In the midst of a bustling week marked by lower stock performances across major indices, small-cap stocks have demonstrated resilience, holding up better than their larger counterparts despite economic uncertainties and mixed earnings reports. As investors navigate these complex market dynamics, identifying stocks with solid foundations becomes crucial for uncovering potential opportunities. In this context, a good stock is often characterized by strong fundamentals and the ability to withstand broader economic pressures—qualities that are particularly valuable in today's unpredictable environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mandiri Herindo Adiperkasa | NA | 20.72% | 11.08% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.26% | -0.74% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Changshu Fengfan Power Equipment | 91.61% | 6.89% | 31.92% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Sun Tekstil Sanayi ve Ticaret (IBSE:SUNTK)

Simply Wall St Value Rating: ★★★★★☆

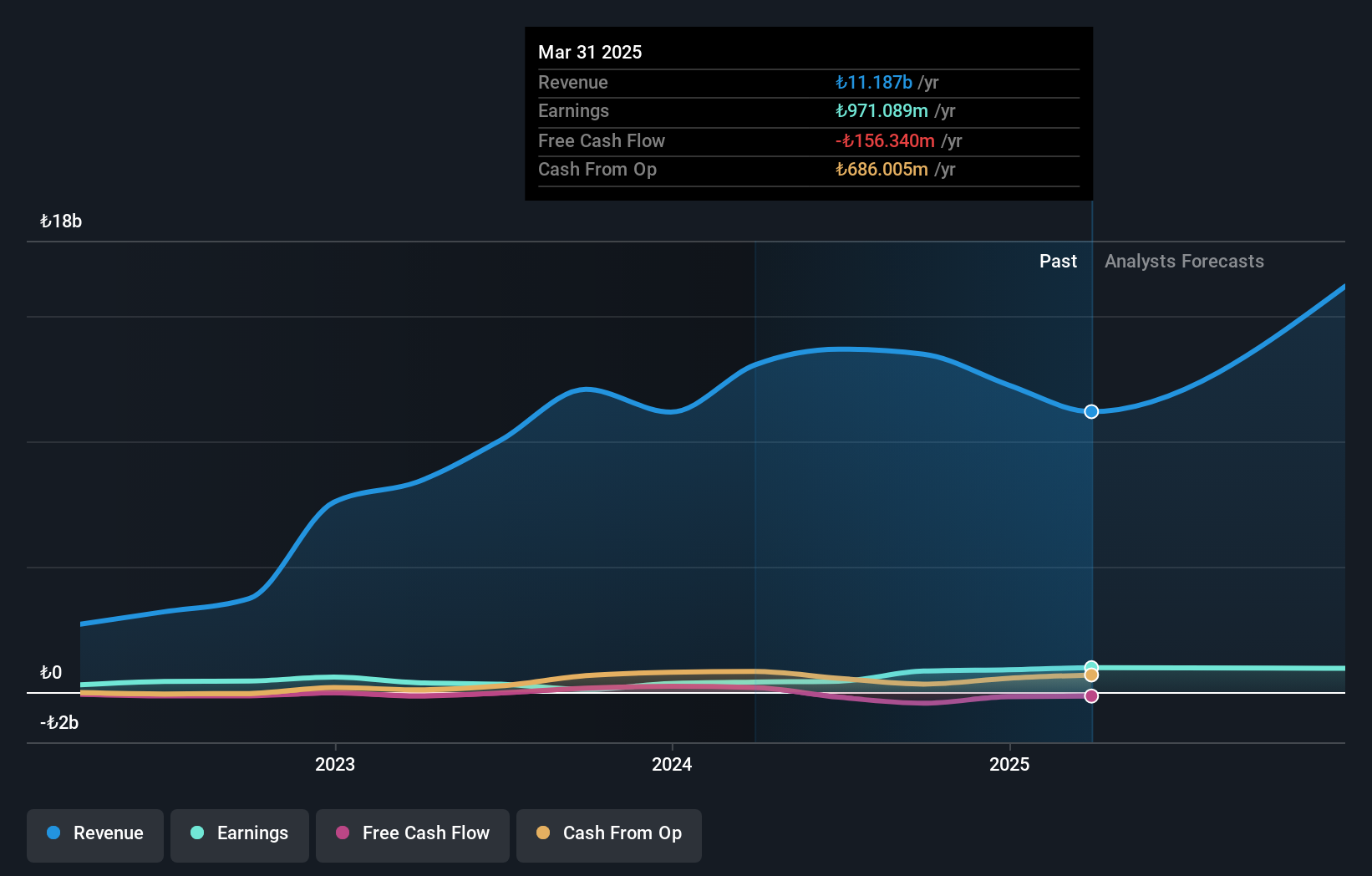

Overview: Sun Tekstil Sanayi ve Ticaret A.S. is engaged in the design, production, and sale of knit fabrics and ready-made womenswear garments both domestically in Turkey and internationally, with a market capitalization of TRY10.59 billion.

Operations: Sun Tekstil generates revenue primarily from ready-made womenswear garments, contributing TRY7.22 billion, and fabric production, adding TRY2.31 billion. The company has a market capitalization of TRY10.59 billion.

Sun Tekstil, a notable player in the textile industry, has shown robust growth with earnings expanding at 19.5% annually over the past five years. Despite not surpassing the luxury industry's 12.3% growth last year, it maintains high-quality earnings and a satisfactory net debt to equity ratio of 9.3%. Recent results highlight strong sales performance, reaching TRY 2.76 billion in Q2 2024 from TRY 2.27 billion a year earlier, with net income rising to TRY 150.57 million from TRY 124.68 million previously. The company seems positioned for continued stability given its financial health and operational achievements.

Shin Nippon Air Technologies (TSE:1952)

Simply Wall St Value Rating: ★★★★★☆

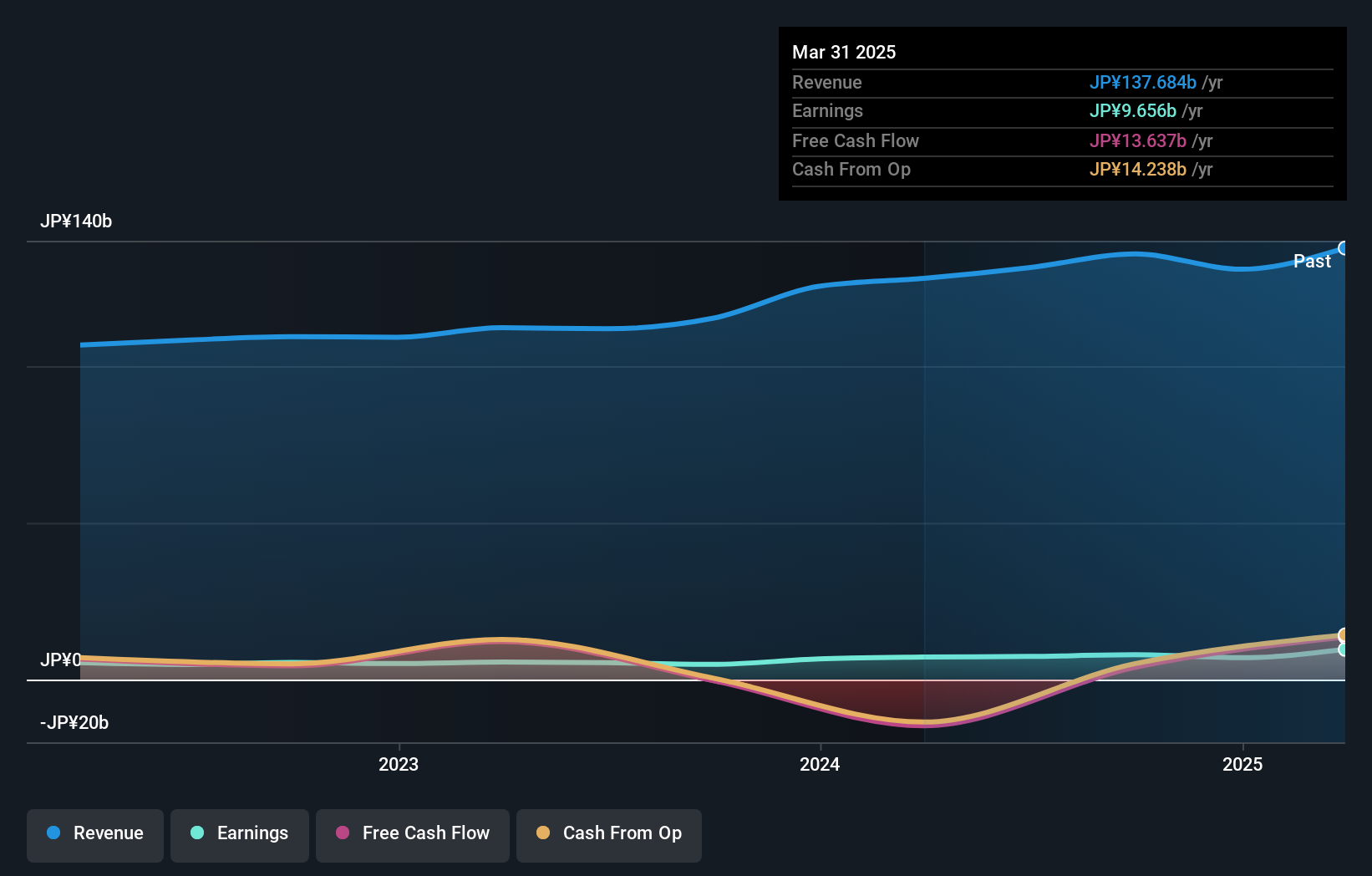

Overview: Shin Nippon Air Technologies Co., Ltd. specializes in engineering systems for air conditioning, electrical, and sanitary facilities both in Japan and internationally, with a market cap of ¥84.41 billion.

Operations: Shin Nippon Air Technologies generates revenue primarily from engineering systems related to air conditioning, electrical, and sanitary facilities. The company operates both domestically in Japan and internationally. Its financial performance is reflected in its market capitalization of ¥84.41 billion.

Shin Nippon Air Technologies, a promising player in its sector, has seen earnings grow by 36.5% over the past year, outpacing the industry average of 16%. The company boasts high-quality earnings and maintains a favorable debt position with more cash than total debt. Its price-to-earnings ratio stands at 11.4x, below the JP market's 13.3x, suggesting good value. Recently, it forecasted net sales of ¥133 billion and an operating profit of ¥9.3 billion for FY2025. The company also announced a second-quarter dividend increase to ¥60 per share from last year's ¥30 per share.

Bank of Nagoya (TSE:8522)

Simply Wall St Value Rating: ★★★★☆☆

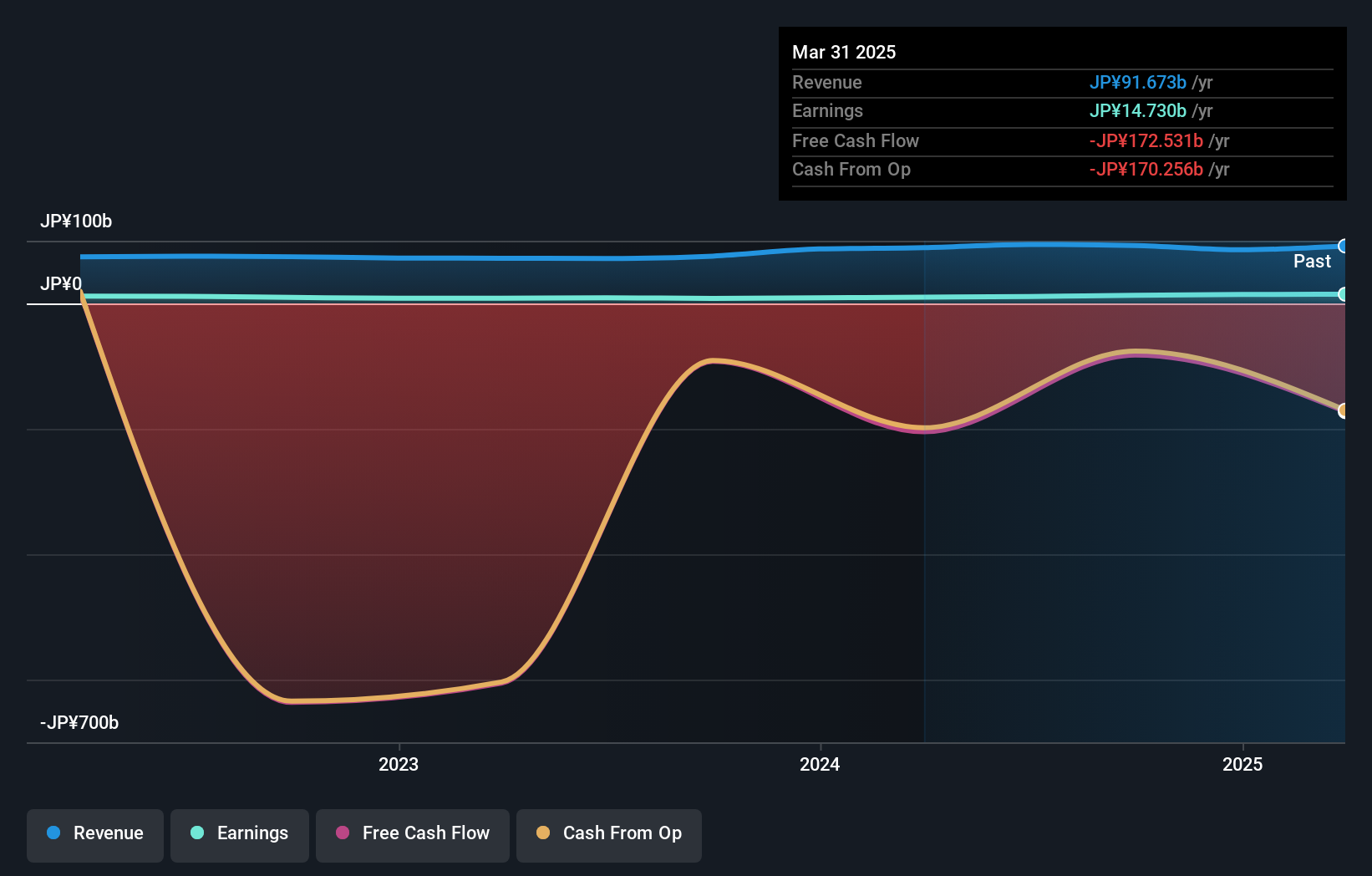

Overview: The Bank of Nagoya, Ltd. offers a range of banking and financial services in Japan with a market capitalization of ¥104.93 billion.

Operations: The primary revenue stream for Bank of Nagoya is its Banking Business, generating ¥78.29 billion, followed by its Leasing Business at ¥21.50 billion and Card Business at ¥2.46 billion. The net profit margin reflects the company's profitability after accounting for all expenses, taxes, and costs associated with its operations.

Nagoya Bank, a smaller player in the financial sector, showcases robust growth with earnings surging by 24.9% over the past year, outpacing the industry average of 19.1%. Despite trading at a 32.8% discount to its estimated fair value, it faces challenges with a high level of bad loans at 2.6% of total loans and an insufficient allowance for these non-performing assets. With total assets amounting to ¥5,558.9 billion and deposits reaching ¥4,779.5 billion, its funding is primarily low risk due to customer deposits making up most liabilities (91%).

- Click here to discover the nuances of Bank of Nagoya with our detailed analytical health report.

Review our historical performance report to gain insights into Bank of Nagoya's's past performance.

Next Steps

- Dive into all 4703 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1952

Shin Nippon Air Technologies

Provides engineering systems to control air, water, heat, and other areas of air conditioning, electrical, and sanitary facilities in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives