- China

- /

- Electronic Equipment and Components

- /

- SZSE:301266

Exploring High Growth Tech Stocks Including EmbedWay Technologies Shanghai

Reviewed by Simply Wall St

As global markets experience mixed signals with moderate gains in major stock indexes and a decline in U.S. consumer confidence, investors are closely watching the technology sector, which continues to play a pivotal role in driving market movements. In this environment, identifying high-growth tech stocks like EmbedWay Technologies Shanghai can offer potential opportunities for investors seeking exposure to innovation-driven sectors amid fluctuating economic indicators.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1270 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

EmbedWay Technologies (Shanghai) (SHSE:603496)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: EmbedWay Technologies (Shanghai) Corporation operates as a network visibility infrastructure and intelligent system platform vendor in China with a market cap of CN¥8.16 billion.

Operations: The company generates revenue primarily from its Computer, Communication, and Other Electronic Equipment Manufacturing segment, amounting to approximately CN¥1.15 billion.

EmbedWay Technologies, with its substantial revenue surge to CNY 880.94 million from CNY 498.37 million last year, underscores a robust growth trajectory, outpacing many in the communications sector where average industry growth has declined by 3%. This performance is bolstered by an impressive earnings increase of 96.7% over the past year and projections suggest a continued annual earnings growth rate of 33.9%. The firm's commitment to innovation is evident from its R&D investments, crucial for maintaining technological leadership and driving future revenue streams in a highly competitive market.

Yangtze Optical Electronic (SHSE:688143)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Yangtze Optical Electronic Co., Ltd. specializes in the R&D, production, and sale of special optical fiber and cable, optical devices, new materials, high-end equipment, and photoelectric systems in China with a market cap of CN¥2.84 billion.

Operations: Yangtze Optical Electronic Co., Ltd. generates revenue primarily from its electronic components and parts segment, with reported revenues of CN¥269.51 million. The company's focus on specialized optical products positions it within the niche market of optical technology in China.

Yangtze Optical Electronic has demonstrated a remarkable revenue growth of 47% annually, significantly outpacing the industry average. Despite a recent net loss of CNY 3.69 million, the company's aggressive R&D spending—evident from its latest figures—underscores its commitment to reclaiming profitability and technological advancement. Recent strategic moves include a private placement and share repurchase totaling CNY 11.21 million, reflecting confidence in future prospects and an ongoing effort to enhance shareholder value amidst challenging market conditions.

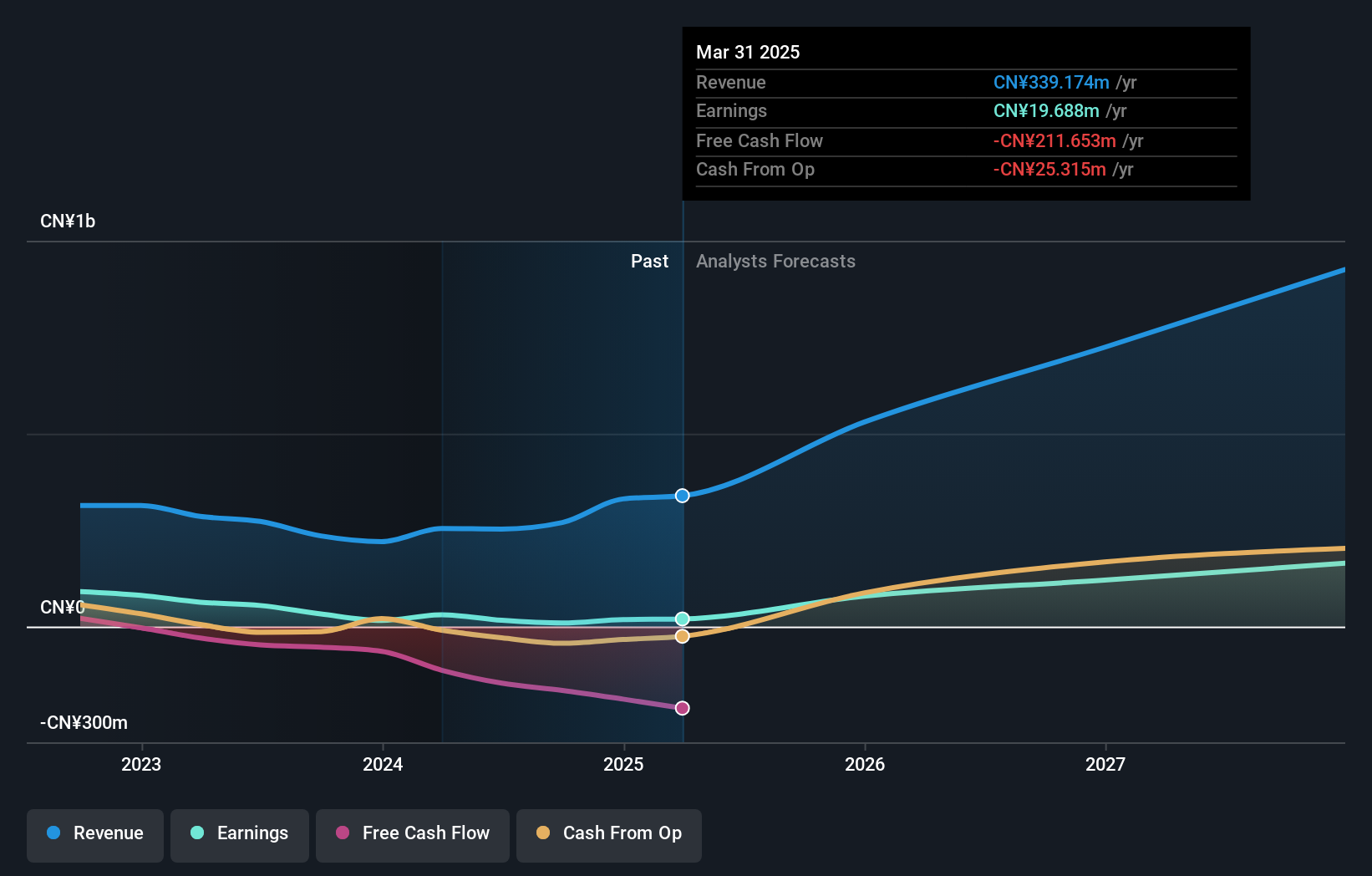

Suzhou YourBest New-type MaterialsLtd (SZSE:301266)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Suzhou YourBest New-type Materials Co. Ltd. is a company engaged in the development and production of advanced materials, with a market capitalization of approximately CN¥3.70 billion.

Operations: Specializing in advanced materials, YourBest New-type Materials generates revenue primarily through the production and sale of these materials. The company's financial structure is characterized by its market capitalization of around CN¥3.70 billion.

Suzhou YourBest New-type Materials Ltd. has navigated a challenging year with its revenue climbing to CNY 2.48 billion, up from CNY 2.05 billion, marking an 18.8% increase despite recent setbacks like being dropped from the S&P Global BMI Index. This growth is complemented by a substantial R&D commitment, integral to its strategy in a competitive tech landscape where innovation is critical. However, the company faces hurdles with earnings dipping by 43.8% over the past year and profit margins shrinking to 2.5% from last year’s 5.4%. These figures reflect both the resilience and challenges within high-growth sectors where Suzhou YourBest aims to leverage its enhanced product offerings for future recovery and market share expansion.

- Click here and access our complete health analysis report to understand the dynamics of Suzhou YourBest New-type MaterialsLtd.

Understand Suzhou YourBest New-type MaterialsLtd's track record by examining our Past report.

Key Takeaways

- Unlock our comprehensive list of 1270 High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301266

Suzhou YourBest New-type MaterialsLtd

Suzhou YourBest New-type Materials Co. Ltd.

Reasonable growth potential with adequate balance sheet.