- Japan

- /

- Construction

- /

- TSE:1802

Did Upgraded Earnings Guidance Just Shift Obayashi's (TSE:1802) Investment Narrative?

Reviewed by Sasha Jovanovic

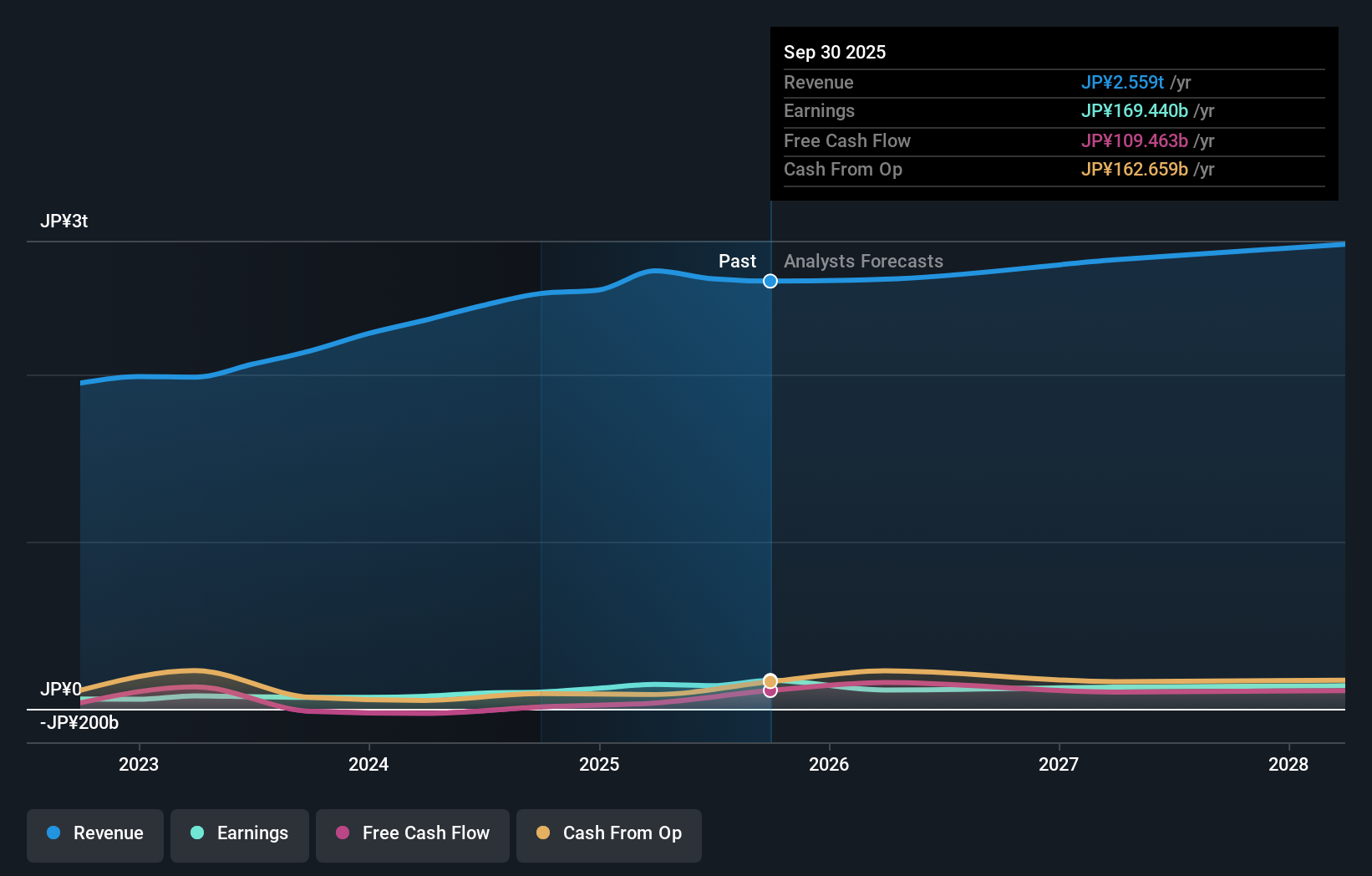

- On November 5, 2025, Obayashi Corporation announced an upward revision to its consolidated and non-consolidated earnings guidance for the fiscal year ending March 31, 2026, citing increased net sales and profits due to favorable construction project progress and improved overseas subsidiary performance.

- An interesting detail is the significant improvement in expected profit margins for completed construction projects, driven by change orders on multiple large-scale domestic projects and the faster-than-planned sale of cross-shareholdings.

- With earnings guidance raised primarily on higher construction profitability, we'll explore how this outlook informs Obayashi's investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Obayashi's Investment Narrative?

To be a shareholder in Obayashi, you want to believe in the company’s ability to translate its robust construction pipeline into sustainable profits, all while navigating a mature, competitive sector. The recent sharp revision to earnings guidance is material, with higher profit margins from large-scale projects and swift asset sales breathing new life into the short-term outlook. This could shift the focus toward execution and margin management as immediate catalysts, especially as the stock price has rallied strongly following the announcement. Yet, this improved forecast comes against pre-existing headwinds like forecasted earnings declines and slower revenue growth when compared to market averages. The dividend has also been reduced, which remains a point of caution. For now, the upbeat outlook might ease immediate concerns, but investors are keeping an eye on whether these profit gains prove repeatable.

But, before assuming the profit jump will persist, there’s a reason for investor caution about one-off gains. Obayashi's shares have been on the rise but are still potentially undervalued by 27%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Obayashi - why the stock might be worth just ¥3940!

Build Your Own Obayashi Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Obayashi research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Obayashi research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Obayashi's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1802

Obayashi

Engages in the construction business in Japan, North America, Asia and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives