- Japan

- /

- Hospitality

- /

- TSE:3397

West Holdings And 2 More Japanese Stocks Trading Below Estimated Value

Reviewed by Simply Wall St

The Japanese stock market has seen significant gains recently, buoyed by dovish commentary from the Bank of Japan and optimism stemming from China's stimulus measures. This favorable environment presents an opportunity to explore stocks that are trading below their estimated value. In such a market, identifying undervalued stocks can be particularly rewarding as these investments may offer potential for growth when the broader economic conditions improve.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hagiwara Electric Holdings (TSE:7467) | ¥3425.00 | ¥6718.08 | 49% |

| Akatsuki (TSE:3932) | ¥2031.00 | ¥3762.34 | 46% |

| Kotobuki Spirits (TSE:2222) | ¥1760.00 | ¥3434.73 | 48.8% |

| Stella Chemifa (TSE:4109) | ¥4080.00 | ¥8075.73 | 49.5% |

| I-PEX (TSE:6640) | ¥1570.00 | ¥2910.36 | 46.1% |

| Pilot (TSE:7846) | ¥4452.00 | ¥8866.80 | 49.8% |

| Infomart (TSE:2492) | ¥315.00 | ¥616.69 | 48.9% |

| KeePer Technical Laboratory (TSE:6036) | ¥4100.00 | ¥7835.41 | 47.7% |

| NATTY SWANKY holdingsLtd (TSE:7674) | ¥3250.00 | ¥6044.83 | 46.2% |

| Nxera Pharma (TSE:4565) | ¥1216.00 | ¥2370.72 | 48.7% |

Let's uncover some gems from our specialized screener.

West Holdings (TSE:1407)

Overview: West Holdings Corporation, with a market cap of ¥110.89 billion, operates in the renewable energy sector both in Japan and internationally through its subsidiaries.

Operations: Revenue Segments (in millions of ¥):

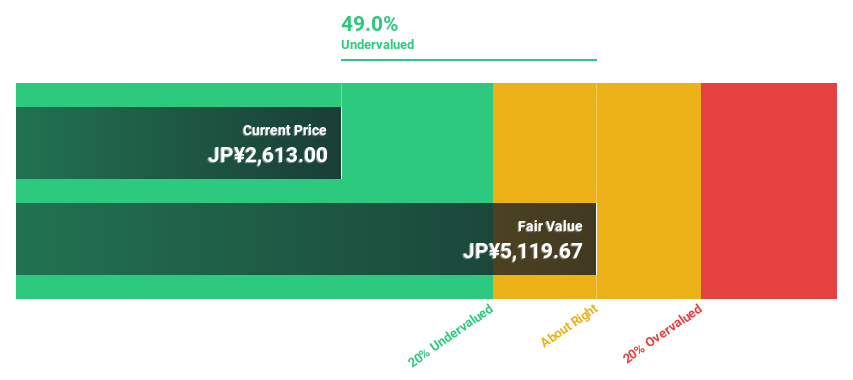

Estimated Discount To Fair Value: 41.5%

West Holdings is trading at ¥2,796, significantly below its estimated fair value of ¥4,776.79. Despite a slower revenue growth forecast of 17.7% annually compared to the 20% benchmark, it surpasses the Japanese market's average of 4.2%. Earnings are expected to grow substantially at 21.7% per year, outpacing the market's 8.7%. However, debt coverage by operating cash flow is inadequate and its dividend yield of 1.97% isn't well supported by free cash flows.

- Our growth report here indicates West Holdings may be poised for an improving outlook.

- Dive into the specifics of West Holdings here with our thorough financial health report.

TORIDOLL Holdings (TSE:3397)

Overview: TORIDOLL Holdings Corporation, with a market cap of ¥326.90 billion, operates and manages restaurants in Japan and internationally through its subsidiaries.

Operations: TORIDOLL Holdings generates revenue from three main segments: Marugame Seimen (¥118.26 billion), Overseas Business (¥97.12 billion), and Domestic Others (¥29.77 billion).

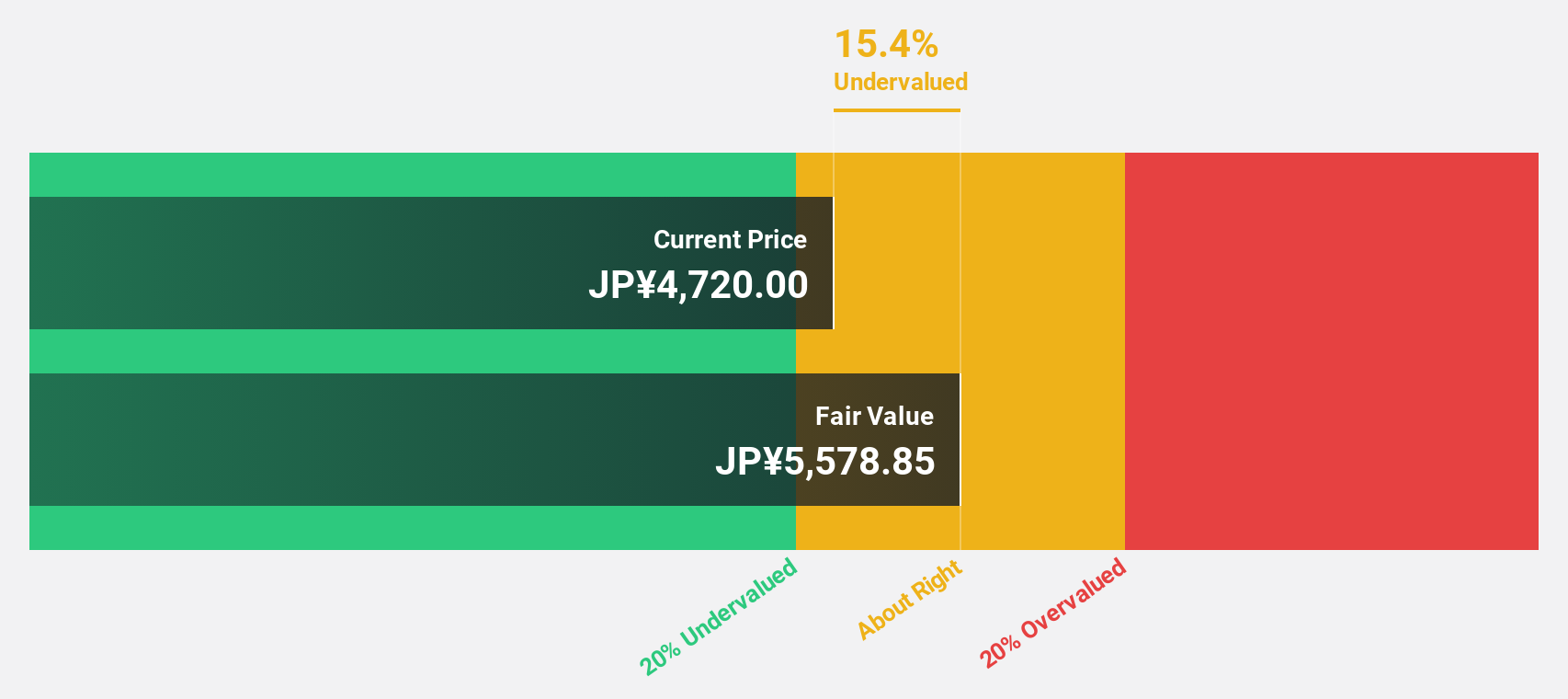

Estimated Discount To Fair Value: 44.5%

TORIDOLL Holdings is trading at ¥3,741, well below its estimated fair value of ¥6,743.93. The company forecasts robust revenue growth of 10.6% annually and significant earnings expansion at 38.1% per year, surpassing the Japanese market averages. Recent guidance anticipates fiscal year revenue of ¥265 billion and a profit attributable to owners of ¥6.46 billion for FY2025. However, the forecasted return on equity remains modest at 11%.

- Insights from our recent growth report point to a promising forecast for TORIDOLL Holdings' business outlook.

- Click here to discover the nuances of TORIDOLL Holdings with our detailed financial health report.

Takara Bio (TSE:4974)

Overview: Takara Bio Inc. operates in the bioindustry, CDMO, and gene therapy sectors across Japan, China, Asia, the United States, Europe, and internationally with a market cap of approximately ¥125.83 billion.

Operations: The company generates revenue from its Drug Discovery segment, which amounts to ¥42.82 million.

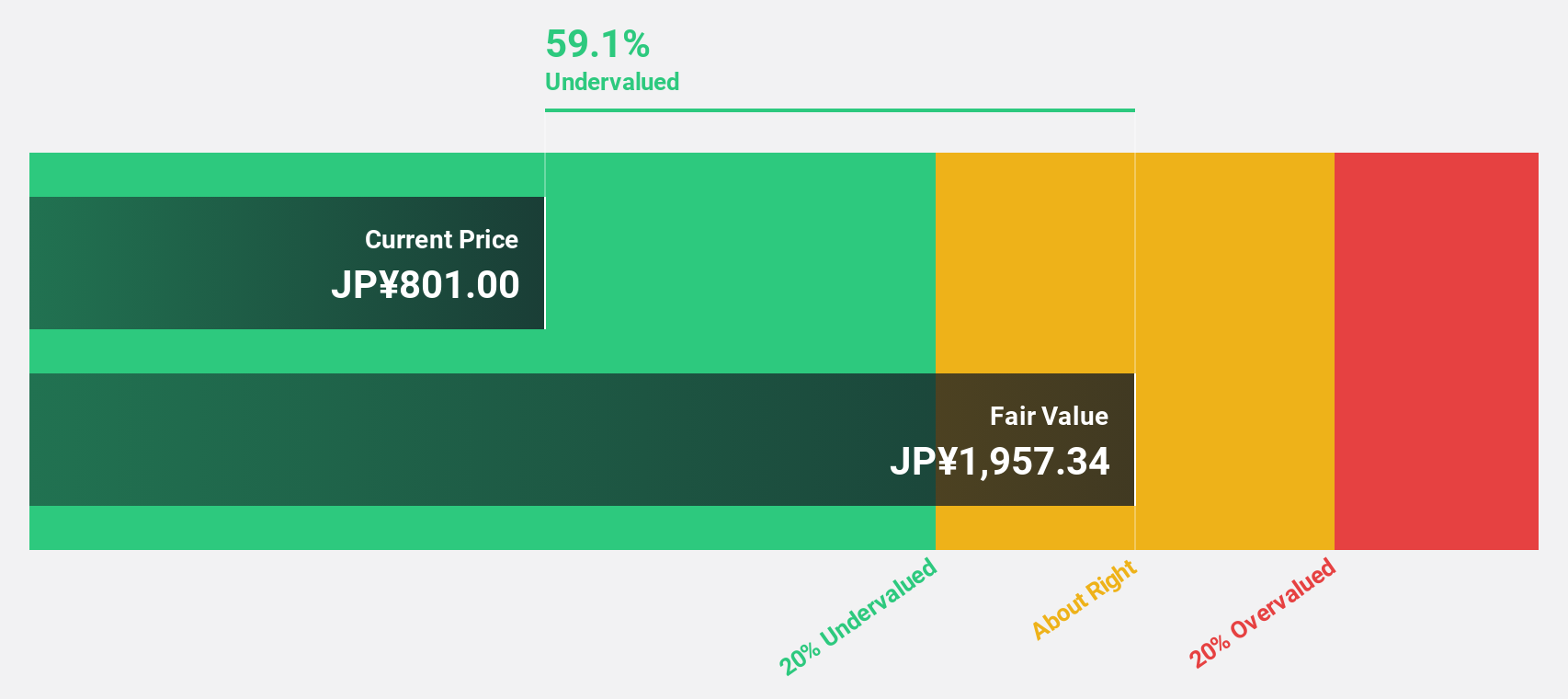

Estimated Discount To Fair Value: 36.2%

Takara Bio is trading at ¥1,045, significantly below its estimated fair value of ¥1,639.05. The company's earnings are expected to grow substantially at 30.17% annually, outpacing the Japanese market average of 8.7%. Despite a decline in profit margins from last year and a low forecasted return on equity of 4.4%, Takara Bio's revenue growth projections and current undervaluation based on discounted cash flow analysis highlight its potential investment appeal in Japan's market.

- Our comprehensive growth report raises the possibility that Takara Bio is poised for substantial financial growth.

- Navigate through the intricacies of Takara Bio with our comprehensive financial health report here.

Where To Now?

- Unlock our comprehensive list of 77 Undervalued Japanese Stocks Based On Cash Flows by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TORIDOLL Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3397

TORIDOLL Holdings

Through its subsidiaries, operates and manages restaurants in Japan and internationally.

Excellent balance sheet with reasonable growth potential.