Subdued Growth No Barrier To Nitto Boseki Co., Ltd. (TSE:3110) With Shares Advancing 25%

Nitto Boseki Co., Ltd. (TSE:3110) shares have continued their recent momentum with a 25% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 32% in the last year.

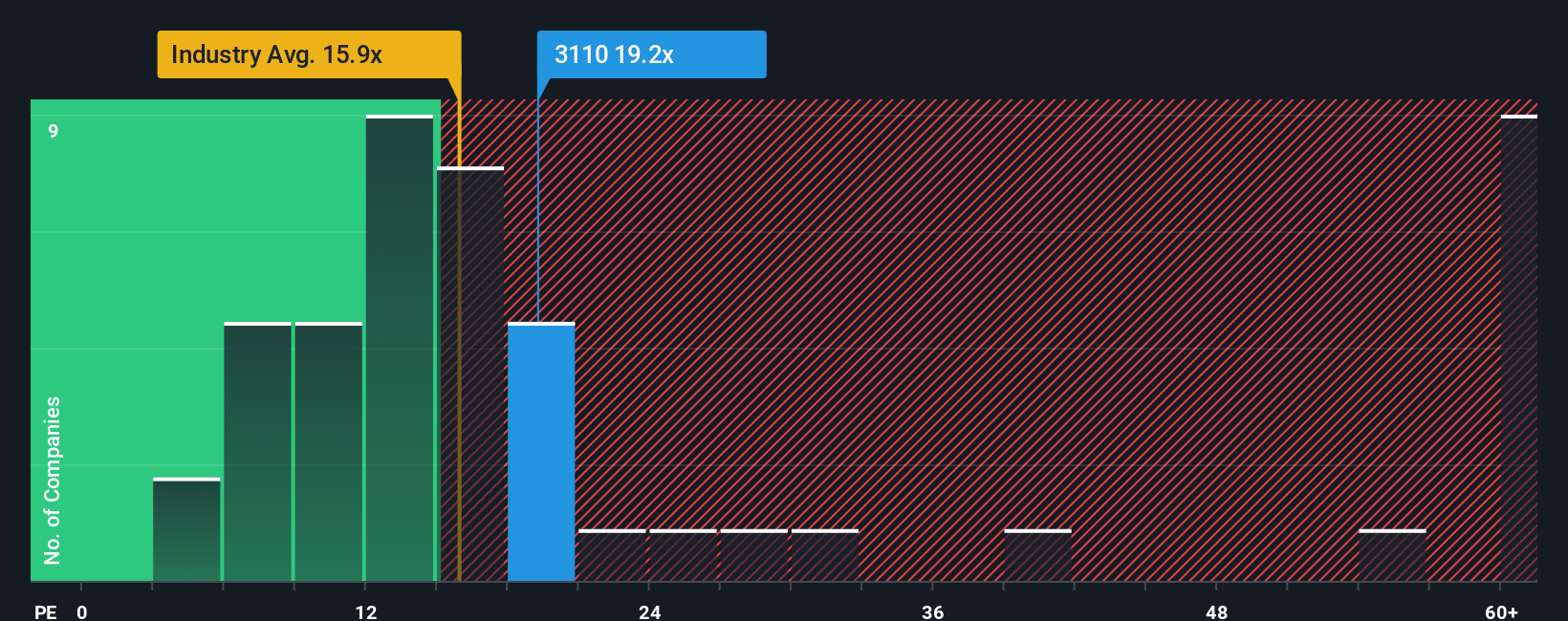

Following the firm bounce in price, Nitto Boseki may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 19.2x, since almost half of all companies in Japan have P/E ratios under 14x and even P/E's lower than 10x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Recent times have been advantageous for Nitto Boseki as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Nitto Boseki

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Nitto Boseki's is when the company's growth is on track to outshine the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 34% last year. As a result, it also grew EPS by 29% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 11% each year during the coming three years according to the nine analysts following the company. With the market predicted to deliver 9.5% growth each year, the company is positioned for a comparable earnings result.

With this information, we find it interesting that Nitto Boseki is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Final Word

Nitto Boseki's P/E is getting right up there since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Nitto Boseki's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Plus, you should also learn about this 1 warning sign we've spotted with Nitto Boseki.

If you're unsure about the strength of Nitto Boseki's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Nitto Boseki might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3110

Nitto Boseki

Engages in the manufacture, processing, and sale of textile products; glass fiber products; chemical products and pharmaceutical products; planning, supervision, and contracting for construction; and design, manufacture, and sale of machinery and equipment in Japan.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives