Here's Why Fuji Latex (TYO:5199) Is Weighed Down By Its Debt Load

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Fuji Latex Co., Ltd. (TYO:5199) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Fuji Latex

How Much Debt Does Fuji Latex Carry?

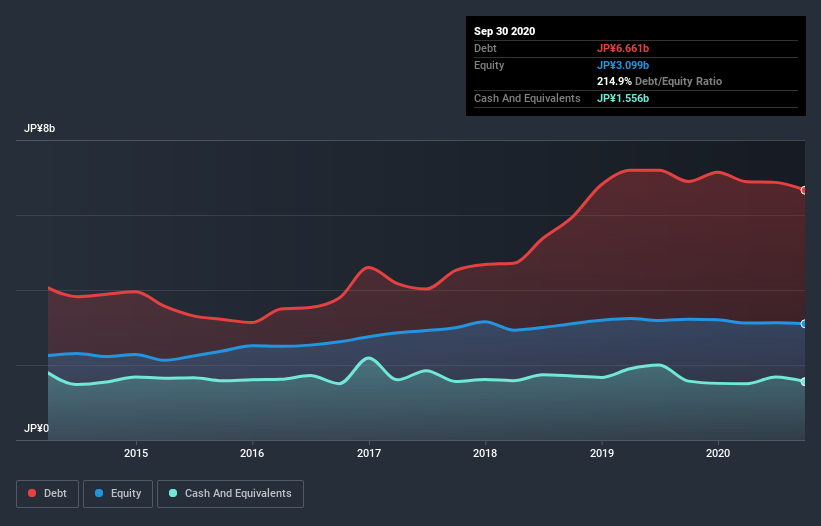

The image below, which you can click on for greater detail, shows that Fuji Latex had debt of JP¥5.87b at the end of September 2020, a reduction from JP¥6.89b over a year. However, it also had JP¥1.56b in cash, and so its net debt is JP¥4.32b.

How Strong Is Fuji Latex's Balance Sheet?

The latest balance sheet data shows that Fuji Latex had liabilities of JP¥5.32b due within a year, and liabilities of JP¥3.78b falling due after that. Offsetting this, it had JP¥1.56b in cash and JP¥1.88b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by JP¥5.66b.

When you consider that this deficiency exceeds the company's JP¥4.48b market capitalization, you might well be inclined to review the balance sheet intently. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Fuji Latex shareholders face the double whammy of a high net debt to EBITDA ratio (8.6), and fairly weak interest coverage, since EBIT is just 0.23 times the interest expense. The debt burden here is substantial. Even worse, Fuji Latex saw its EBIT tank 95% over the last 12 months. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Fuji Latex's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Fuji Latex burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both Fuji Latex's conversion of EBIT to free cash flow and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. And furthermore, its net debt to EBITDA also fails to instill confidence. We think the chances that Fuji Latex has too much debt a very significant. To our minds, that means the stock is rather high risk, and probably one to avoid; but to each their own (investing) style. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example Fuji Latex has 4 warning signs (and 2 which can't be ignored) we think you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade Fuji Latex, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Fuji Latex, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSE:5199

Fuji Latex

Designs, develops, and sells motion controlling devices in Japan.

Established dividend payer with adequate balance sheet.

Market Insights

Community Narratives