- Japan

- /

- Trade Distributors

- /

- TSE:3388

Top Global Dividend Stocks To Watch In May 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by mixed equity performances and cautious economic outlooks, investors are keenly observing the potential impacts of recent trade developments and central bank decisions. Amidst this backdrop, dividend stocks remain a focal point for those seeking steady income streams, as they often provide a measure of stability in uncertain times.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 4.42% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.24% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 3.94% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.01% | ★★★★★★ |

| Chudenko (TSE:1941) | 4.00% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.09% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.70% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.99% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.56% | ★★★★★★ |

Click here to see the full list of 1535 stocks from our Top Global Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

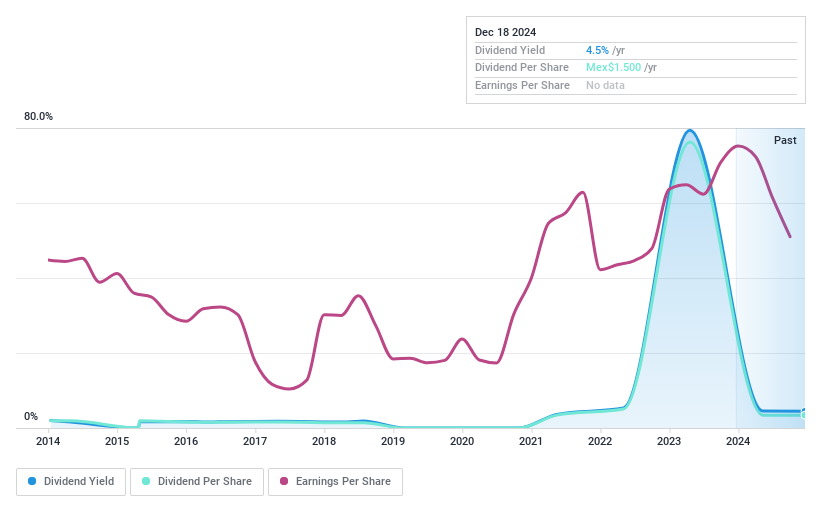

Médica Sur. de (BMV:MEDICA B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Médica Sur, S.A.B. de C.V. operates as a healthcare hospital in Mexico with a market cap of MX$4.53 billion.

Operations: Médica Sur, S.A.B. de C.V. generates its revenue from operating healthcare services in Mexico.

Dividend Yield: 3.5%

Médica Sur's dividend payments have increased over the past decade, but they have been volatile with instances of annual drops exceeding 20%. Despite this instability, the dividends are well covered by earnings and cash flows, with payout ratios of 42.8% and 31.5% respectively. Trading at a significant discount to its estimated fair value, Médica Sur recently affirmed an annual dividend of MXN 1.50 per share payable on May 20, 2025.

- Delve into the full analysis dividend report here for a deeper understanding of Médica Sur. de.

- The valuation report we've compiled suggests that Médica Sur. de's current price could be quite moderate.

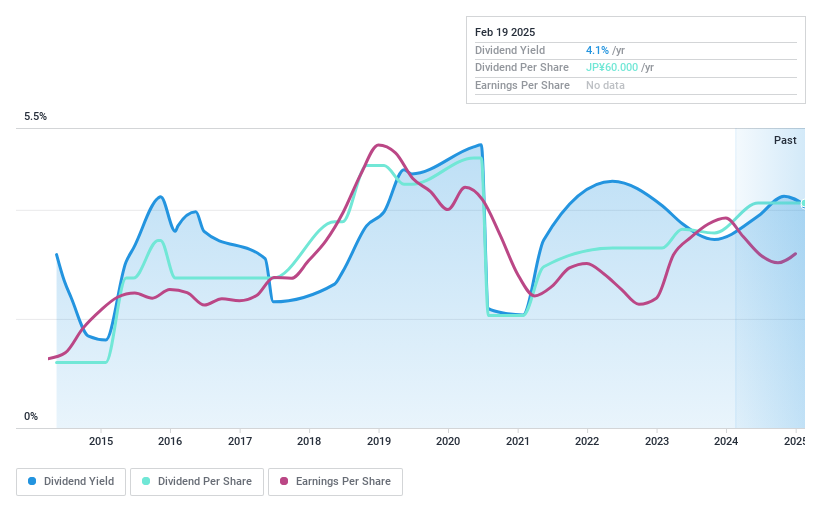

Meiji Electric IndustriesLtd (TSE:3388)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Meiji Electric Industries Co., Ltd. engages in the import, export, and sale of electrical devices, measuring instruments, electrical equipment, and automation and energy-saving components with a market cap of ¥19.18 billion.

Operations: Meiji Electric Industries Ltd generates revenue of ¥75.26 billion from its segments, which include control equipment, industrial equipment, and measuring equipment.

Dividend Yield: 3.3%

Meiji Electric Industries' dividend payments have been volatile over the past decade, with significant annual fluctuations. Despite this, dividends are well-covered by earnings and cash flows, with payout ratios of 39% and 10.3%, respectively. The stock trades at a substantial discount to its estimated fair value. Recent board discussions focused on capital cost awareness and stock price considerations may influence future dividend strategies.

- Take a closer look at Meiji Electric IndustriesLtd's potential here in our dividend report.

- Our valuation report unveils the possibility Meiji Electric IndustriesLtd's shares may be trading at a premium.

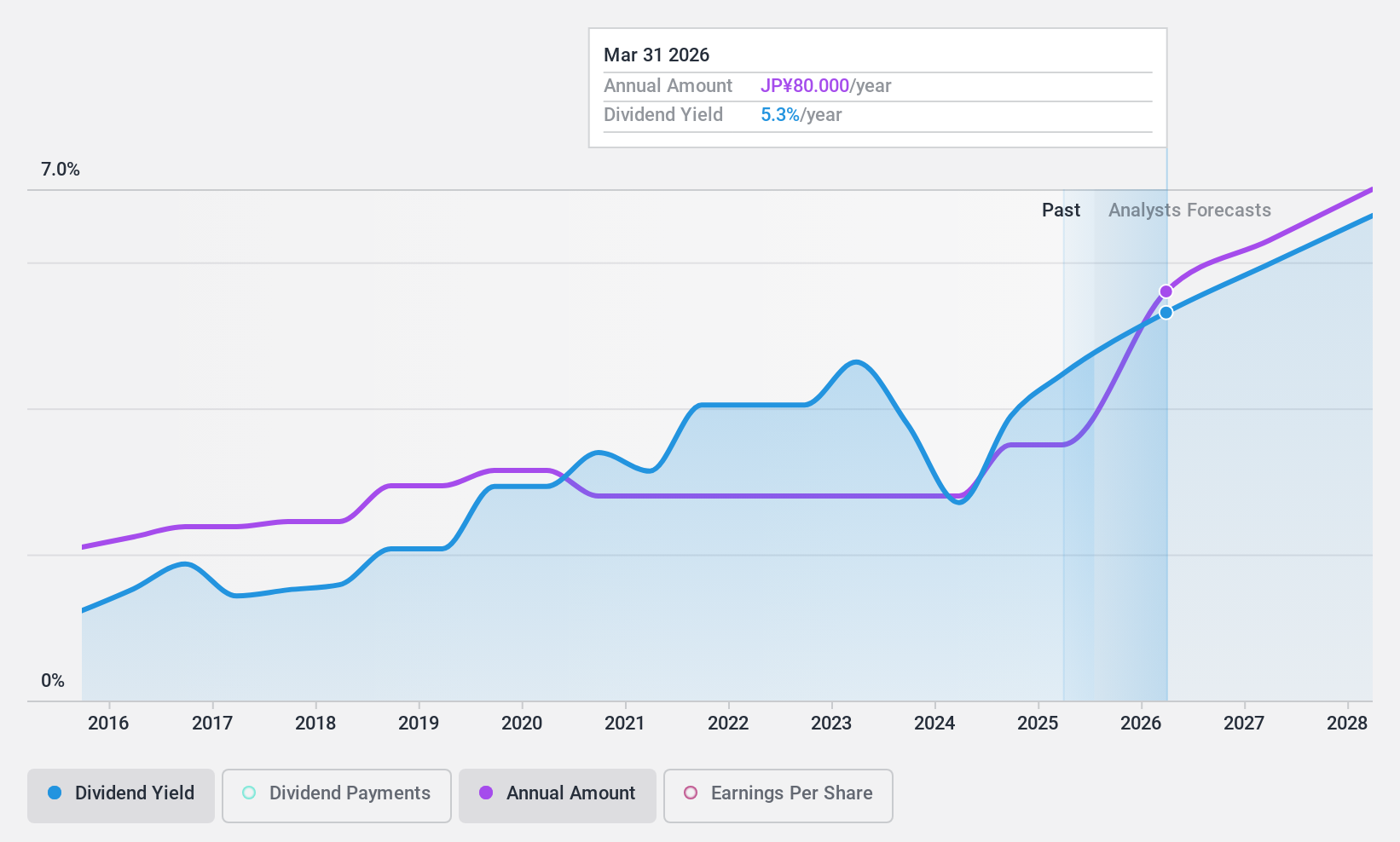

Nippon Seiki (TSE:7287)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Seiki Co., Ltd. manufactures and sells instruments for vehicles and machinery across various regions, including Japan, the Americas, Europe, and Asia, with a market cap of ¥67.23 billion.

Operations: Nippon Seiki Co., Ltd.'s revenue segments include the Automotive Parts Business at ¥252.05 billion, Automotive Sales at ¥26.63 billion, Resin Compound Business at ¥10.75 billion, and Consumer Parts at ¥13.92 billion.

Dividend Yield: 3.7%

Nippon Seiki's dividend payments have been stable and growing over the past decade, indicating reliability. However, the current payout ratio of 88.2% suggests dividends are covered by earnings but not by free cash flows, as the company lacks them. The dividend yield of 3.66% is below top-tier levels in Japan and profit margins have declined to 1.1%. These factors raise concerns about long-term sustainability despite historical consistency in payments.

- Unlock comprehensive insights into our analysis of Nippon Seiki stock in this dividend report.

- The valuation report we've compiled suggests that Nippon Seiki's current price could be inflated.

Seize The Opportunity

- Unlock our comprehensive list of 1535 Top Global Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Meiji Electric IndustriesLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3388

Meiji Electric IndustriesLtd

Imports, exports, and sells electrical devices, measuring instruments, electrical equipment, and automation and energy-saving function components and equipment.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives