- Japan

- /

- Gas Utilities

- /

- TSE:9543

Top Global Dividend Stocks For February 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of geopolitical tensions, fluctuating consumer spending, and evolving trade policies, investors are increasingly seeking stability through dividend stocks. In such a volatile environment, stocks that offer reliable dividends can provide a steady income stream and potentially mitigate some market risks.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.44% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.23% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.19% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.86% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.85% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.83% | ★★★★★★ |

| Chudenko (TSE:1941) | 3.83% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.57% | ★★★★★★ |

Click here to see the full list of 1443 stocks from our Top Global Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

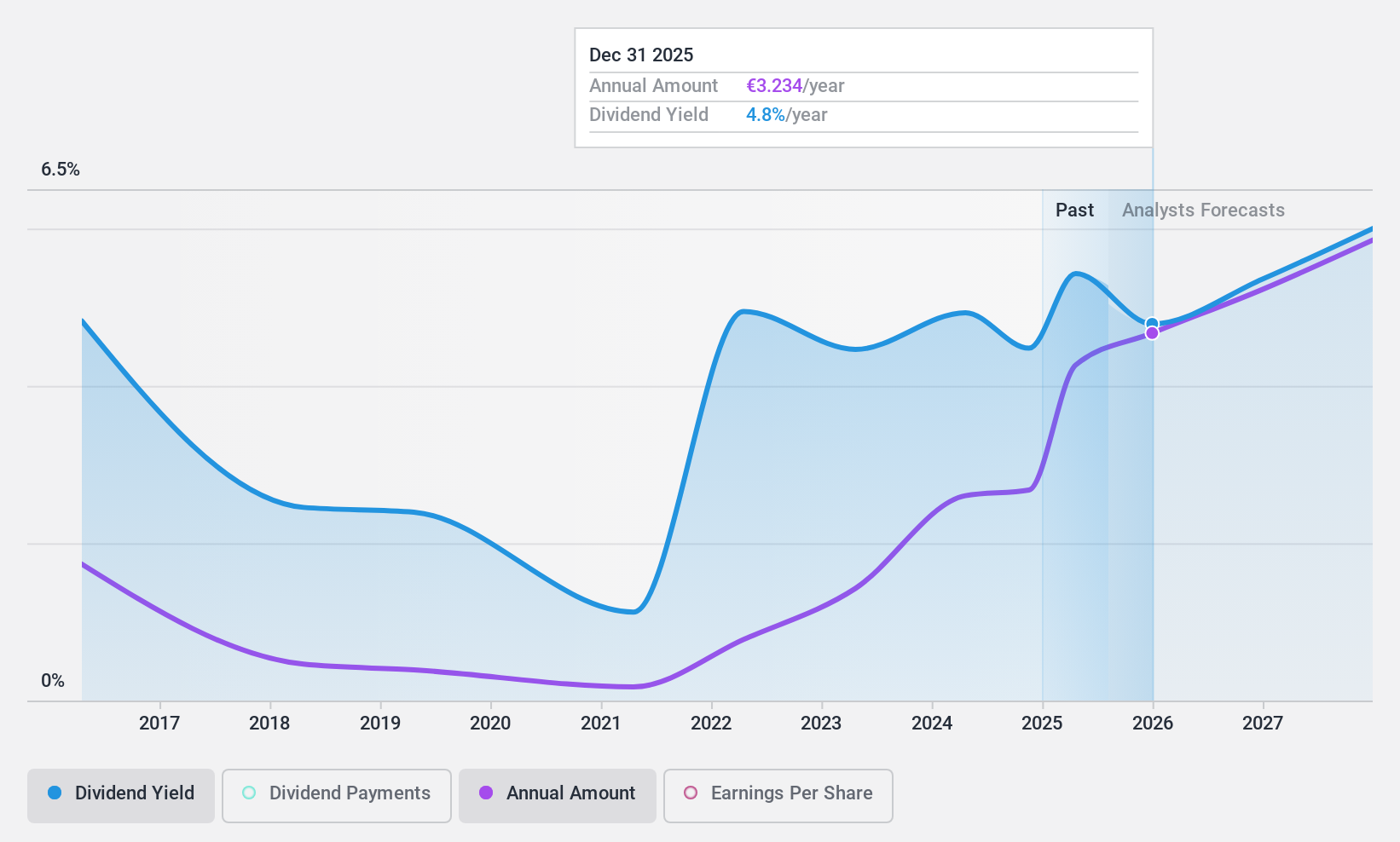

UniCredit (BIT:UCG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: UniCredit S.p.A. is a commercial banking institution operating in Italy, Germany, Central Europe, and Eastern Europe with a market capitalization of approximately €79.22 billion.

Operations: UniCredit S.p.A.'s revenue is primarily derived from its operations in Italy (€10.85 billion), Germany (€5.19 billion), Central and Eastern Europe excluding Austria (€4.50 billion), Austria (€2.68 billion), and Russia (€1.44 billion).

Dividend Yield: 5.8%

UniCredit's dividend is well covered by earnings with a payout ratio of 41.9%, and its yield ranks in the top 25% of Italian dividend payers. However, the dividend history has been volatile, showing unreliability over the past decade. Despite recent earnings growth, future projections indicate a decline in earnings. The bank's strategic moves include acquiring a significant stake in Commerzbank, which could impact financial stability and future dividends amidst regulatory scrutiny and market reactions.

- Take a closer look at UniCredit's potential here in our dividend report.

- The analysis detailed in our UniCredit valuation report hints at an deflated share price compared to its estimated value.

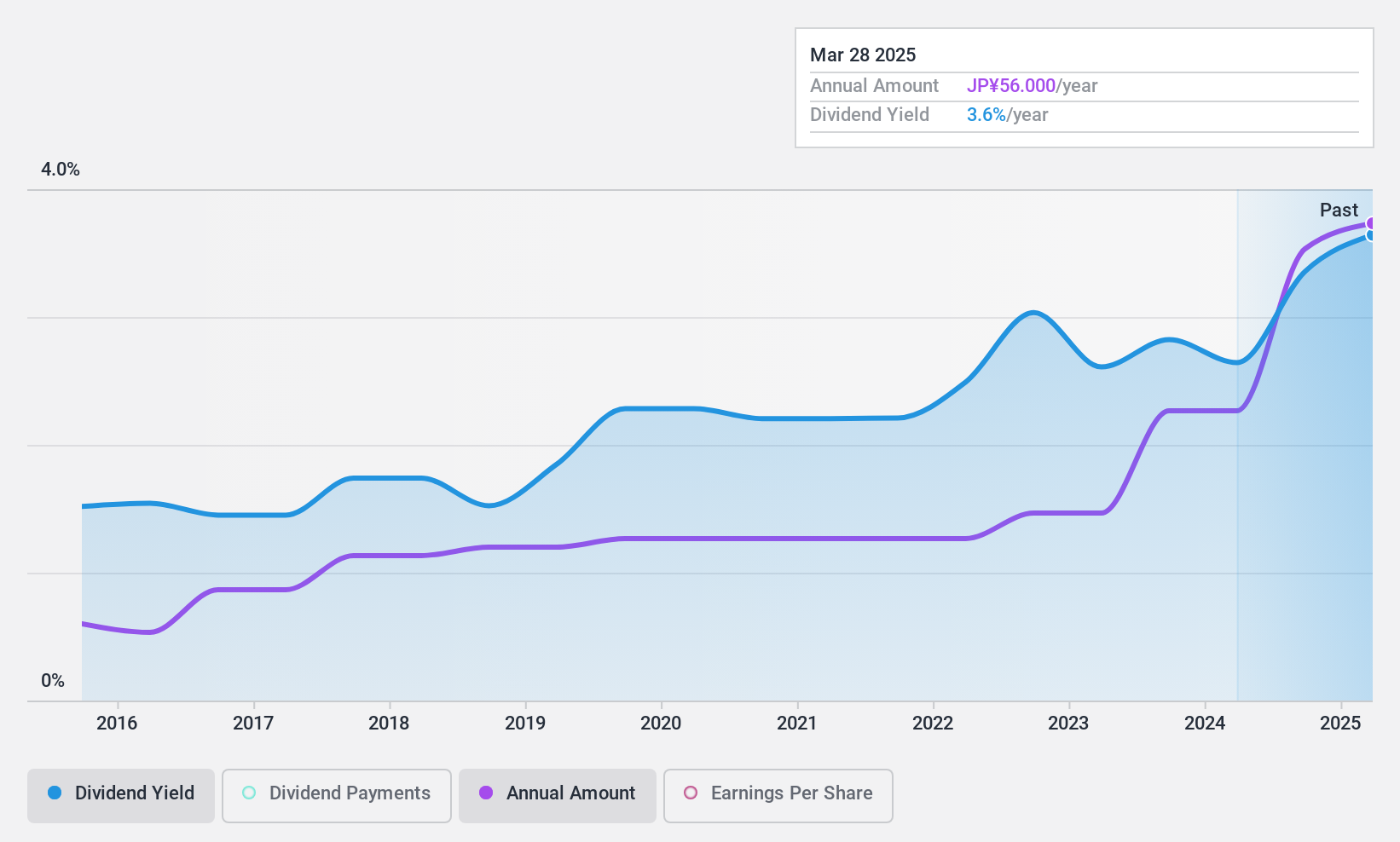

Shinnihon (TSE:1879)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shinnihon Corporation operates as a construction company in Japan with a market cap of ¥85.51 billion.

Operations: Shinnihon Corporation generates revenue primarily through its Construction Business, which accounts for ¥68.67 billion, and Development segment, contributing ¥68.38 billion.

Dividend Yield: 3.7%

Shinnihon's dividend payments have been volatile over the past decade, though they are well covered by earnings and cash flows with payout ratios of 30.9% and 17%, respectively. Currently trading at a significant discount to estimated fair value, its dividend yield is slightly below the top tier in Japan. Recent announcements include a commemorative JPY 3 per share dividend for its 60th anniversary, bringing the total year-end dividend to JPY 30 per share for fiscal year ending March 2025.

- Navigate through the intricacies of Shinnihon with our comprehensive dividend report here.

- According our valuation report, there's an indication that Shinnihon's share price might be on the cheaper side.

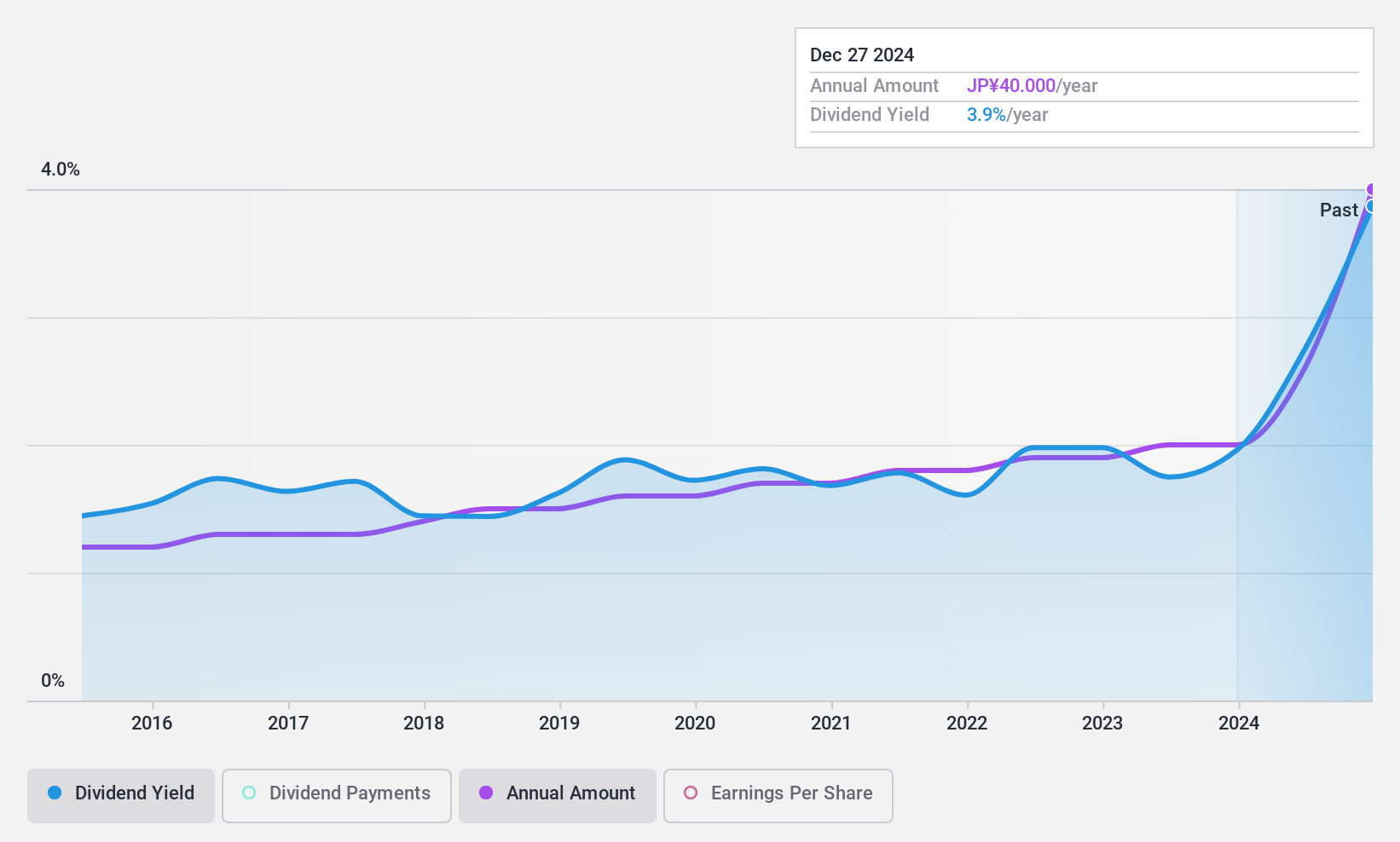

Shizuoka Gas (TSE:9543)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Shizuoka Gas Co., Ltd. produces, supplies, and sells city gas in Japan with a market cap of ¥78.87 billion.

Operations: Shizuoka Gas Co., Ltd. generates revenue from three main segments: Gas at ¥160.89 billion, LPG/Other Energy at ¥31.87 billion, and Other Businesses at ¥18.49 billion.

Dividend Yield: 3.8%

Shizuoka Gas offers a compelling dividend profile with a stable and growing dividend history over the past decade. The company recently announced an increase in dividends to JPY 27 per share for fiscal year 2024, up from JPY 15, and expects JPY 20.50 for the next quarter. With a payout ratio of 34.2% and cash coverage at 85.4%, dividends are well-supported by earnings and cash flows despite slightly reduced profit margins this year.

- Delve into the full analysis dividend report here for a deeper understanding of Shizuoka Gas.

- Our comprehensive valuation report raises the possibility that Shizuoka Gas is priced higher than what may be justified by its financials.

Summing It All Up

- Dive into all 1443 of the Top Global Dividend Stocks we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9543

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives