Japan’s stock markets have rebounded strongly this August, with the Nikkei 225 Index gaining 8.7% and the broader TOPIX Index up 7.9%, driven by better-than-expected U.S. economic data and a robust domestic GDP expansion in the second quarter. This positive market sentiment provides an opportune moment to explore some lesser-known stocks that could benefit from these favorable conditions. In such a dynamic environment, identifying promising stocks often involves looking for companies with solid fundamentals, growth potential, and resilience to market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tokyo Tekko | 10.81% | 7.30% | 7.30% | ★★★★★★ |

| AOKI Holdings | 28.27% | 0.91% | 37.15% | ★★★★★★ |

| Ad-Sol Nissin | NA | 4.02% | 7.90% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | -0.08% | 12.04% | ★★★★★★ |

| Innotech | 38.96% | 7.08% | 6.36% | ★★★★★☆ |

| AJIS | 0.69% | 0.07% | -12.44% | ★★★★★☆ |

| Marusan Securities | 5.33% | 1.01% | 10.00% | ★★★★★☆ |

| Imuraya Group | 26.21% | 2.37% | 32.09% | ★★★★★☆ |

| GakkyushaLtd | 23.64% | 5.03% | 18.56% | ★★★★☆☆ |

| Toho Bank | 98.27% | 0.43% | 22.80% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Fuji Furukawa Engineering & ConstructionLtd (TSE:1775)

Simply Wall St Value Rating: ★★★★★★

Overview: Fuji Furukawa Engineering & Construction Co. Ltd. (TSE:1775) specializes in electrical and air conditioning equipment construction services, with a market cap of ¥55.48 billion.

Operations: Fuji Furukawa Engineering & Construction Co. Ltd. generates revenue primarily from its Electrical Equipment Construction Business (¥68.75 billion) and Air Conditioning Equipment Construction Business (¥33.68 billion).

Fuji Furukawa Engineering & Construction has seen a 30% earnings growth over the past year, outpacing the construction industry’s 22.4%. The company is trading at 14.1% below its estimated fair value and boasts high-quality earnings. Over five years, debt to equity ratio dropped from 12.8% to 0.2%, reflecting strong financial management. Notably, interest payments are well covered by EBIT at a remarkable 343x coverage ratio, indicating robust profitability and stability in operations.

KITZ (TSE:6498)

Simply Wall St Value Rating: ★★★★★★

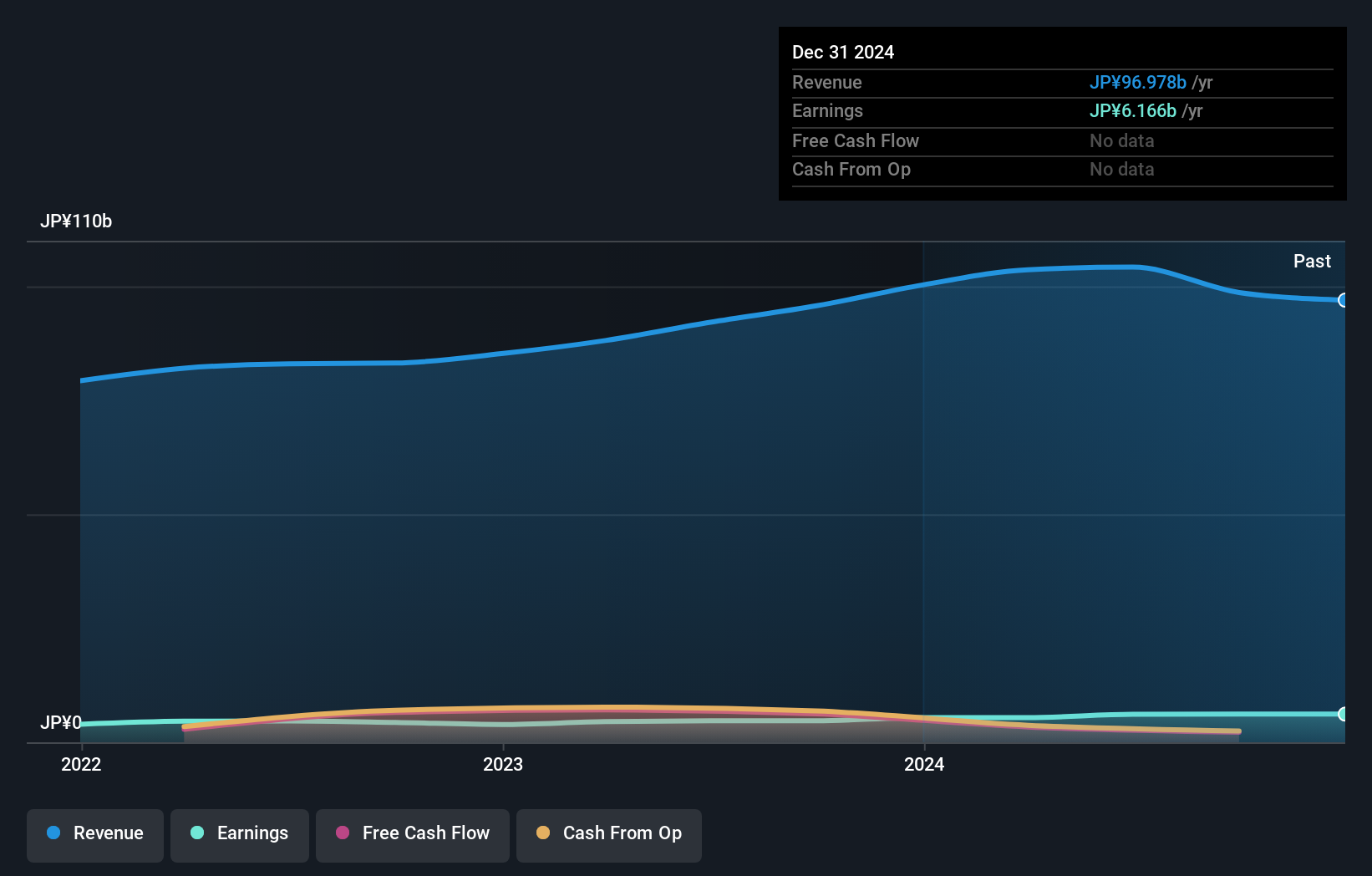

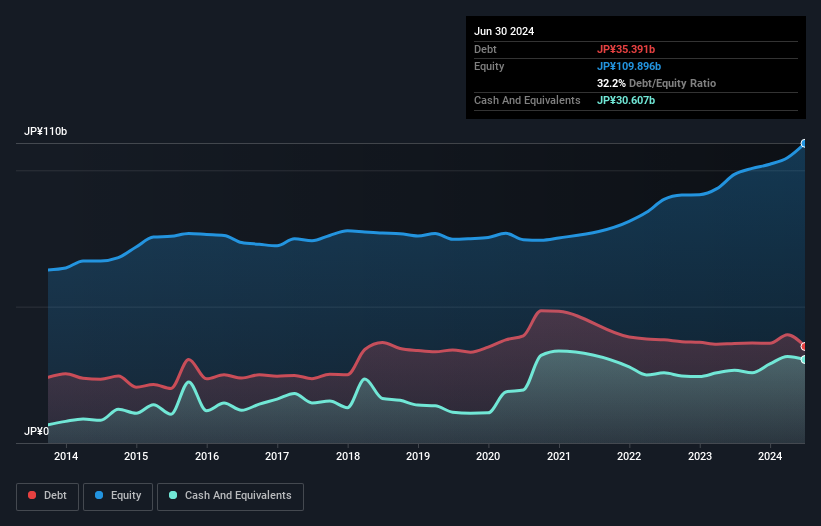

Overview: KITZ Corporation manufactures and sells valves, flow control devices, and related products in Japan and internationally with a market cap of ¥95.29 billion.

Operations: KITZ Corporation's primary revenue streams are from the manufacturing and selling of valves and flow control devices. The company's net profit margin stands at 5.12%.

KITZ has shown consistent growth, with earnings increasing 20.5% annually over the past five years. Despite a 6.5% rise in earnings last year, it lagged behind the Machinery industry's 13.1%. The company repurchased shares this year and announced a dividend increase to ¥19 per share from ¥18 last year, payable on September 18, 2024. With a debt-to-equity ratio reduced from 45.7% to 32.2%, KITZ appears well-positioned for future stability and growth potential in its sector.

Ricoh Leasing Company (TSE:8566)

Simply Wall St Value Rating: ★★★★☆☆

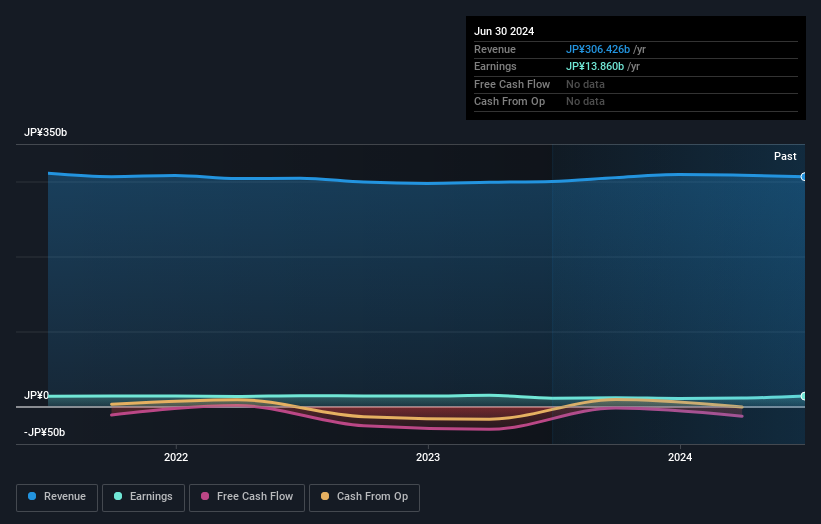

Overview: Ricoh Leasing Company, Ltd. operates in Japan offering leasing, investment, and financial services with a market cap of ¥157.82 billion.

Operations: Ricoh Leasing generates revenue primarily through leasing and financial services in Japan. The company reported a market cap of ¥157.82 billion.

Ricoh Leasing Company, a smaller player in the financial sector, has seen its debt to equity ratio drop from 454.5% to 425% over five years. Earnings have grown at 1.2% annually during this period, with recent annual growth of 24.9%, though this matches industry averages. Trading at a significant discount of 37.1% below estimated fair value, it shows potential for value investors despite high net debt levels (423.4%).

- Delve into the full analysis health report here for a deeper understanding of Ricoh Leasing Company.

Understand Ricoh Leasing Company's track record by examining our Past report.

Seize The Opportunity

- Gain an insight into the universe of 754 Japanese Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KITZ might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6498

KITZ

Engages in the manufacturing and selling of valves, other flow control devices, and related products in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives