- Japan

- /

- Construction

- /

- TSE:1721

Unpleasant Surprises Could Be In Store For COMSYS Holdings Corporation's (TSE:1721) Shares

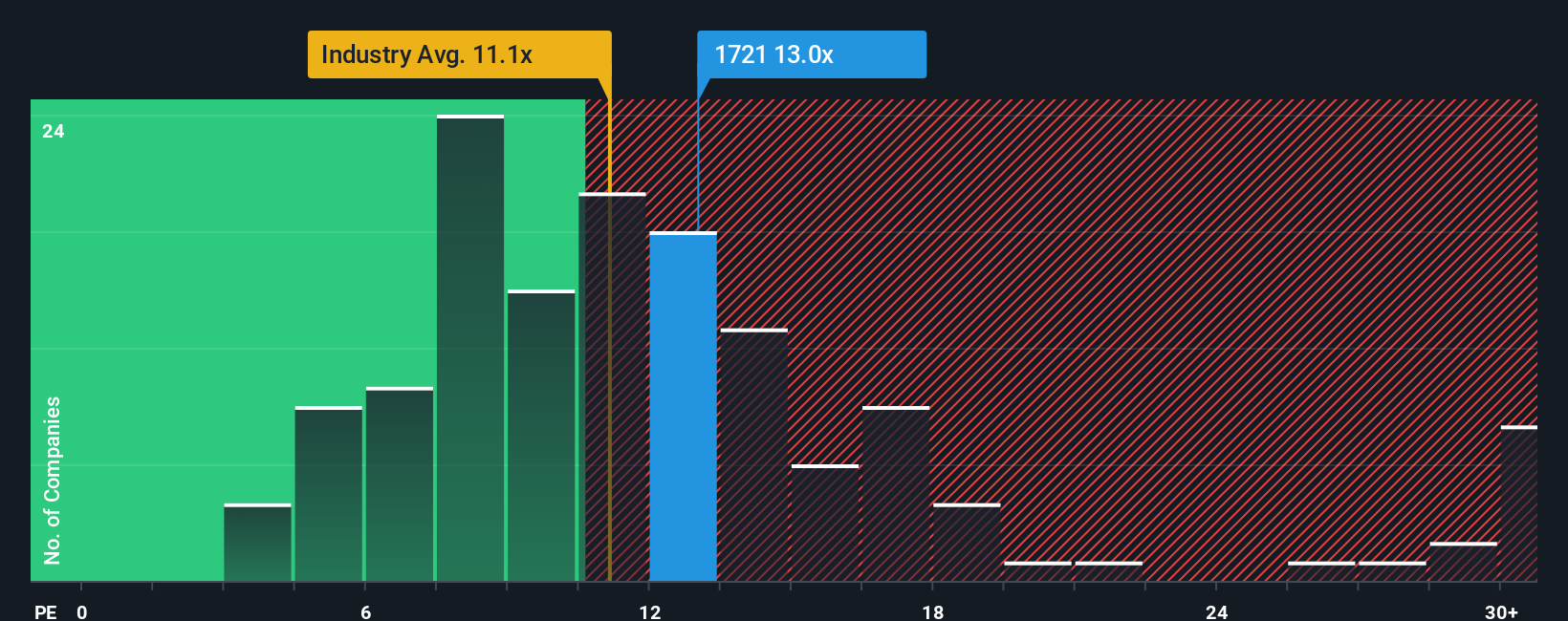

With a median price-to-earnings (or "P/E") ratio of close to 13x in Japan, you could be forgiven for feeling indifferent about COMSYS Holdings Corporation's (TSE:1721) P/E ratio of 13x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

There hasn't been much to differentiate COMSYS Holdings' and the market's earnings growth lately. The P/E is probably moderate because investors think this modest earnings performance will continue. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

View our latest analysis for COMSYS Holdings

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like COMSYS Holdings' to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 11% last year. The latest three year period has also seen a 8.9% overall rise in EPS, aided somewhat by its short-term performance. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Turning to the outlook, the next three years should generate growth of 5.9% each year as estimated by the five analysts watching the company. That's shaping up to be materially lower than the 8.7% per year growth forecast for the broader market.

With this information, we find it interesting that COMSYS Holdings is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that COMSYS Holdings currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for COMSYS Holdings that you should be aware of.

If these risks are making you reconsider your opinion on COMSYS Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:1721

COMSYS Holdings

Engages in information and communication construction, electrical equipment construction, and information processing-related businesses.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives