The board of Sumitomo Densetsu Co.,Ltd. (TSE:1949) has announced that it will pay a dividend of ¥60.00 per share on the 26th of June. This makes the dividend yield about the same as the industry average at 2.5%.

Check out our latest analysis for Sumitomo DensetsuLtd

Sumitomo DensetsuLtd's Future Dividend Projections Appear Well Covered By Earnings

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. However, prior to this announcement, Sumitomo DensetsuLtd's dividend was comfortably covered by both cash flow and earnings. As a result, a large proportion of what it earned was being reinvested back into the business.

Looking forward, earnings per share is forecast to fall by 2.4% over the next year. Assuming the dividend continues along recent trends, we believe the payout ratio could be 41%, which we are pretty comfortable with and we think is feasible on an earnings basis.

Sumitomo DensetsuLtd Has A Solid Track Record

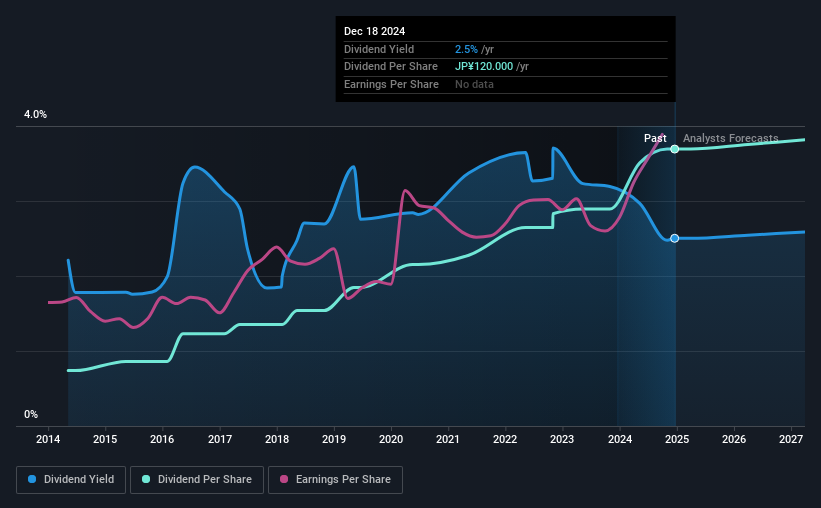

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The annual payment during the last 10 years was ¥24.00 in 2014, and the most recent fiscal year payment was ¥120.00. This implies that the company grew its distributions at a yearly rate of about 17% over that duration. Rapidly growing dividends for a long time is a very valuable feature for an income stock.

The Dividend Looks Likely To Grow

Investors could be attracted to the stock based on the quality of its payment history. Sumitomo DensetsuLtd has seen EPS rising for the last five years, at 15% per annum. With a decent amount of growth and a low payout ratio, we think this bodes well for Sumitomo DensetsuLtd's prospects of growing its dividend payments in the future.

We Really Like Sumitomo DensetsuLtd's Dividend

Overall, a dividend increase is always good, and we think that Sumitomo DensetsuLtd is a strong income stock thanks to its track record and growing earnings. The distributions are easily covered by earnings, and there is plenty of cash being generated as well. However, it is worth noting that the earnings are expected to fall over the next year, which may not change the long term outlook, but could affect the dividend payment in the next 12 months. All in all, this checks a lot of the boxes we look for when choosing an income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 1 warning sign for Sumitomo DensetsuLtd that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:1949

Sumitomo DensetsuLtd

Operates as a construction company in Japan, Indonesia, Thailand, Cambodia, Myanmar, the Philippines, China, and Malaysia.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives