- Japan

- /

- Construction

- /

- TSE:1812

Kajima (TSE:1812) Valuation: Weighing Innovation After New Digital Construction Partnership

Reviewed by Kshitija Bhandaru

When weighing your next move on Kajima (TSE:1812), the company’s freshly inked agreement with Glodon International is tough to ignore. This partnership, centered on boosting digital construction education by integrating smart technologies and hands-on digital tools, signals a clear step by Kajima to nurture new talent and modernize its operations. For investors, the news stands out less for any immediate financial impact and more as an indicator of management’s proactive approach to industry challenges and long-term transformation.

Looking at the bigger picture, Kajima’s willingness to embrace innovation and invest in workforce development appears to be resonating. The stock has gathered impressive momentum, climbing 65% over the past year and delivering strong returns both in the past month and over the last three years. While recent returns have outpaced broader market expectations, the focus on digitalization follows other strategic moves by the company in positioning itself for ongoing change within the construction sector. So far, the long-term growth story seems increasingly tied to these forward-looking initiatives.

After such a strong run and this latest news, is Kajima undervalued given its innovation push, or is the market already betting on even more growth ahead?

Price-to-Earnings of 15.4x: Is it justified?

Kajima trades at a price-to-earnings (P/E) ratio of 15.4x, which is below the peer average of 16.5x but above the Japanese construction industry average of 12.4x. This suggests the market places Kajima between its direct competitors and the broader sector in terms of expectations for profitability and growth.

The P/E ratio reflects what investors are willing to pay for each unit of earnings and is a key measure in comparing companies within the same sector. For Kajima, a higher multiple than the industry average may indicate a premium for its future growth prospects or perceived stability. At the same time, it still appears as a relative bargain versus direct peers.

This implies that while Kajima's shares look attractively valued compared to other major companies in the space, the premium to the sector average suggests that the market is pricing in ongoing strategic progress or above-average operational quality. Whether this optimism is warranted will depend on the company's ability to sustain its recent growth momentum and execute further innovation.

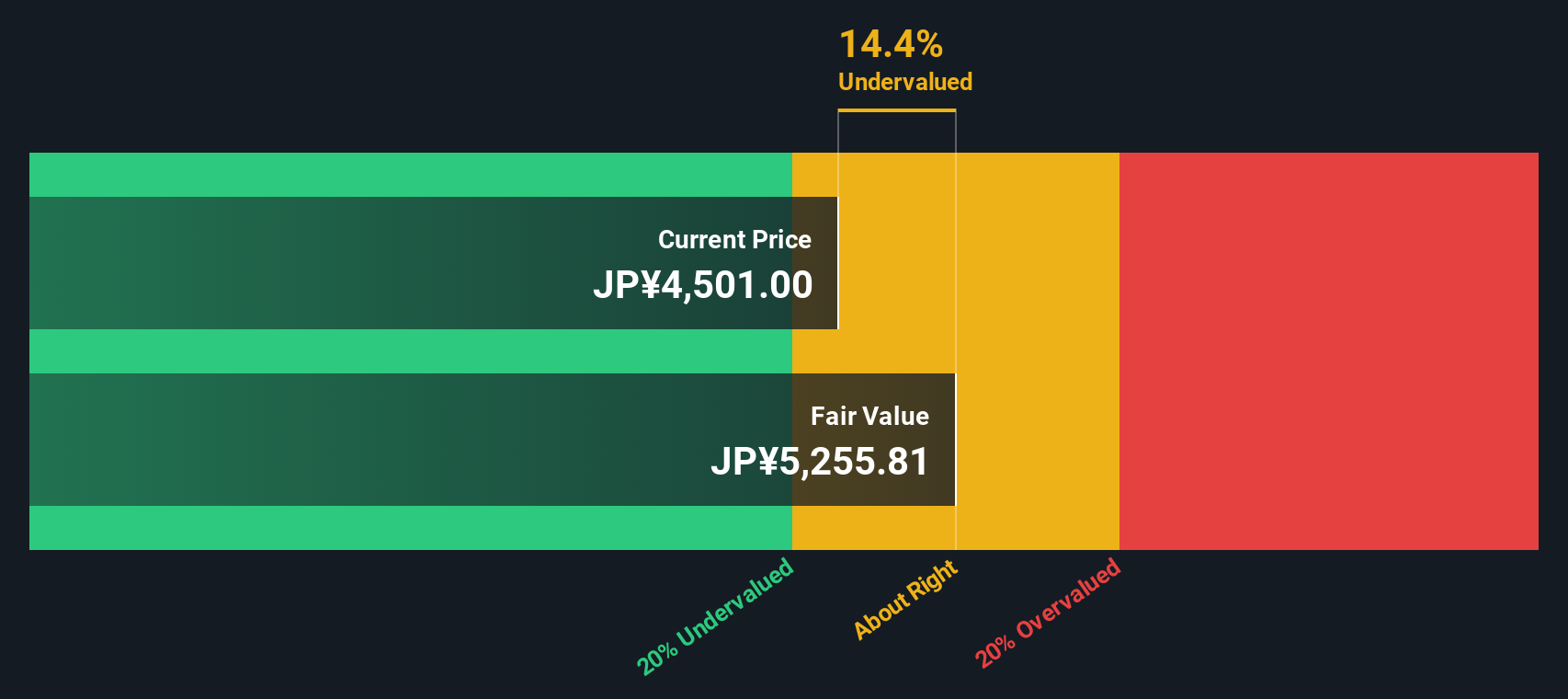

Result: Fair Value of ¥5,272.97 (UNDERVALUED)

See our latest analysis for Kajima.However, weaker revenue growth or a slowdown in profitability could challenge the case for Kajima’s current valuation and growth story.

Find out about the key risks to this Kajima narrative.Another View: SWS DCF Model Perspective

Looking at Kajima through the lens of our DCF model, a different perspective emerges. This method also points to undervaluation, but it uses future cash flows to reach its conclusion. Which approach tells the fuller story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Kajima Narrative

Of course, if you have a different take on Kajima or want to dig into the details yourself, shaping your own view takes just a few minutes. Do it your way.

A great starting point for your Kajima research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t miss out on new opportunities that could shape your portfolio’s future. Use the Simply Wall St Screener to uncover compelling stocks perfectly matched to your investment goals.

- Boost your search for undervalued potential by tapping into companies showing strong cash flow stories within our undervalued stocks based on cash flows.

- Explore businesses at the forefront of digital assets and financial technology with instant access to cryptocurrency and blockchain stocks.

- Take advantage of stable returns and long-term compounding power by browsing through dividend stocks with yields > 3% delivering impressive yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kajima might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1812

Kajima

Engages in civil engineering, building construction, real estate development, architectural design, and other businesses worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives