- Japan

- /

- Construction

- /

- TSE:1803

Why Investors Shouldn't Be Surprised By Shimizu Corporation's (TSE:1803) P/S

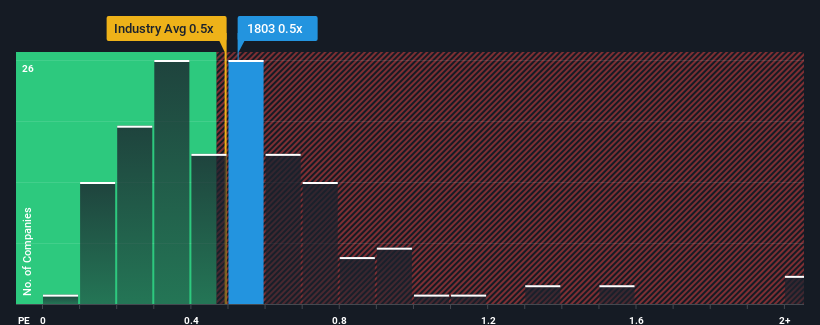

There wouldn't be many who think Shimizu Corporation's (TSE:1803) price-to-sales (or "P/S") ratio of 0.5x is worth a mention when the median P/S for the Construction industry in Japan is very similar. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Shimizu

How Shimizu Has Been Performing

Shimizu hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shimizu.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Shimizu's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 8.6% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 32% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 2.2% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 2.1% per annum, which is not materially different.

With this information, we can see why Shimizu is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A Shimizu's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Construction industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Shimizu (1 is a bit concerning!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:1803

Shimizu

Engages in the construction, development, engineering, and life cycle valuation businesses in Japan and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives