- Japan

- /

- Construction

- /

- TSE:1904

Some Investors May Be Worried About Taisei Oncho's (TYO:1904) Returns On Capital

When researching a stock for investment, what can tell us that the company is in decline? A business that's potentially in decline often shows two trends, a return on capital employed (ROCE) that's declining, and a base of capital employed that's also declining. This combination can tell you that not only is the company investing less, it's earning less on what it does invest. On that note, looking into Taisei Oncho (TYO:1904), we weren't too upbeat about how things were going.

Return On Capital Employed (ROCE): What is it?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Taisei Oncho is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.072 = JP¥1.7b ÷ (JP¥40b - JP¥17b) (Based on the trailing twelve months to December 2020).

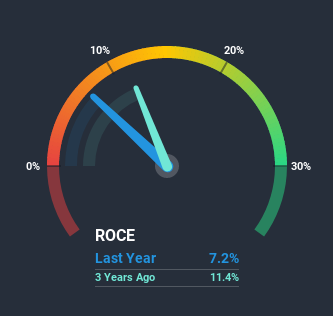

So, Taisei Oncho has an ROCE of 7.2%. In absolute terms, that's a low return and it also under-performs the Construction industry average of 10%.

Check out our latest analysis for Taisei Oncho

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings, revenue and cash flow of Taisei Oncho, check out these free graphs here.

So How Is Taisei Oncho's ROCE Trending?

In terms of Taisei Oncho's historical ROCE movements, the trend doesn't inspire confidence. Unfortunately the returns on capital have diminished from the 9.5% that they were earning five years ago. And on the capital employed front, the business is utilizing roughly the same amount of capital as it was back then. Companies that exhibit these attributes tend to not be shrinking, but they can be mature and facing pressure on their margins from competition. So because these trends aren't typically conducive to creating a multi-bagger, we wouldn't hold our breath on Taisei Oncho becoming one if things continue as they have.

On a separate but related note, it's important to know that Taisei Oncho has a current liabilities to total assets ratio of 42%, which we'd consider pretty high. This can bring about some risks because the company is basically operating with a rather large reliance on its suppliers or other sorts of short-term creditors. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

In Conclusion...

In summary, it's unfortunate that Taisei Oncho is generating lower returns from the same amount of capital. Since the stock has skyrocketed 166% over the last five years, it looks like investors have high expectations of the stock. In any case, the current underlying trends don't bode well for long term performance so unless they reverse, we'd start looking elsewhere.

If you're still interested in Taisei Oncho it's worth checking out our FREE intrinsic value approximation to see if it's trading at an attractive price in other respects.

While Taisei Oncho may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

When trading Taisei Oncho or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Taisei Oncho might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSE:1904

Taisei Oncho

Engages in the design and construction of air conditioning, water supply/drainage sanitary, and electrical equipment systems in Japan.

Proven track record with adequate balance sheet and pays a dividend.