- China

- /

- Electronic Equipment and Components

- /

- SHSE:688522

Insider Favorites: December 2024's Top Growth Companies

Reviewed by Simply Wall St

As global markets navigate a mixed landscape of rising stock indices and declining consumer confidence, investors are keenly observing the performance of growth stocks, which have shown resilience despite recent economic fluctuations. In this environment, companies with high insider ownership often attract attention due to their potential alignment between management and shareholder interests, making them compelling considerations for those seeking growth opportunities.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Propel Holdings (TSX:PRL) | 23.8% | 37.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

Let's uncover some gems from our specialized screener.

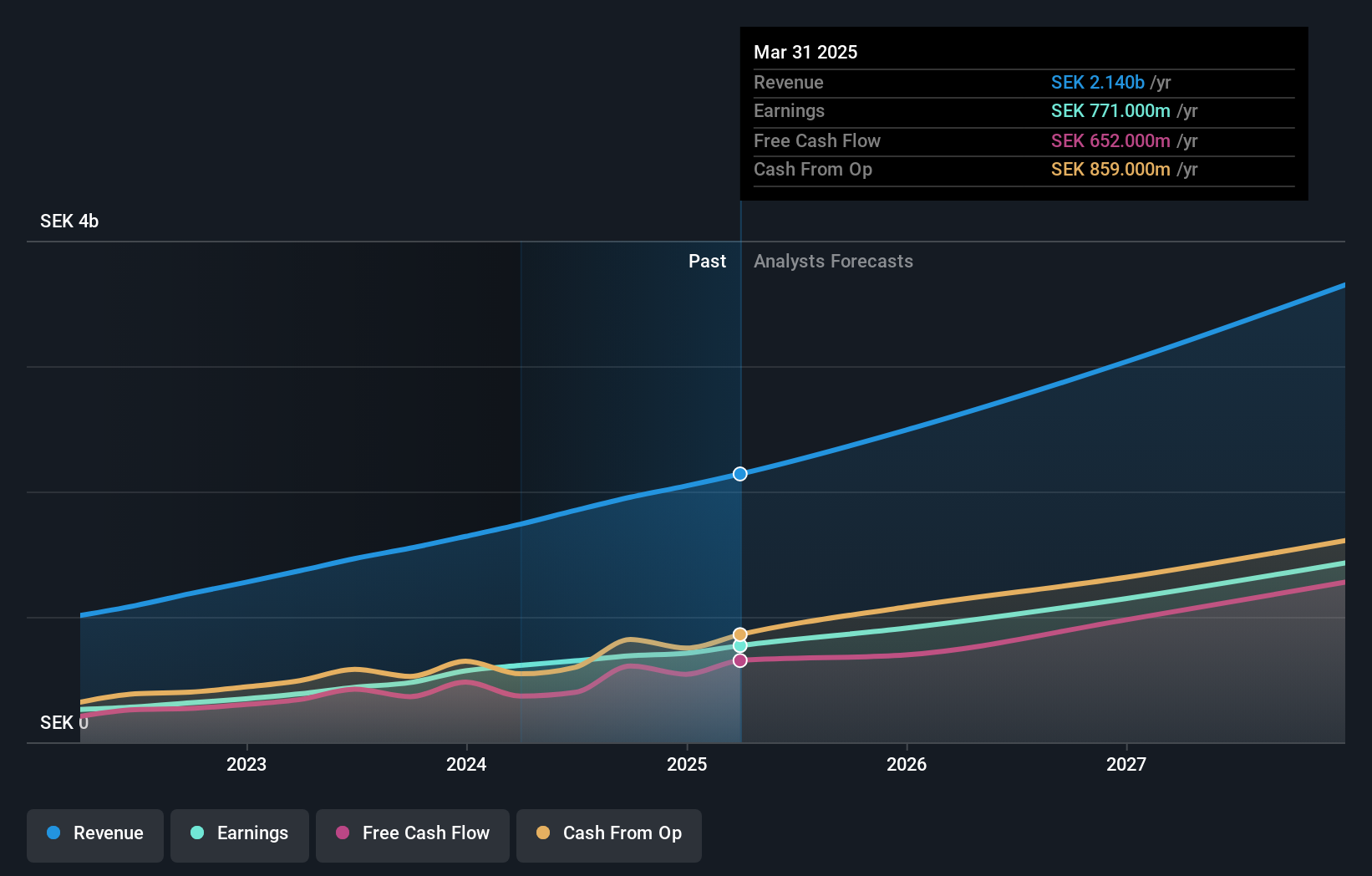

Fortnox (OM:FNOX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fortnox AB (publ) offers financial and administrative software solutions for small and medium-sized businesses, accounting firms, and organizations, with a market cap of SEK44.52 billion.

Operations: The company's revenue segments include Core Products (SEK768 million), Businesses (SEK397 million), Accounting Firms (SEK376 million), Marketplaces (SEK173 million), and Financial Services (SEK267 million).

Insider Ownership: 19.1%

Revenue Growth Forecast: 18.7% p.a.

Fortnox has demonstrated strong growth, with earnings increasing by 45% over the past year and a forecasted annual profit growth of 22.8%, outpacing the Swedish market. Despite revenue growth being slower than 20%, it still surpasses the market average. Insider activity shows more buying than selling recently, indicating confidence in future prospects. The company trades at a slight discount to its estimated fair value, suggesting potential for investors seeking high insider ownership in growth stocks.

- Take a closer look at Fortnox's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Fortnox's current price could be inflated.

Naruida Technology (SHSE:688522)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Naruida Technology Co., Ltd. manufactures and sells polarized multifunctional active phased array radars in China, with a market cap of CN¥12.64 billion.

Operations: The company generates revenue of CN¥235.19 million from its Scientific & Technical Instruments segment.

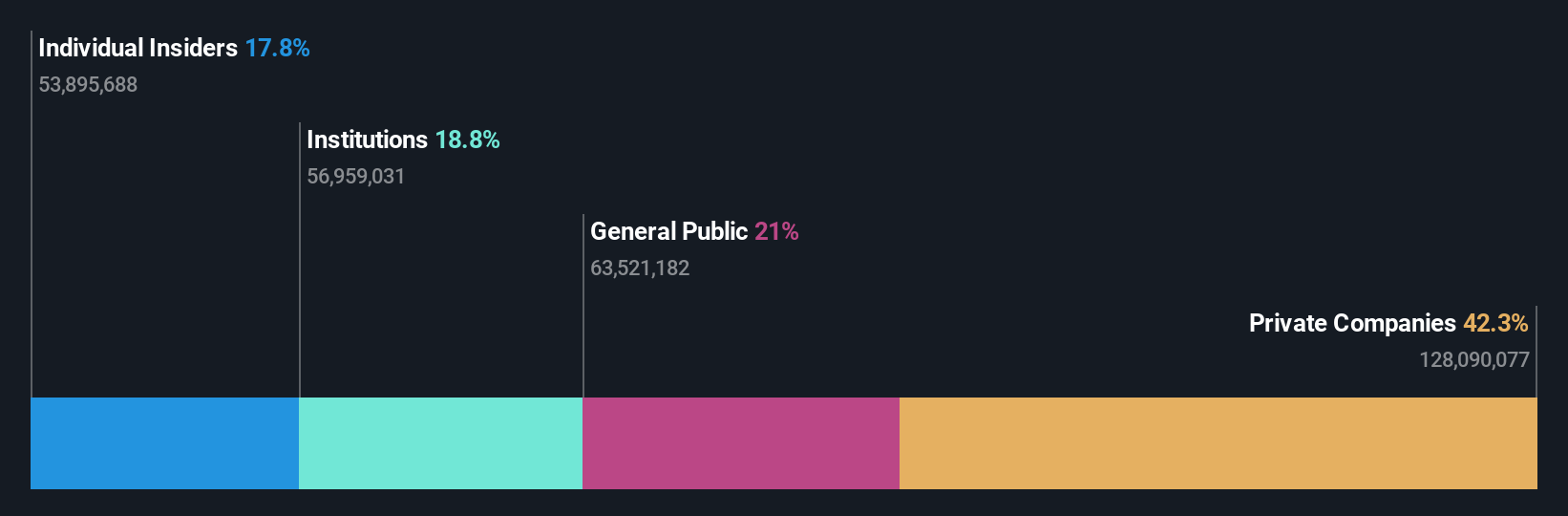

Insider Ownership: 17.8%

Revenue Growth Forecast: 60.8% p.a.

Naruida Technology's earnings are projected to grow significantly at 72.3% annually, outpacing the Chinese market's average. Despite this, recent financials indicate a decline in net income from CNY 33.24 million to CNY 26.01 million over nine months, with profit margins decreasing from 39.5% to 23.8%. Revenue growth is robust, forecasted at 60.8% per year; however, insider trading activity remains unclear in recent months, and share price volatility persists.

- Get an in-depth perspective on Naruida Technology's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Naruida Technology is trading beyond its estimated value.

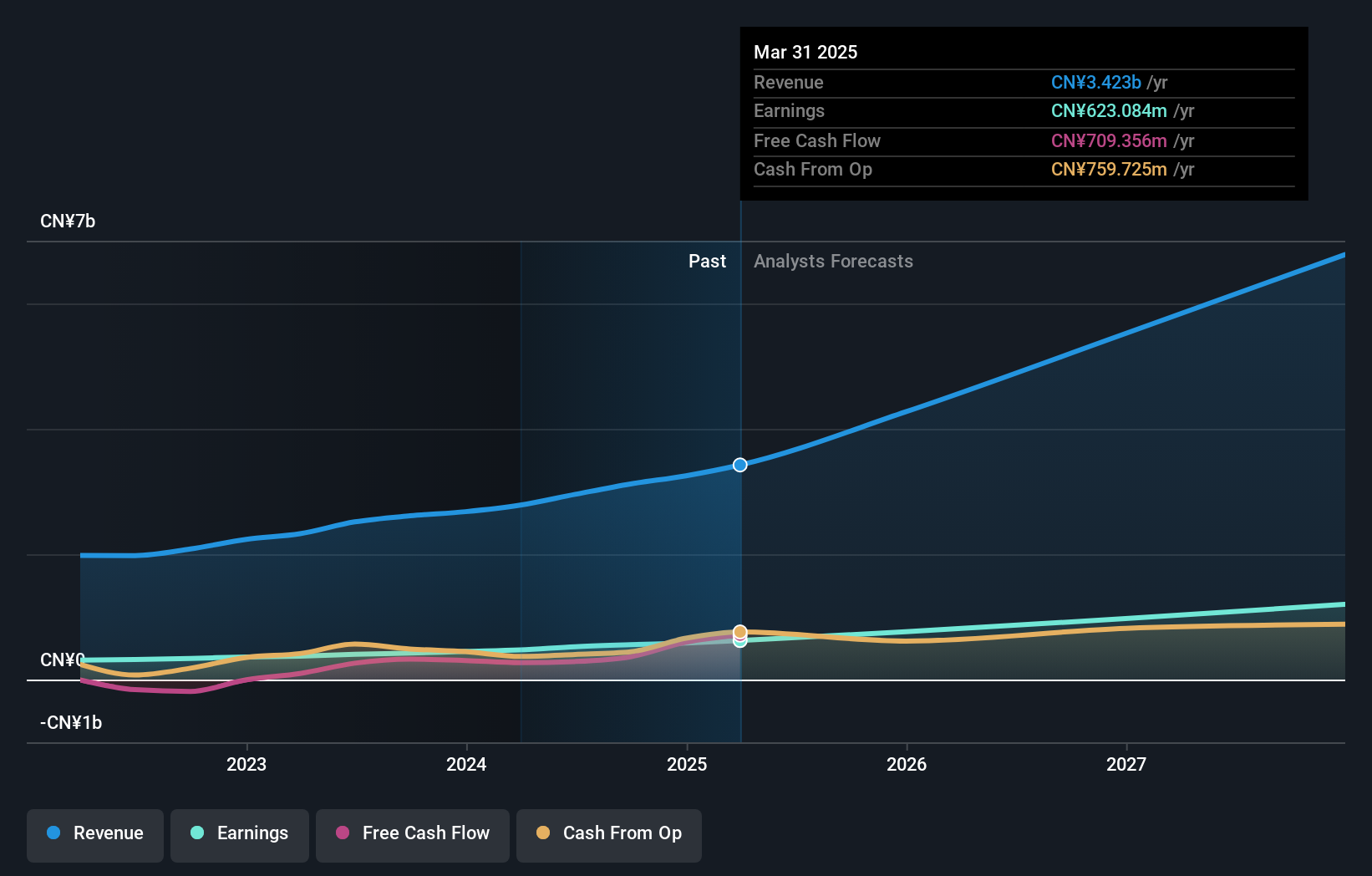

Shanghai Huace Navigation Technology (SZSE:300627)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Huace Navigation Technology Ltd. operates in the field of navigation and positioning technology, with a market cap of CN¥22.80 billion.

Operations: Unfortunately, the provided text does not include specific revenue segment data for Shanghai Huace Navigation Technology Ltd., so I am unable to summarize the revenue segments.

Insider Ownership: 24.8%

Revenue Growth Forecast: 25.8% p.a.

Shanghai Huace Navigation Technology exhibits strong growth potential with earnings expected to increase significantly over the next three years. The company's revenue is forecast to grow at 25.8% annually, outpacing the broader Chinese market. Recent collaborations, such as with Swift Navigation for precise positioning services, highlight its innovative edge in GNSS technology. Despite a high price-to-earnings ratio of 41x, it remains below industry average levels. Notably, it was added to key Shenzhen indices recently, enhancing its visibility among investors.

- Click to explore a detailed breakdown of our findings in Shanghai Huace Navigation Technology's earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Shanghai Huace Navigation Technology shares in the market.

Turning Ideas Into Actions

- Navigate through the entire inventory of 1507 Fast Growing Companies With High Insider Ownership here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Naruida Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688522

Naruida Technology

Manufactures and sells polarized multifunctional active phased array radars in China.

Flawless balance sheet with high growth potential.