- Japan

- /

- Construction

- /

- TSE:1885

TOA Corporation (TSE:1885) Shares Fly 25% But Investors Aren't Buying For Growth

Despite an already strong run, TOA Corporation (TSE:1885) shares have been powering on, with a gain of 25% in the last thirty days. The last 30 days bring the annual gain to a very sharp 36%.

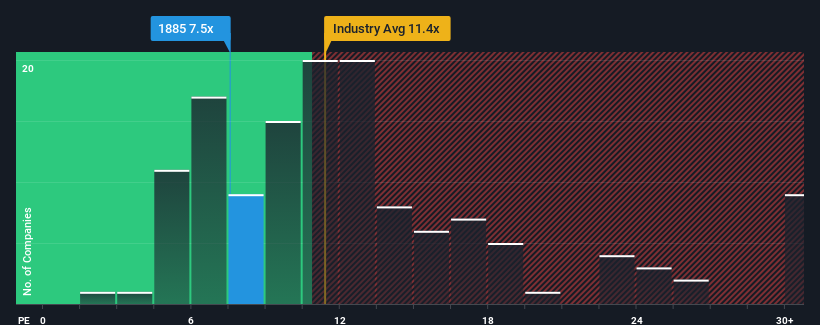

Although its price has surged higher, TOA may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 7.5x, since almost half of all companies in Japan have P/E ratios greater than 14x and even P/E's higher than 22x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

TOA certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for TOA

How Is TOA's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like TOA's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 55% gain to the company's bottom line. Pleasingly, EPS has also lifted 54% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to slump, contracting by 1.7% per annum during the coming three years according to the one analyst following the company. Meanwhile, the broader market is forecast to expand by 10% each year, which paints a poor picture.

In light of this, it's understandable that TOA's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On TOA's P/E

Despite TOA's shares building up a head of steam, its P/E still lags most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that TOA maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for TOA that you need to be mindful of.

You might be able to find a better investment than TOA. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if TOA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:1885

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives