- Japan

- /

- Construction

- /

- TSE:1434

Benign Growth For Jesco Holdings, Inc. (TSE:1434) Underpins Stock's 31% Plummet

The Jesco Holdings, Inc. (TSE:1434) share price has fared very poorly over the last month, falling by a substantial 31%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 10% in that time.

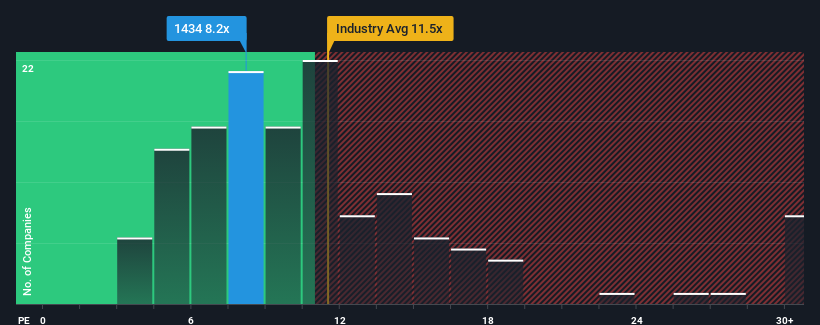

Although its price has dipped substantially, Jesco Holdings may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 8.2x, since almost half of all companies in Japan have P/E ratios greater than 14x and even P/E's higher than 21x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

For instance, Jesco Holdings' receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

See our latest analysis for Jesco Holdings

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Jesco Holdings' is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a frustrating 65% decrease to the company's bottom line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 7.9% overall rise in EPS. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 9.8% shows it's noticeably less attractive on an annualised basis.

In light of this, it's understandable that Jesco Holdings' P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Jesco Holdings' P/E has taken a tumble along with its share price. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Jesco Holdings maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Jesco Holdings is showing 6 warning signs in our investment analysis, and 2 of those are significant.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1434

Jesco Holdings

Engages in the electrical equipment construction business.

Moderate average dividend payer.

Market Insights

Community Narratives