As global markets react to China's robust stimulus measures, Japan's stock markets have seen significant gains, with the Nikkei 225 Index rising by 5.6% and the broader TOPIX Index up by 3.7%. This positive sentiment is partly driven by optimism surrounding potential economic benefits from China's actions, making it an opportune moment to explore some of Japan's lesser-known yet promising stocks. In light of these favorable market conditions, identifying a good stock often involves looking for companies that can capitalize on increased economic activity and exhibit strong fundamentals such as solid earnings growth and competitive positioning.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Toho | 69.52% | 2.84% | 55.65% | ★★★★★★ |

| Tokyo Tekko | 10.81% | 7.30% | 7.30% | ★★★★★★ |

| Nihon Parkerizing | 0.31% | 0.86% | 4.40% | ★★★★★★ |

| KurimotoLtd | 20.73% | 3.34% | 18.64% | ★★★★★★ |

| Techno Quartz | 18.64% | 16.15% | 22.17% | ★★★★★★ |

| Otec | 9.81% | 2.32% | -1.39% | ★★★★★★ |

| Maezawa Kasei Industries | 0.81% | 2.01% | 18.42% | ★★★★★★ |

| Icom | NA | 4.68% | 14.92% | ★★★★★★ |

| Imuraya Group | 26.21% | 2.37% | 32.09% | ★★★★★☆ |

| Ogaki Kyoritsu Bank | 139.93% | 2.20% | -0.27% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Sumitomo DensetsuLtd (TSE:1949)

Simply Wall St Value Rating: ★★★★★★

Overview: Sumitomo Densetsu Co., Ltd. operates as a construction company with a presence in Japan and several Southeast Asian countries, including Indonesia, Thailand, Cambodia, Myanmar, the Philippines, China, and Malaysia; it has a market cap of ¥163.40 billion.

Operations: Sumitomo Densetsu Co., Ltd. generates revenue primarily from its Utilities Engineering Service segment, which accounted for ¥182.44 billion. The company has a market cap of ¥163.40 billion and operates across Japan and several Southeast Asian countries.

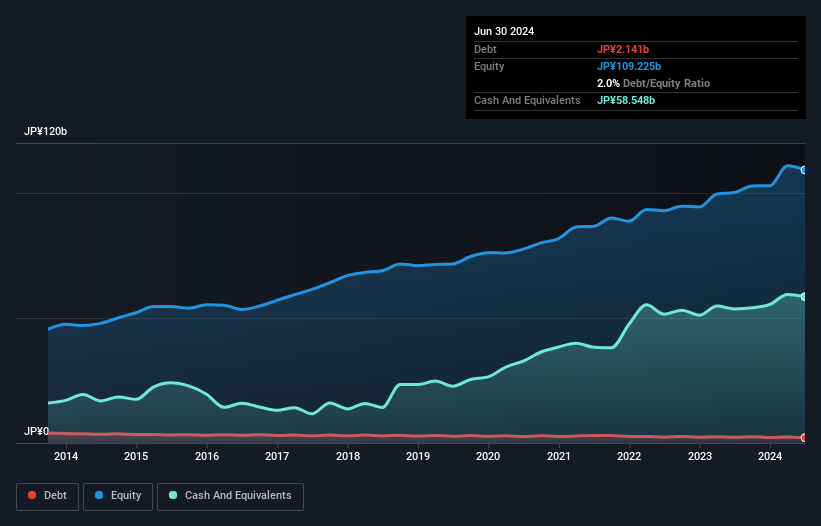

Sumitomo Densetsu Ltd. has demonstrated strong financial health, with earnings growth of 33.5% over the past year, outpacing the construction industry’s 26.6%. The company’s debt-to-equity ratio has improved from 3.8 to 2 over five years, and it holds more cash than its total debt. Despite a highly volatile share price in recent months, Sumitomo Densetsu remains profitable with high-quality earnings and positive free cash flow.

- Unlock comprehensive insights into our analysis of Sumitomo DensetsuLtd stock in this health report.

Explore historical data to track Sumitomo DensetsuLtd's performance over time in our Past section.

KH Neochem (TSE:4189)

Simply Wall St Value Rating: ★★★★★★

Overview: KH Neochem Co., Ltd. researches, manufactures, and sells petrochemical products in Japan and internationally with a market cap of ¥78.32 billion.

Operations: KH Neochem Co., Ltd. generates revenue primarily from its Chemical Business segment, which reported ¥113.32 billion. The company's net profit margin is a key financial metric to monitor for evaluating profitability trends over time.

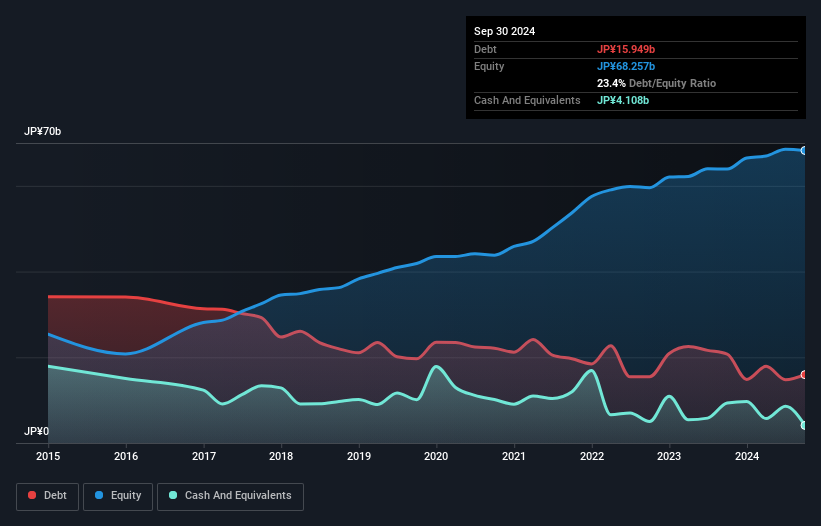

KH Neochem, a small cap player in Japan's chemical sector, has demonstrated consistent earnings growth of 3.9% annually over the past five years. Despite not outpacing the industry’s 13% growth last year, its net debt to equity ratio has impressively decreased from 49.1% to 21.5%. The company forecasts net sales of ¥121 billion and operating income of ¥11.8 billion for FY2024, with dividends remaining steady at ¥45 per share.

- Click to explore a detailed breakdown of our findings in KH Neochem's health report.

Gain insights into KH Neochem's historical performance by reviewing our past performance report.

Micronics Japan (TSE:6871)

Simply Wall St Value Rating: ★★★★★★

Overview: Micronics Japan Co., Ltd. develops, manufactures, and sells testing and measurement equipment for semiconductors and LCD testing systems worldwide, with a market cap of ¥158.41 billion.

Operations: Micronics Japan generates revenue primarily from its Probe Card Business (¥45.29 billion) and TE Business (¥2.19 billion). The company focuses on these segments to drive its financial performance.

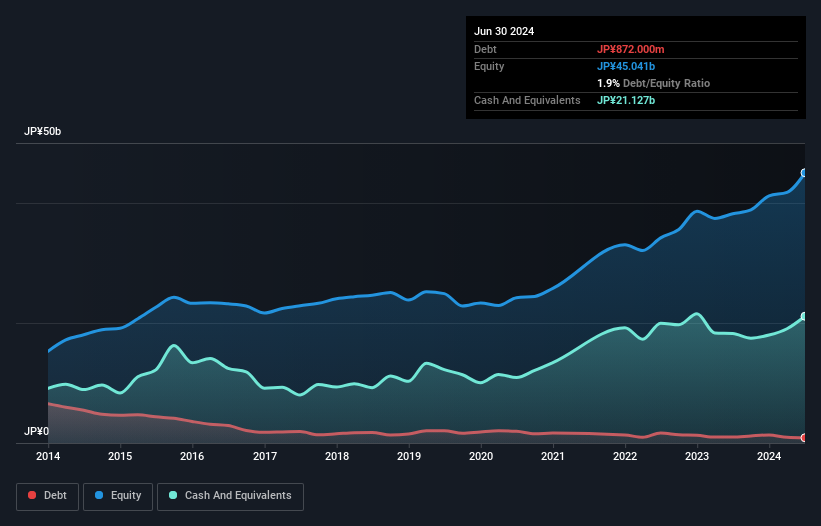

Micronics Japan, a small-cap player in the semiconductor industry, has shown impressive financial health. Its debt-to-equity ratio improved significantly from 8.3 to 1.9 over five years, and it trades at 58% below its estimated fair value. The company’s earnings growth of 15% last year outpaced the industry’s -3.8%, and it's forecasted to grow by 31% annually. Despite recent volatility in share price, Micronics remains profitable with high-quality earnings and positive free cash flow.

- Dive into the specifics of Micronics Japan here with our thorough health report.

Review our historical performance report to gain insights into Micronics Japan's's past performance.

Next Steps

- Reveal the 749 hidden gems among our Japanese Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KH Neochem might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4189

KH Neochem

Researches, manufactures, and sells of petrochemical products in Japan and internationally.

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives