- Japan

- /

- Construction

- /

- TSE:1870

Undiscovered Gems in Japan for August 2024

Reviewed by Simply Wall St

Japan's stock markets have shown modest gains recently, with the Nikkei 225 Index rising by 0.8% and the broader TOPIX Index up by 0.2%. Amid speculation about interest rate adjustments from the Bank of Japan, economic indicators such as core consumer price inflation have supported a more hawkish monetary policy stance. In this context, identifying promising stocks often involves looking for companies that can thrive despite market volatility and benefit from favorable economic conditions. Here are three lesser-known Japanese stocks that could be considered undiscovered gems for August 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Toukei Computer | NA | 5.46% | 12.14% | ★★★★★★ |

| Kanda HoldingsLtd | 30.47% | 4.35% | 18.02% | ★★★★★★ |

| KurimotoLtd | 20.73% | 3.34% | 18.64% | ★★★★★★ |

| Uoriki | NA | 3.90% | 6.15% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | -0.08% | 12.04% | ★★★★★★ |

| Maezawa Kasei Industries | 0.81% | 2.01% | 18.42% | ★★★★★★ |

| Nikko | 31.99% | 4.24% | -8.75% | ★★★★★☆ |

| Pharma Foods International | 191.14% | 33.83% | 23.46% | ★★★★★☆ |

| YagiLtd | 32.86% | -9.57% | -0.12% | ★★★★☆☆ |

| GENOVA | 0.93% | 33.82% | 30.22% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Yahagi ConstructionLtd (TSE:1870)

Simply Wall St Value Rating: ★★★★★★

Overview: Yahagi Construction Co., Ltd. engages in the construction of buildings in Japan and has a market cap of ¥69.44 billion.

Operations: Yahagi Construction Co., Ltd. generates revenue primarily from building construction projects in Japan. The company reported a market cap of ¥69.44 billion and its financial performance is driven by the volume and scale of its construction contracts.

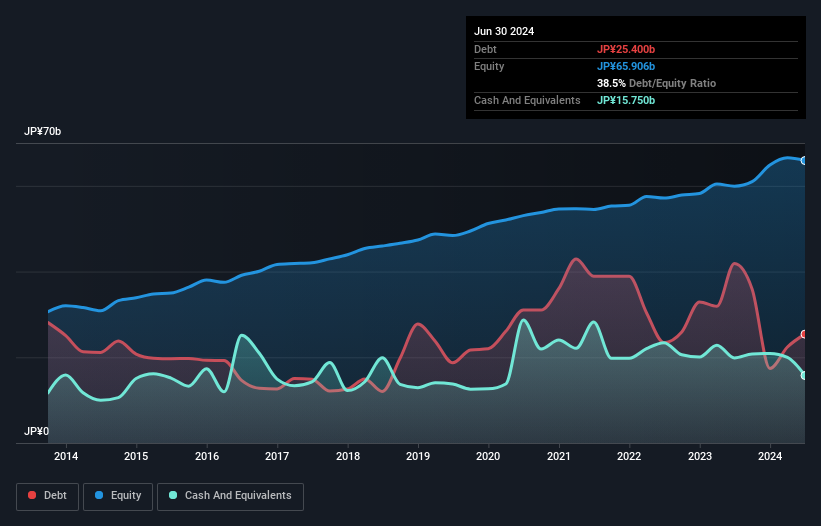

Yahagi Construction Ltd., a small cap player in Japan's construction sector, has shown impressive performance with earnings growing by 63.3% over the past year, outpacing the industry average of 21.2%. The company's net debt to equity ratio stands at a satisfactory 14.6%, and it trades at 47.1% below its estimated fair value, indicating potential undervaluation. Yahagi's high-quality earnings and reduced debt levels from 38.7% to 38.5% over five years further bolster its investment appeal.

- Click here and access our complete health analysis report to understand the dynamics of Yahagi ConstructionLtd.

Gain insights into Yahagi ConstructionLtd's past trends and performance with our Past report.

Tomoe (TSE:1921)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tomoe Corporation engages in general construction, steel structures construction, and real estate businesses in Japan with a market cap of ¥39.46 billion.

Operations: Tomoe Corporation generates revenue from its general construction, steel structures construction, and real estate businesses in Japan. The company has a market cap of ¥39.46 billion.

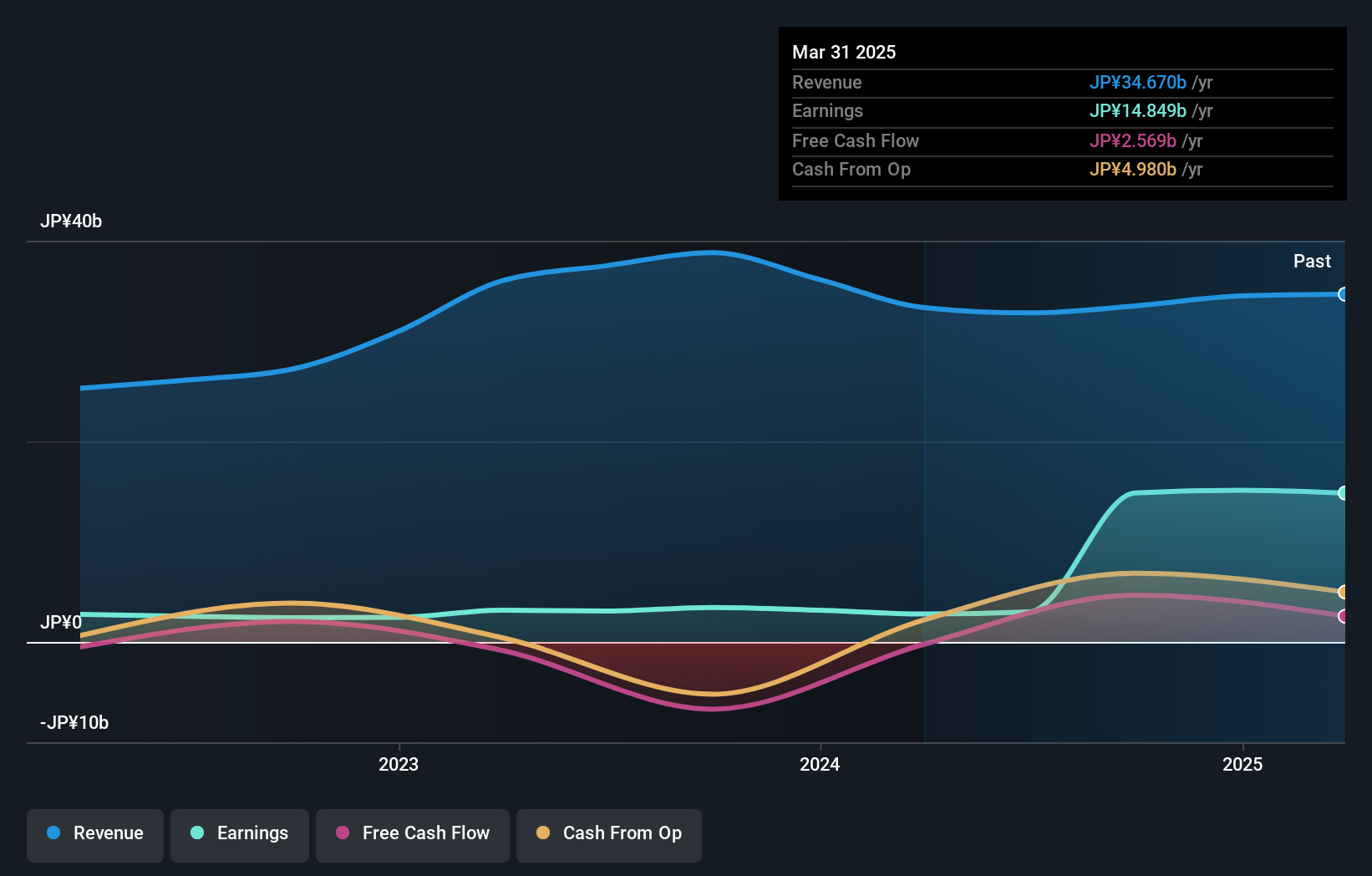

Tomoe, a niche player in the construction industry, has seen its debt to equity ratio rise from 12.4% to 20.4% over the past five years while maintaining high-quality earnings. Despite a price-to-earnings ratio of 13.2x, slightly below the JP market average of 13.4x, Tomoe reported negative earnings growth (-2.8%) last year against an industry average of 21.2%. The company earns more interest than it pays and will release Q1 2025 results on August 9, 2024.

- Delve into the full analysis health report here for a deeper understanding of Tomoe.

Explore historical data to track Tomoe's performance over time in our Past section.

Strike CompanyLimited (TSE:6196)

Simply Wall St Value Rating: ★★★★★★

Overview: Strike Company, Limited offers mergers and acquisitions brokerage services for small and medium-sized companies in Japan with a market cap of ¥75.18 billion.

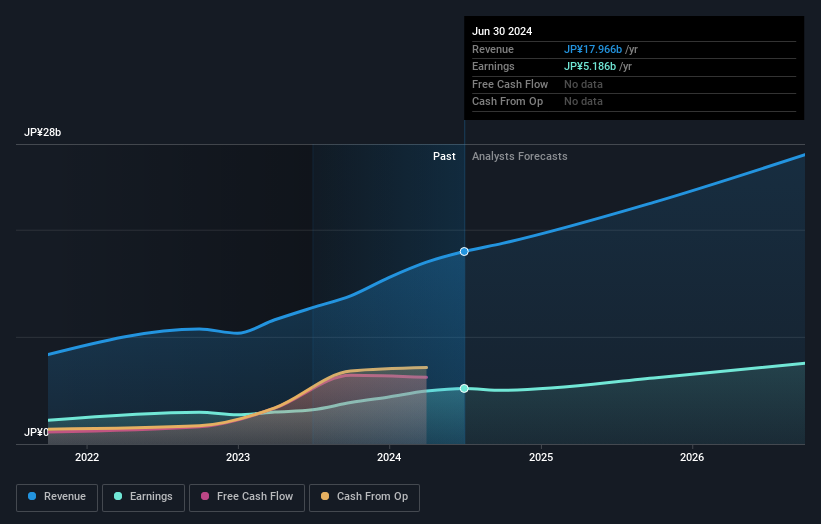

Operations: With a market cap of ¥75.18 billion, Strike Company, Limited generates revenue primarily from its M&A Intermediary Business segment, which brought in ¥17.97 billion.

Strike CompanyLimited, a promising small-cap entity, has shown impressive earnings growth of 62.3% over the past year, outpacing the Capital Markets industry average of 36.1%. The firm is debt-free and trades at 41.3% below its estimated fair value, signaling potential for investors seeking undervalued stocks. Recent board decisions include revising the payout ratio and increasing the year-end dividend to ¥85 per share from ¥22 previously forecasted, reflecting strong financial health and commitment to shareholder returns.

- Navigate through the intricacies of Strike CompanyLimited with our comprehensive health report here.

Assess Strike CompanyLimited's past performance with our detailed historical performance reports.

Key Takeaways

- Reveal the 757 hidden gems among our Japanese Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1870

Yahagi ConstructionLtd

Engages in the construction of buildings in Japan.

Established dividend payer with adequate balance sheet.

Market Insights

Community Narratives