- China

- /

- Electrical

- /

- SZSE:002533

Top Three Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As global markets experience a mixed bag of economic indicators, with U.S. consumer confidence declining and major stock indexes showing moderate gains, investors are navigating through a landscape marked by cautious optimism. In such an environment, dividend stocks can offer stability and potential income, making them an attractive option for those looking to bolster their portfolios amidst fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| CAC Holdings (TSE:4725) | 4.85% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.59% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.03% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.35% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.84% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.80% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.04% | ★★★★★★ |

Click here to see the full list of 1938 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

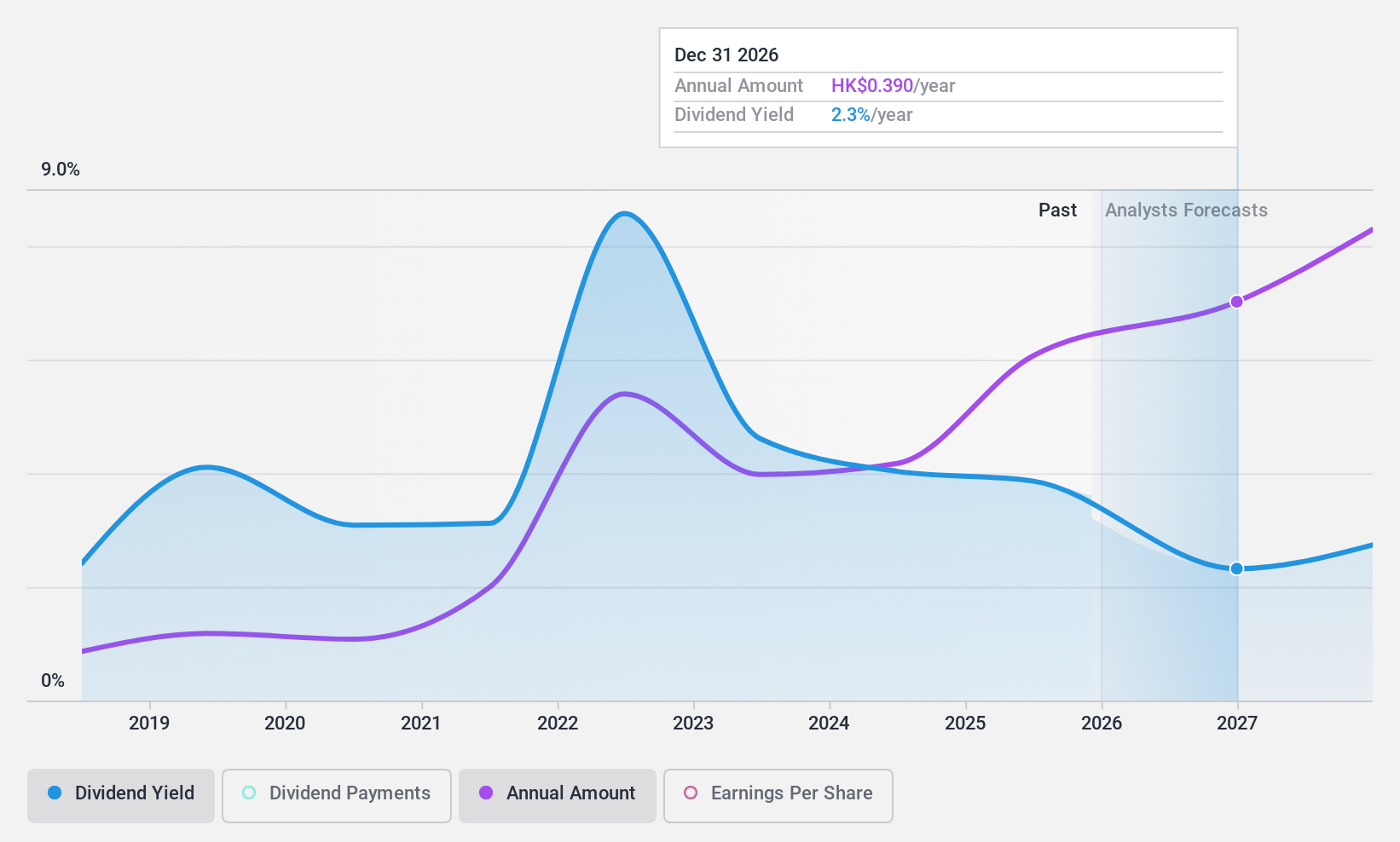

China Nonferrous Mining (SEHK:1258)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Nonferrous Mining Corporation Limited is an investment holding company involved in the exploration, mining, ore processing, leaching, smelting, and sale of copper products such as cathodes and anodes with a market cap of HK$20.10 billion.

Operations: China Nonferrous Mining Corporation Limited generates revenue through its leaching operations, which contribute $1.04 billion, and smelting activities, accounting for $2.77 billion.

Dividend Yield: 4.5%

China Nonferrous Mining's dividend is well-covered by earnings and cash flows, with a payout ratio of 36% and a cash payout ratio of 30.3%. Despite this coverage, dividends have been volatile over the past decade. The stock trades at a significant discount to its estimated fair value and offers good relative value compared to peers. Recent guidance indicates a profit increase of approximately US$314 million, up 23% year-on-year, despite some production challenges.

- Unlock comprehensive insights into our analysis of China Nonferrous Mining stock in this dividend report.

- The valuation report we've compiled suggests that China Nonferrous Mining's current price could be quite moderate.

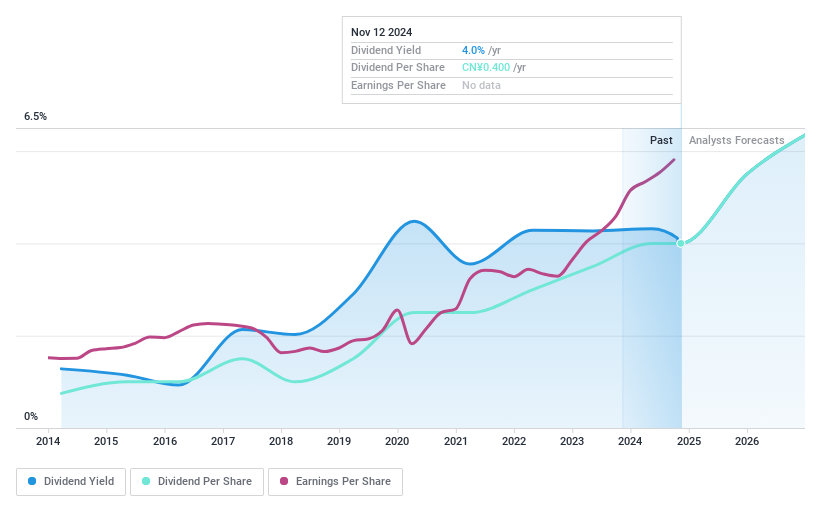

Gold cup Electric ApparatusLtd (SZSE:002533)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Gold cup Electric Apparatus Co., Ltd. is engaged in the research, development, manufacturing, and sale of wires and cables both in China and internationally, with a market capitalization of CN¥7.37 billion.

Operations: Unfortunately, the provided text does not contain specific revenue segment information for Gold cup Electric Apparatus Co., Ltd. If you have additional data on their revenue segments, I can help summarize it for you.

Dividend Yield: 3.9%

Gold cup Electric Apparatus Ltd.'s dividends are covered by earnings (74.6% payout ratio) and cash flows (65.8% cash payout ratio), though they have been volatile over the past decade. The company trades significantly below fair value, offering good relative value compared to peers. Recent earnings show growth, with net income rising to CNY 426.76 million for the first nine months of 2024 from CNY 358.94 million a year ago, supporting dividend sustainability despite past instability.

- Get an in-depth perspective on Gold cup Electric ApparatusLtd's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Gold cup Electric ApparatusLtd shares in the market.

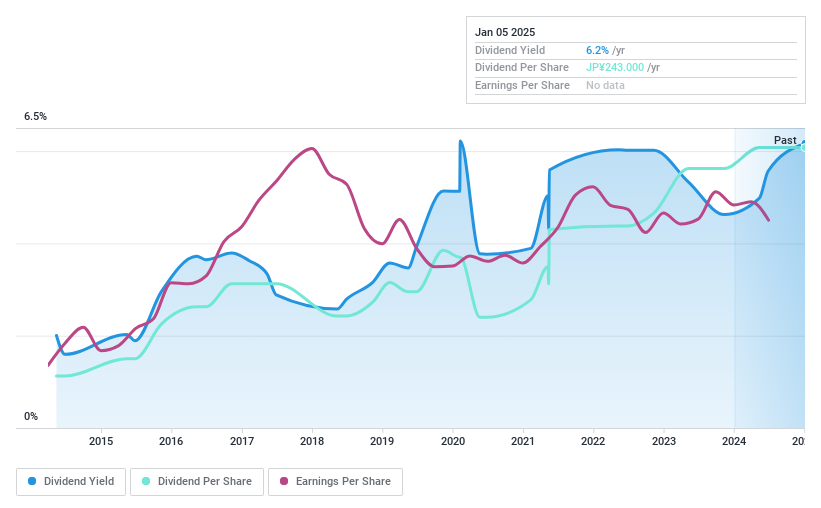

Okumura (TSE:1833)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Okumura Corporation operates in the construction and related sectors within Japan, with a market capitalization of ¥145.47 billion.

Operations: Okumura Corporation's revenue is derived from its Construction Business, generating ¥167.32 billion, and its Civil Engineering Business, contributing ¥103.54 billion.

Dividend Yield: 6.2%

Okumura's dividend yield of 6.15% ranks within the top 25% of JP market payers, yet its sustainability is questionable as dividends are not covered by free cash flows and have been volatile over the past decade. The current payout ratio of 76% indicates coverage by earnings, but historical instability and lack of free cash flow support present concerns. Trading at a slight discount to fair value, it offers some valuation appeal despite these issues.

- Click to explore a detailed breakdown of our findings in Okumura's dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Okumura shares in the market.

Turning Ideas Into Actions

- Click here to access our complete index of 1938 Top Dividend Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002533

Gold cup Electric ApparatusLtd

Researches, develops, manufactures, and sells wires and cables in China and internationally.

Very undervalued with solid track record and pays a dividend.