continue to attract attention for their potential to provide steady income streams and mitigate some market uncertainties. A strong dividend stock typically offers reliable payouts and demonstrates resilience amid economic shifts, making it a compelling consideration for those seeking stability in today's evolving financial environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.15% | ★★★★★★ |

Click here to see the full list of 1948 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

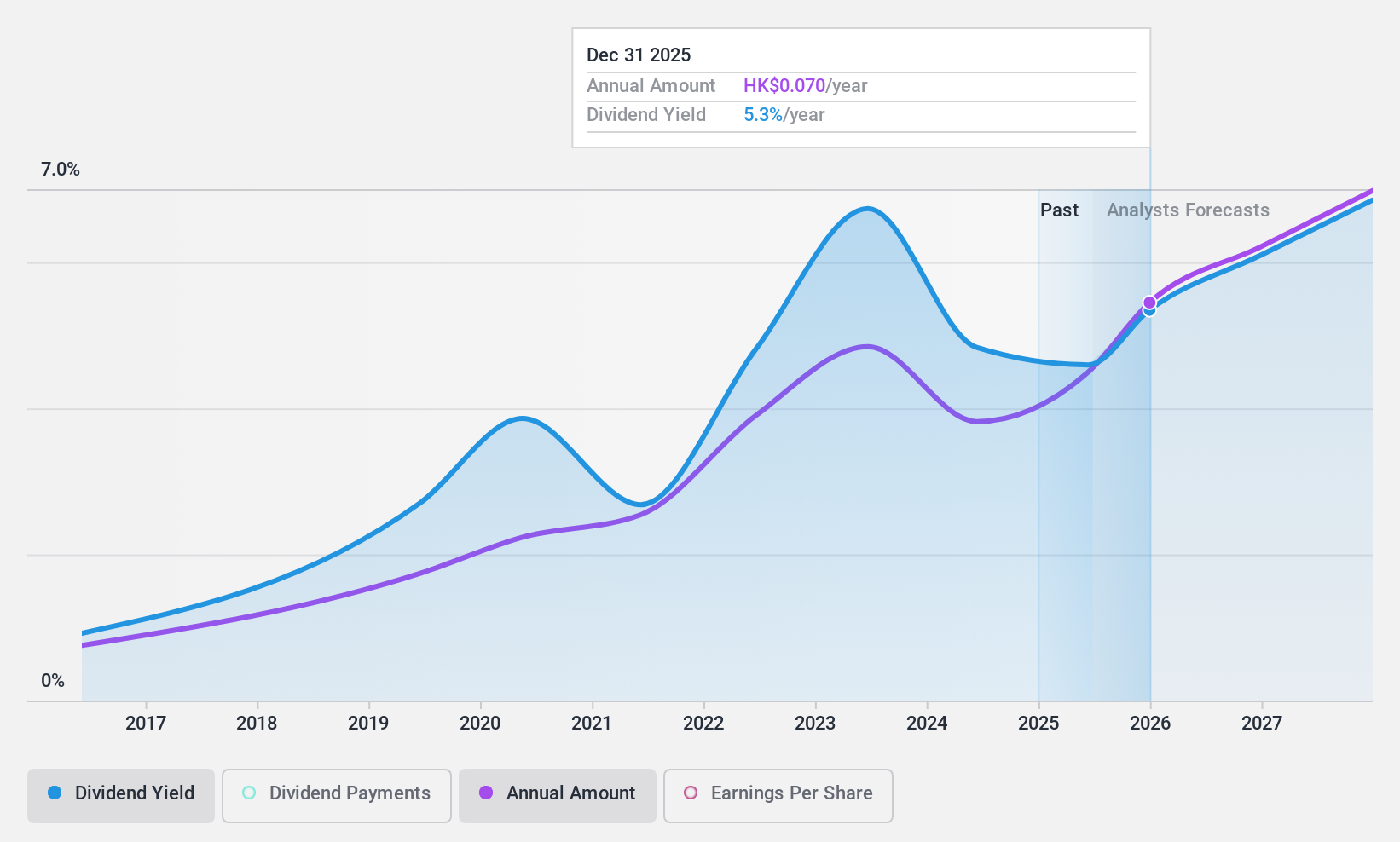

Sinofert Holdings (SEHK:297)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sinofert Holdings Limited is an investment holding company involved in the production, import and export, distribution, and retail of fertilizer raw materials and crop nutrition products in Mainland China and internationally, with a market cap of HK$8.29 billion.

Operations: Sinofert Holdings Limited generates revenue from its Production segment (CN¥5.15 billion), Basic Business segment (CN¥13.93 billion), and Growth Business segment (CN¥11.14 billion).

Dividend Yield: 3.9%

Sinofert Holdings' dividend payments, while having increased over the past decade, have been volatile and unreliable. Despite this instability, dividends are well-covered by earnings and cash flows with a payout ratio of 46.5% and a cash payout ratio of 14.9%. The stock trades significantly below its estimated fair value but offers a relatively low dividend yield of 3.88% compared to top-tier payers in Hong Kong. Recent shareholder meetings focused on strategic agreements may impact future operations.

- Click here to discover the nuances of Sinofert Holdings with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Sinofert Holdings is priced higher than what may be justified by its financials.

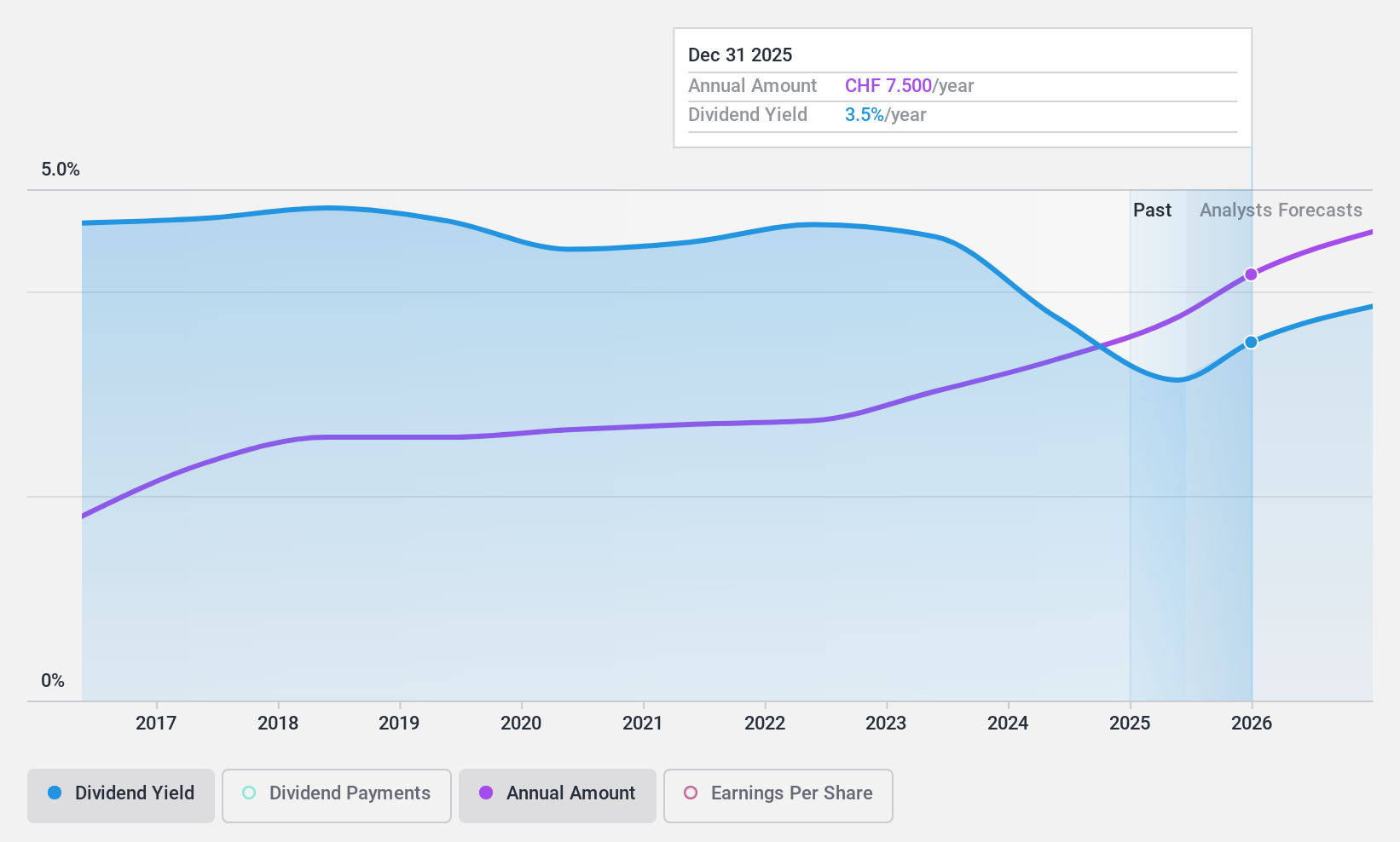

Compagnie Financière Tradition (SWX:CFT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Compagnie Financière Tradition SA is an interdealer broker of financial and non-financial products globally, with a market cap of CHF1.43 billion.

Operations: Compagnie Financière Tradition SA's revenue is divided into the following segments: Americas at CHF352.67 million, Asia-Pacific at CHF273.16 million, and Europe, Middle East and Africa at CHF452.85 million.

Dividend Yield: 3.3%

Compagnie Financière Tradition offers a stable dividend history, with payments growing steadily over the past decade. The dividend yield stands at 3.25%, which is modest compared to the top Swiss payers. However, dividends are well-covered by earnings and cash flows, with payout ratios of 43.3% and 60.8%, respectively. Despite recent shareholder dilution, the company trades at a good value—16.2% below its estimated fair value—and has shown strong earnings growth of 16.1% last year.

- Click to explore a detailed breakdown of our findings in Compagnie Financière Tradition's dividend report.

- According our valuation report, there's an indication that Compagnie Financière Tradition's share price might be on the expensive side.

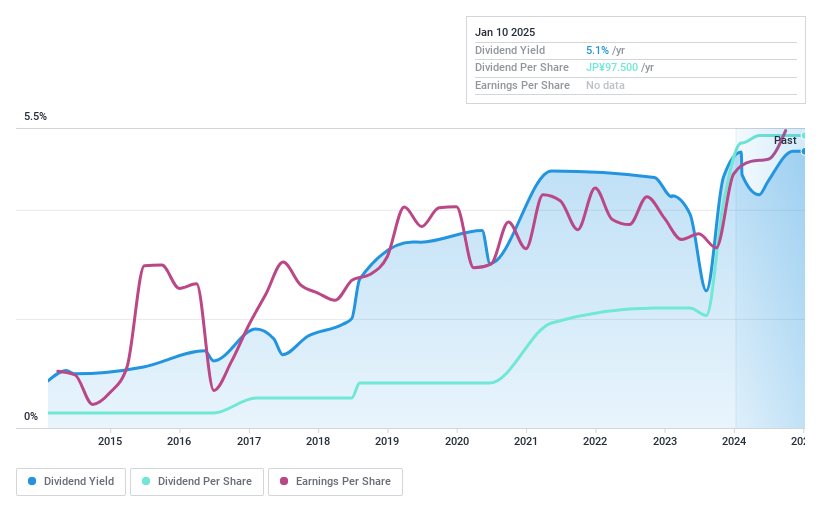

Miyaji Engineering GroupInc (TSE:3431)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Miyaji Engineering Group Inc., through its subsidiaries, is involved in construction and civil engineering activities in Japan with a market cap of ¥53.17 billion.

Operations: Miyaji Engineering Group Inc.'s revenue segments include MEC generating ¥42.46 billion and MMB contributing ¥32.21 billion.

Dividend Yield: 4.9%

Miyaji Engineering Group's dividend yield of 4.86% ranks in the top 25% in Japan, but payments have been volatile and are not covered by free cash flows. The payout ratio is reasonable at 53.8%, suggesting earnings cover dividends, yet recent cuts from ¥150 to ¥85 per share highlight instability. With a price-to-earnings ratio of 11x below the market average, it offers value despite high non-cash earnings impacting quality perceptions.

- Get an in-depth perspective on Miyaji Engineering GroupInc's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of Miyaji Engineering GroupInc shares in the market.

Summing It All Up

- Unlock our comprehensive list of 1948 Top Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CFT

Compagnie Financière Tradition

Operates as an interdealer broker of financial and non-financial products worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.