- Japan

- /

- Trade Distributors

- /

- TSE:2768

Sojitz (TSE:2768): Assessing Valuation Following Genomatica Partnership in Plant-Based Nylon-6 Innovation

Reviewed by Kshitija Bhandaru

Sojitz (TSE:2768) just unveiled a new partnership with Genomatica, combining a strategic financial investment and expertise to help bring 100% plant-based nylon-6 to market more quickly. This move places Sojitz in the sustainable materials spotlight.

See our latest analysis for Sojitz.

Momentum is clearly building for Sojitz, with its recent partnership news adding to a strong run. The 22.68% share price return since January and a standout 22.32% total shareholder return over the past year show investors’ growing optimism about the company’s future, especially given an impressive 324.7% five-year total return.

If you’re interested in what other fast-moving companies are catching investor attention, now’s a smart time to explore fast growing stocks with high insider ownership

With shares not far off their analyst price target and recent strong returns, should investors see Sojitz as an undervalued chance to buy into future growth, or has the market already priced in these gains?

Most Popular Narrative: 10.2% Undervalued

The most widely followed narrative values Sojitz shares at ¥4,397, which is noticeably above the latest close of ¥3,948. This hints at strong expectations for future business growth.

Expansion into high-growth sectors such as chemicals (for example, the full acquisition of NIPPON A&L for lithium-ion battery materials and resins) and value chain moves into manufacturing are likely to strengthen Sojitz's presence in rapidly growing industries tied to global electrification, increasing potential revenue and net margins over time.

Want to know what’s powering this ambitious fair value? The key is bold expansion bets and future profit margins typically reserved for industry leaders. Which financial levers are analysts relying on for these growth projections? Unlock the details that set this valuation apart.

Result: Fair Value of ¥4,397 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising costs or a sharp downturn in global commodities could easily slow Sojitz's earnings momentum and challenge current growth assumptions.

Find out about the key risks to this Sojitz narrative.

Another View: DCF Model Challenges the Bullish Narrative

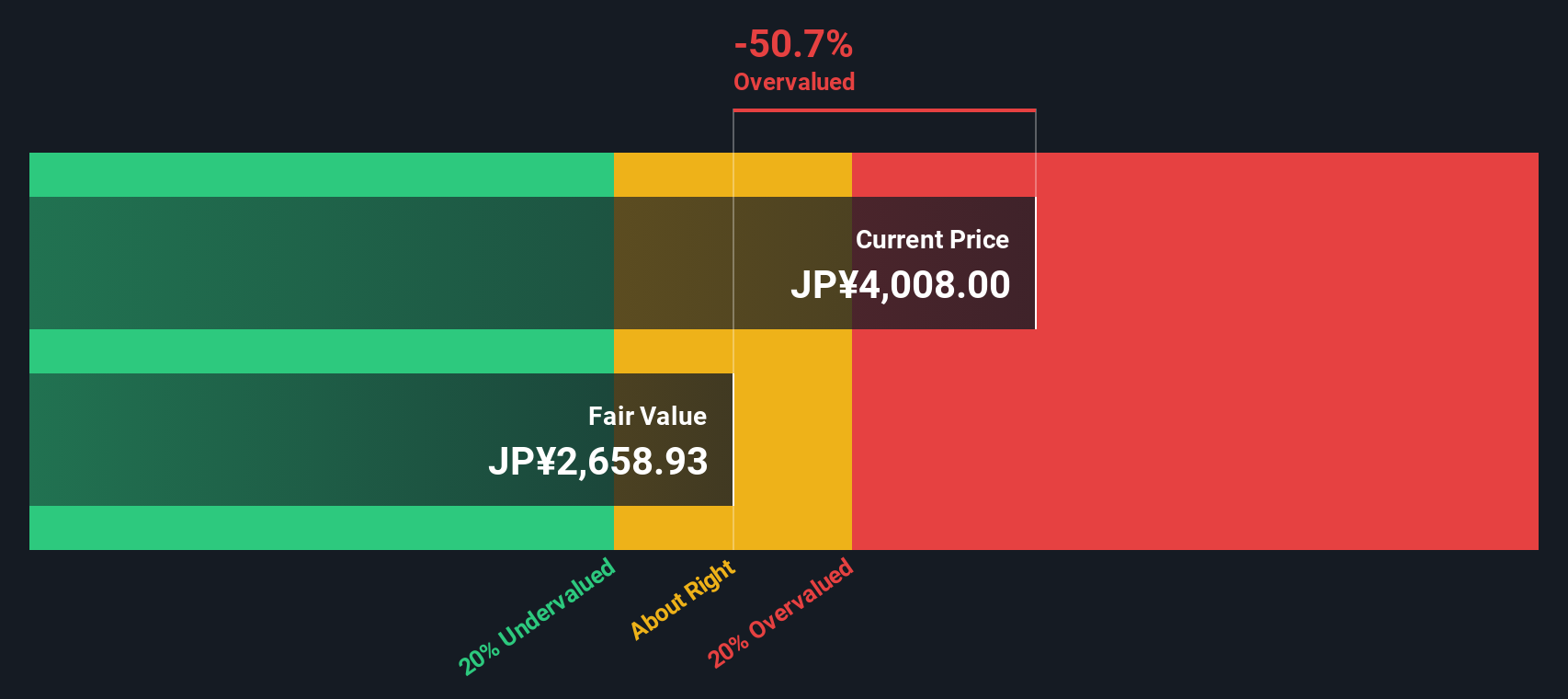

While multiples suggest Sojitz is undervalued compared to peers, our SWS DCF model presents a more cautious perspective. It estimates a fair value of ¥2,653.25 per share, indicating that the current price is well above this level. Does the future warrant paying a premium, or is optimism outpacing fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sojitz for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sojitz Narrative

If you want a fresh perspective or enjoy digging into the numbers yourself, you can create your personal narrative for Sojitz in just a few minutes, guided entirely by your own insights. Do it your way

A great starting point for your Sojitz research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop searching for their next opportunity. Let Simply Wall Street Screener point you toward fresh trends and sectors on the verge of rapid growth.

- Kickstart your strategy with these 25 AI penny stocks as you explore growth in artificial intelligence breakthroughs and real-world tech solutions.

- Secure income and stability by checking out these 19 dividend stocks with yields > 3% featuring companies that offer yields above 3% and have robust dividend histories.

- Tap into tomorrow’s financial innovations with these 79 cryptocurrency and blockchain stocks which highlights businesses shaping the evolution of blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2768

Sojitz

Operates as a general trading company that engages in various business activities worldwide.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives