- China

- /

- Entertainment

- /

- SHSE:603103

High Growth Tech Stocks To Watch In December 2024

Reviewed by Simply Wall St

As December 2024 unfolds, global markets are experiencing mixed signals with U.S. consumer confidence dipping and major stock indexes showing moderate gains, led by large-cap growth stocks before a mid-week reversal. Amid this backdrop, investors are keenly observing high-growth tech stocks, which can offer significant potential due to their innovative capabilities and adaptability in fluctuating economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Sarepta Therapeutics | 24.07% | 43.17% | ★★★★★★ |

| CD Projekt | 24.92% | 27.00% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1270 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Hengdian EntertainmentLTD (SHSE:603103)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hengdian Entertainment Co., LTD operates theaters in China and has a market cap of CN¥9.84 billion.

Operations: Hengdian Entertainment Co., LTD focuses on theater operations in China. The company's revenue is primarily derived from ticket sales, concessions, and related services within its theaters.

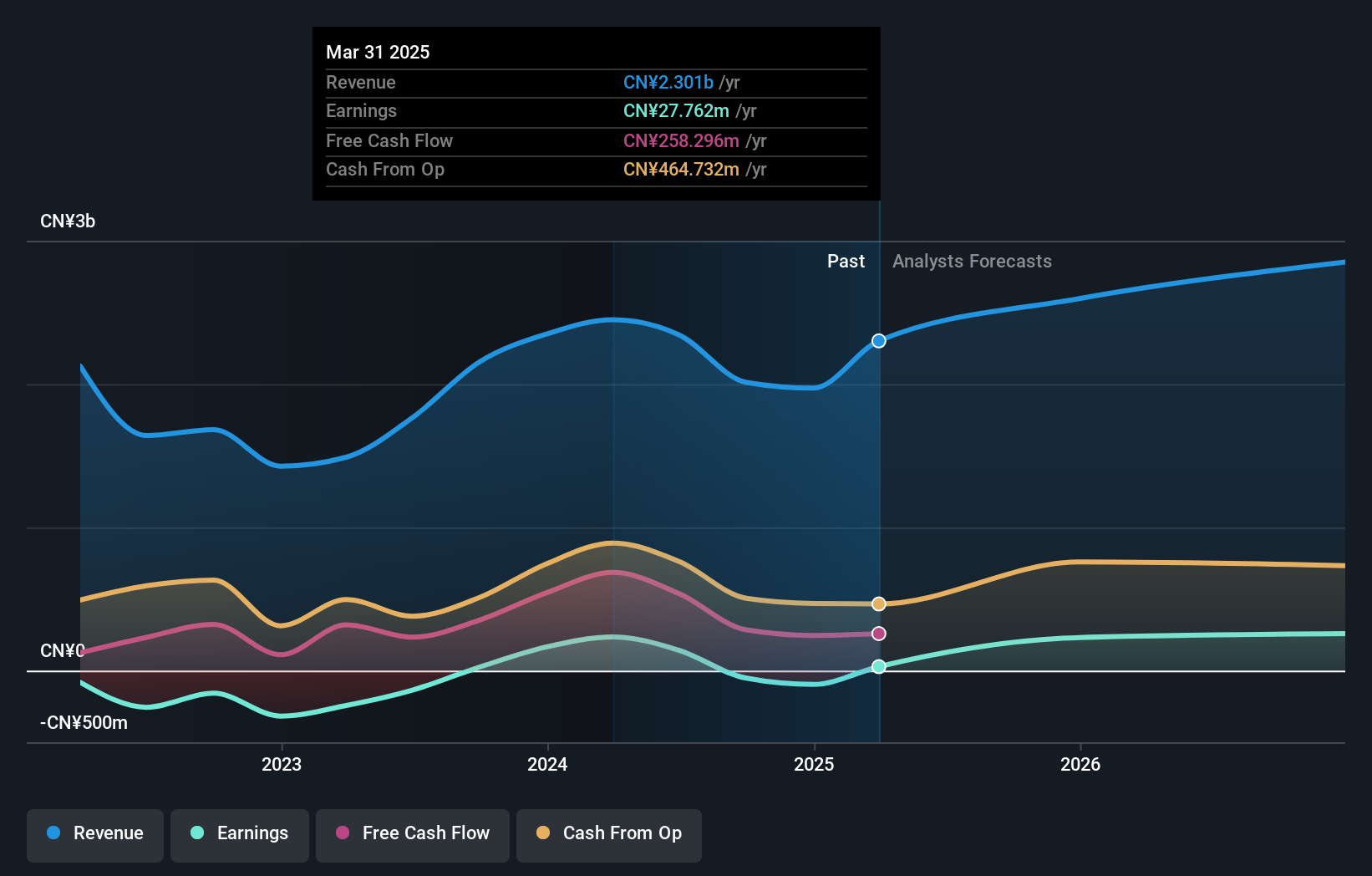

Hengdian EntertainmentLTD, amidst a challenging fiscal year with a significant drop in sales to CNY 1.62 billion from CNY 1.95 billion and net income plunging to CNY 17.39 million from CNY 235.87 million, still shows potential for recovery. The company's strategic focus on innovation is evident as it navigates through its financial troughs with an eye on future profitability, forecasted to grow earnings by an impressive annual rate of 124.85%. Despite current unprofitability and industry-wide challenges reflected in a -16.1% earnings growth within the entertainment sector, Hengdian's commitment to R&D and adapting to market dynamics underscores its resilience and potential for rebound, especially considering its revenue growth projections outpacing the Chinese market average at 18.1% per year compared to 13.7%.

- Dive into the specifics of Hengdian EntertainmentLTD here with our thorough health report.

Gain insights into Hengdian EntertainmentLTD's past trends and performance with our Past report.

Beijing Zhong Ke San Huan High-Tech (SZSE:000970)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Zhong Ke San Huan High-Tech Co., Ltd. focuses on the production and development of high-performance magnetic materials, with a market cap of CN¥13.31 billion.

Operations: The company generates revenue primarily from the production and sale of high-performance magnetic materials. It has a market cap of CN¥13.31 billion, indicating its significant presence in the industry.

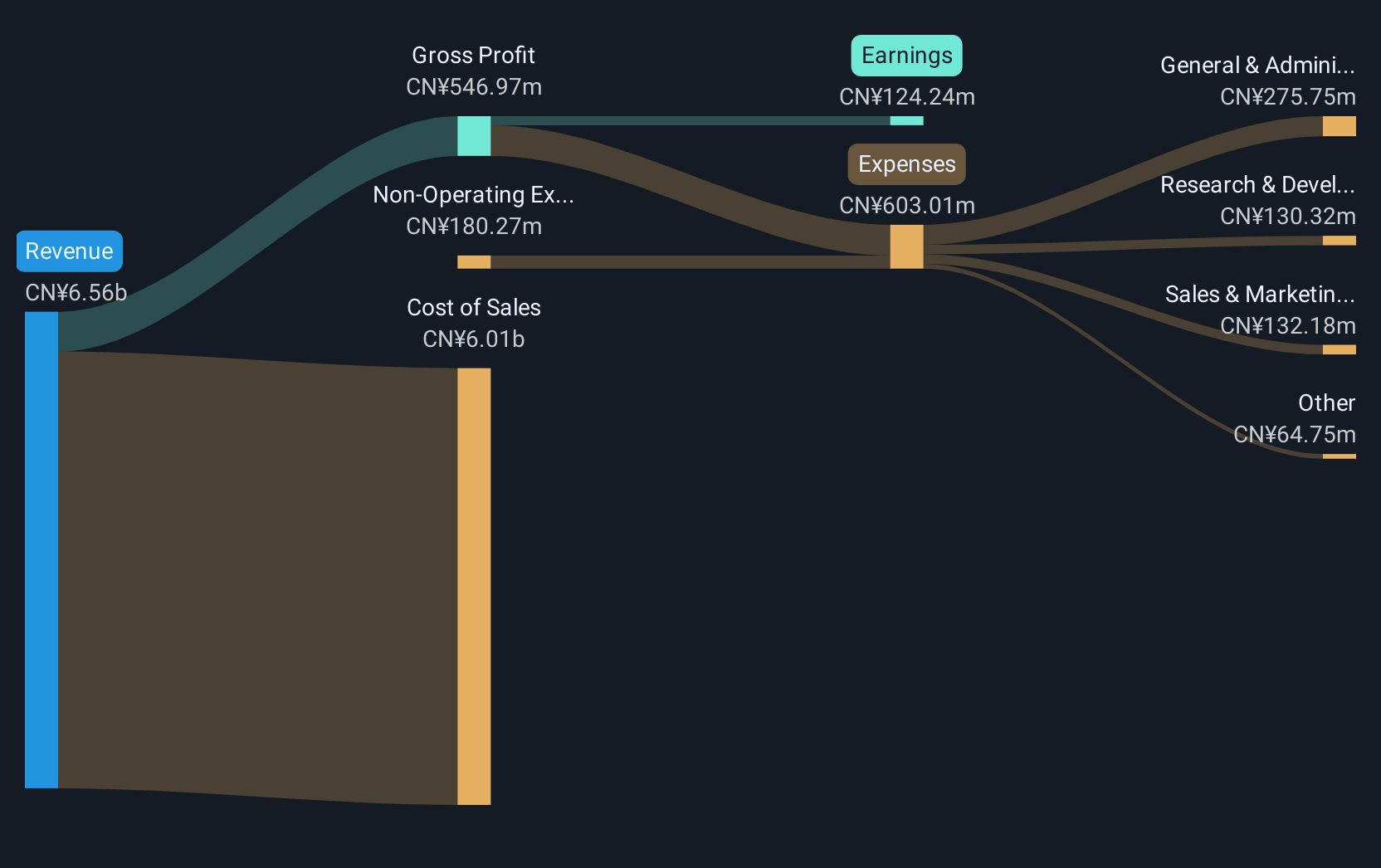

Beijing Zhong Ke San Huan High-Tech has faced significant challenges, with a sharp revenue drop to CNY 4.98 billion from CNY 6.42 billion and transitioning from a net income of CNY 223.49 million to a net loss of CNY 42.05 million within the year. Despite these hurdles, the company's aggressive share repurchase strategy, buying back shares worth over CNY 107.95 million, underscores its management's confidence in its recovery potential. This is coupled with an ambitious R&D commitment set against a backdrop of declining earnings but forecasted robust annual earnings growth at 82.8%, suggesting a strategic pivot towards innovation-driven growth that could outpace broader market trends.

Beijing Enlight Media (SZSE:300251)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Enlight Media Co., Ltd. is involved in the investment, production, and distribution of film and television projects in China, with a market cap of CN¥27.89 billion.

Operations: Enlight Media focuses on creating and distributing films and television content in China. The company's revenue is primarily derived from its film production and distribution activities.

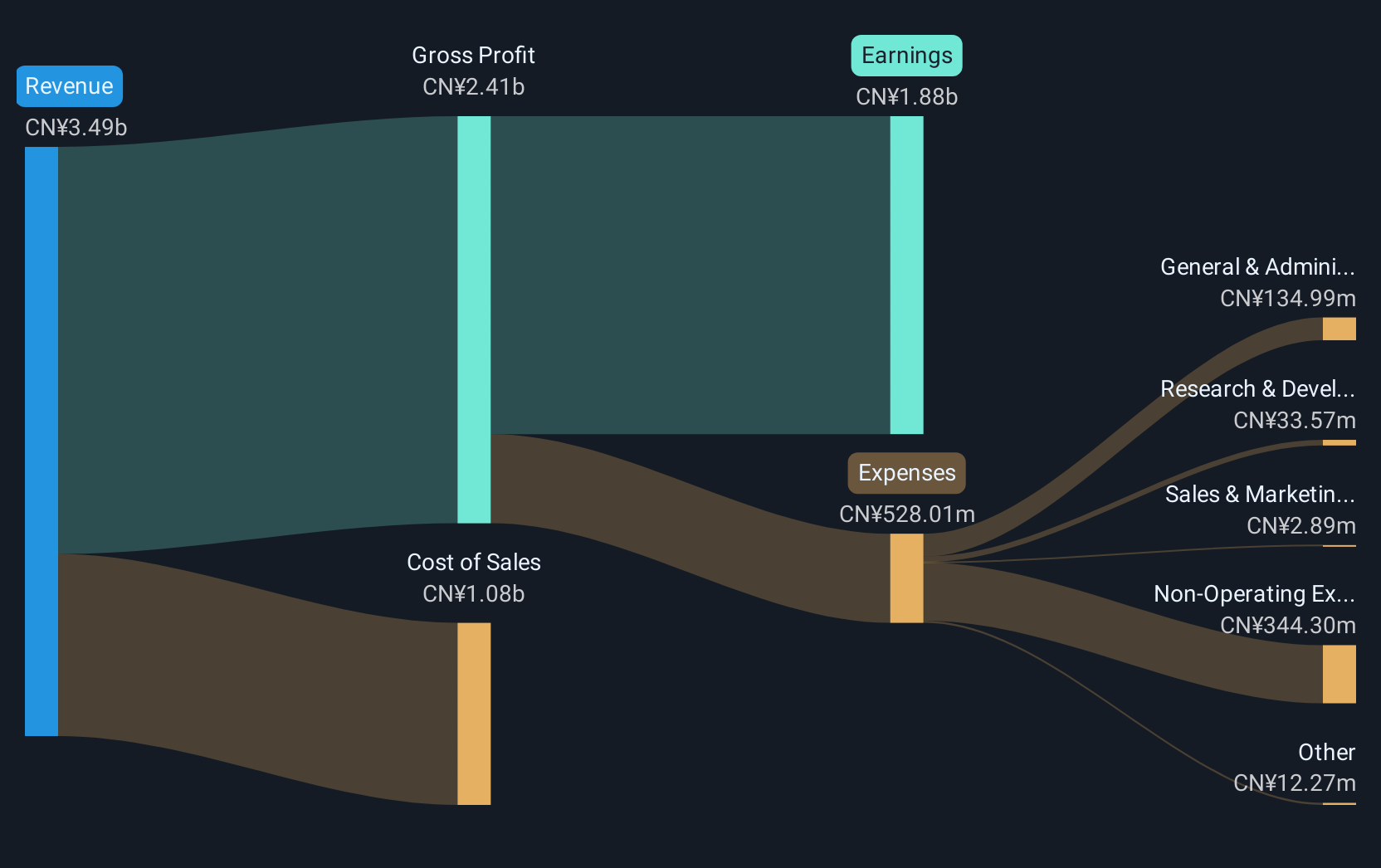

Beijing Enlight Media has demonstrated a robust turnaround, with its recent earnings report showcasing a significant revenue jump to CNY 1.44 billion from CNY 940.08 million year-over-year and an increase in net income to CNY 460.88 million from CNY 368.47 million. This financial uplift is underpinned by a strong annualized revenue growth of 19.1% and even more impressive earnings growth at 37.3%, signaling effective management and promising market positioning compared to the slower CN market growth of 13.7%. Furthermore, the company's commitment to innovation is evident in its substantial R&D investments, ensuring it remains competitive in the fast-evolving tech landscape where staying ahead technologically is crucial for sustained success.

Next Steps

- Get an in-depth perspective on all 1270 High Growth Tech and AI Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hengdian EntertainmentLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603103

Hengdian EntertainmentLTD

Engages in film and television investment, production, distribution, film screening, and related derivative businesses in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026